Sustaining Strong Communities on Maryland’s Eastern Shore – Supporting Broad Prosperity

In a modern economy built on connections among people and places, our state cannot thrive unless every part of it thrives. Strengthening the Eastern Shore’s economy by fostering healthy employment growth, business creation, and family-sustaining jobs will bring benefits to residents of the region and across the state.

connections among people and places, our state cannot thrive unless every part of it thrives. Strengthening the Eastern Shore’s economy by fostering healthy employment growth, business creation, and family-sustaining jobs will bring benefits to residents of the region and across the state.

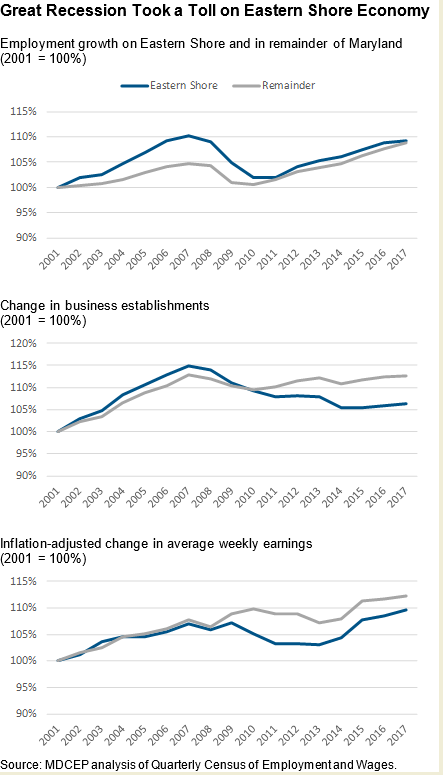

The Eastern Shore began the 21st century with strong growth across multiple economic indicators. The region gained jobs at double the rate of the rest of the state from 2001 to 2007 while also outpacing the state in net business creation and keeping pace in wage growth.[i] However, the Great Recession hit the region as hard as the rest of the state and in some respects changed its trajectory. Post-recession job growth on the Eastern Shore has been slower than during the pre-recession period, while the number of private employers in the region did not begin growing again until 2014. Inflation-adjusted wages have also grown more slowly since the Great Recession, although the region has outpaced the statewide average.

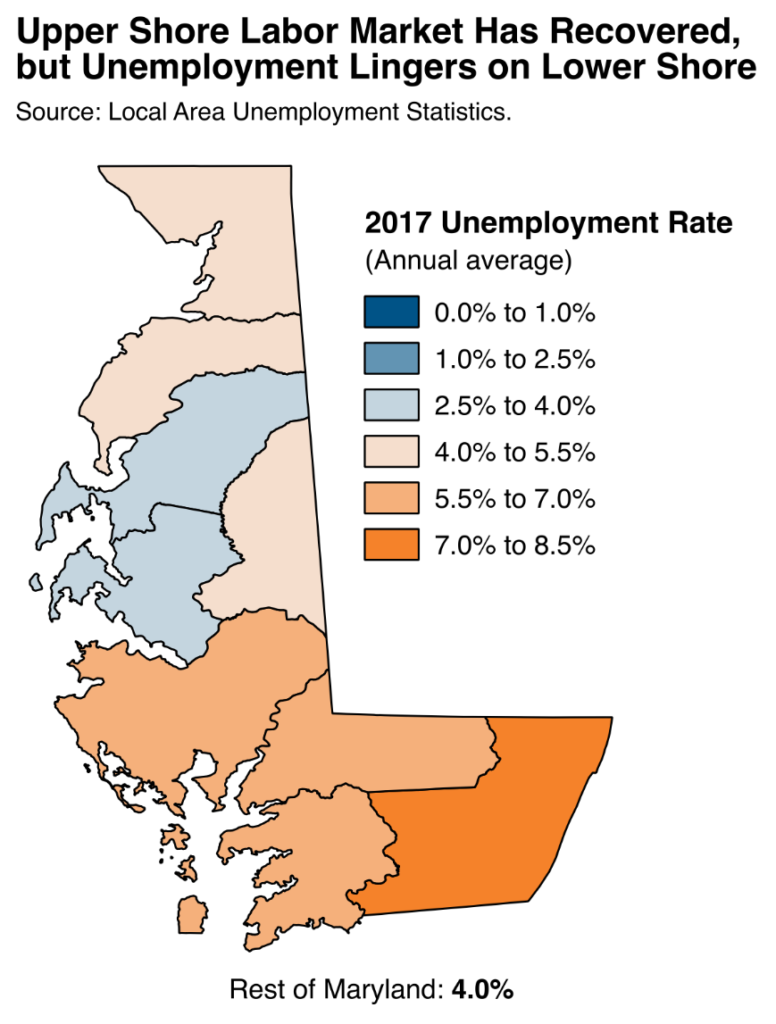

The unemployment rate averaged 5.3 percent across the Eastern Shore in 2017, 1.2 percentage points above the statewide average.[ii] Unemployment was lowest in the Mid-Shore region, with Queen Anne’s and Talbot counties having jobless rates at or below the state average. The Lower Shore continued to experience above-average unemployment, ranging from 5.7 percent in Wicomico County to 8.5 percent in Worcester County.[iii]

Although wages have grown more quickly on the Eastern Shore than elsewhere in Maryland in recent years, jobs in the region still generally pay less than in the rest of the state. This is partly a function of the mix of industries present and types of jobs available on the Shore. For example, arts, entertainment, recreation, accommodation, and food services jobs—which typically pay low wages—together account for 11 percent of jobs in the region, compared to 8 percent statewide. Meanwhile, professional, scientific, management, administrative, and waste management services—which typically pay significantly higher wages—together account for 12 percent of Eastern Shore jobs, compared to 15 percent statewide.[iv] Looking at types of jobs rather than types of employers, low-paying food preparation and serving occupations are a larger share of jobs on the Eastern Shore than high-paying computer and mathematical occupations. Statewide, computer and mathematical occupations are higher.

| Table 1. Eastern Shore Industry Composition and Typical Earnings | |||||

| Industry | Median Annual Earnings | Employment Shares | Location Quotient | ||

| Eastern Shore | Maryland | Eastern Shore | Maryland | ||

| Agriculture, Forestry, Fishing and Hunting | $31,361 | $25,089 | 2.4% | 0.5% | 4.98 |

| Mining | $30,000 | $42,700 | 0.1% | 0.1% | 1.75 |

| Utilities | $53,670 | $63,884 | 0.7% | 0.7% | 1.06 |

| Construction | $36,497 | $41,600 | 6.5% | 6.6% | 1.00 |

| Manufacturing | $41,216 | $52,268 | 6.3% | 4.5% | 1.39 |

| Wholesale Trade | $40,246 | $48,257 | 2.0% | 1.9% | 1.05 |

| Retail Trade | $20,608 | $23,291 | 10.7% | 9.6% | 1.11 |

| Transportation and Warehousing | $40,000 | $41,216 | 4.0% | 3.8% | 1.06 |

| Information and Communications | $32,442 | $52,718 | 1.8% | 2.1% | 0.83 |

| Finance, Insurance, Real Estate, and Rental and Leasing | $36,064 | $51,520 | 4.9% | 6.1% | 0.81 |

| Professional, Scientific, Management, Administrative, and Waste Management Services | $35,442 | $60,000 | 11.8% | 15.2% | 0.78 |

| Educational, Health and Social Services | $35,990 | $41,566 | 22.7% | 23.5% | 0.97 |

| Arts, Entertainment, Recreation, Accommodations, and Food Services | $15,190 | $16,202 | 10.9% | 8.3% | 1.31 |

| Other Services (Except Public Administration) | $25,000 | $30,000 | 5.3% | 5.4% | 0.99 |

| Public Administration | $47,041 | $72,994 | 9.3% | 10.8% | 0.86 |

| Active Duty Military | $38,365 | $45,569 | 0.5% | 0.9% | 0.52 |

| Source: MDCEP analysis of 2012–2016 American Community Survey (five-year estimates and IPUMS microdata). Note: The location quotient measures the relative concentration of an industry on the Eastern Shore. It is defined as the Eastern Shore employment share divided by the statewide employment share. The top five values in each column are bold. | |||||

In addition to differences in the predominant types of jobs available, Eastern Shore jobs typically pay less than similar jobs elsewhere in the state. For example, manufacturing is one of the best-paying industries for typical workers (those in the middle of the earnings distribution) both on the Eastern Shore and throughout Maryland. However, while a typical manufacturing job statewide pays $52,000 per year, it pays only $41,000 on the Eastern Shore.[v] Similarly, sales and related occupations typically pay $30,000 statewide, compared to $23,000 on the Eastern Shore. A major exception is agriculture, which pays better on the Eastern Shore than elsewhere in the state. However, this is a function more of low earnings among agriculture workers statewide than of especially high pay on the Shore.

| Table 2. Eastern Shore Occupational Composition and Typical Earnings | |||||

| Median Annual Earnings | Employment Shares | Location Quotient | |||

| Occupation | Eastern Shore | Maryland | Eastern Shore | Maryland | |

| Management Occupations | $56,708 | $79,076 | 10.1% | 11.6% | 0.87 |

| Business Operations Specialists | $50,000 | $64,812 | 4.3% | 6.2% | 0.69 |

| Financial Specialists | $42,531 | $65,000 | |||

| Computer and Mathematical Occupations | $68,000 | $87,583 | 1.7% | 5.1% | 0.33 |

| Architecture and Engineering Occupations | $65,897 | $86,074 | 1.6% | 2.1% | 0.78 |

| Life, Physical, and Social Science Occupations | $46,368 | $70,000 | 1.0% | 1.8% | 0.56 |

| Community and Social Services Occupations | $36,588 | $45,000 | 1.9% | 1.9% | 0.99 |

| Legal Occupations | $54,682 | $84,492 | 0.8% | 1.7% | 0.48 |

| Education, Training, and Library Occupations | $45,621 | $46,368 | 6.2% | 6.4% | 0.97 |

| Arts, Design, Entertainment, Sports, and Media Occupations | $27,821 | $44,607 | 1.6% | 2.1% | 0.77 |

| Healthcare Practitioners and Technical Occupations | $51,520 | $60,758 | 5.9% | 6.1% | 0.98 |

| Healthcare Support Occupations | $23,000 | $25,760 | 2.5% | 2.3% | 1.08 |

| Protective Service Occupations | $47,041 | $50,000 | 2.7% | 3.0% | 0.89 |

| Food Preparation and Serving Occupations | $12,500 | $14,425 | 6.4% | 4.8% | 1.34 |

| Building and Grounds Cleaning and Maintenance Occupations | $23,699 | $22,359 | 4.3% | 3.6% | 1.19 |

| Personal Care and Service Occupations | $17,517 | $17,771 | 3.6% | 3.4% | 1.05 |

| Sales and Related Occupations | $22,506 | $30,379 | 10.5% | 9.2% | 1.14 |

| Office and Administrative Support Occupations | $28,386 | $34,430 | 12.9% | 13.0% | 0.99 |

| Farming, Fishing, and Forestry Occupations | $25,000 | $20,608 | 1.1% | 0.2% | 4.79 |

| Construction Occupations | $34,497 | $37,633 | 5.4% | 4.7% | 1.16 |

| Extraction Workers | $40,505 | $41,216 | |||

| Installation, Maintenance, and Repair Workers | $40,000 | $46,800 | 3.9% | 2.8% | 1.39 |

| Production Occupations | $28,000 | $35,483 | 5.3% | 2.9% | 1.84 |

| Transportation and Material Moving Occupations | $27,000 | $30,379 | 6.3% | 5.1% | 1.24 |

| Source: MDCEP analysis of 2012–2016 American Community Survey (five-year estimates and IPUMS microdata). Note: The location quotient measures the relative concentration of an occupation on the Eastern Shore. It is defined as the Eastern Shore employment share divided by the statewide employment share. The top five values in each column are bold. | |||||

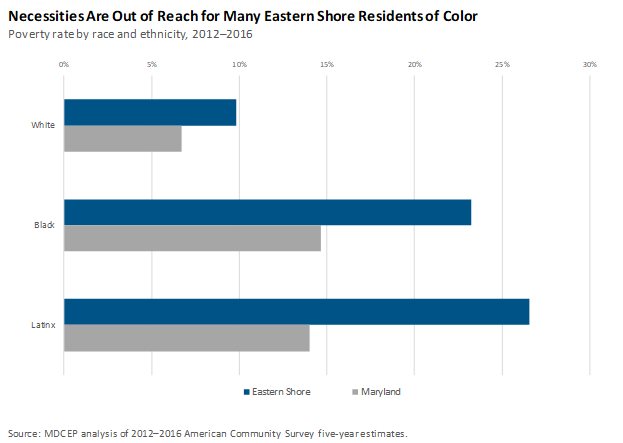

Partly as a result of above-average unemployment and below average wages, families on the Eastern Shore are more likely than families in other parts of Maryland to struggle to make ends meet. In 2016, 13.6 percent of Eastern Shore residents had family incomes below the federal poverty line ($24,300 for a family of four in that year).[vi] Statewide, 9.7 percent of residents had family incomes below the poverty line in 2016, down from a peak of 10.3 percent following the Great Recession.

Some Eastern Shore residents face an even higher risk of financial hardship. For example, 24 percent of Somerset County residents had incomes below the poverty line in 2016, compared to only 7 percent of Queen Anne’s County residents.[vii] Black and Latinx residents face some of the highest barriers to opportunity, with more than 20 percent unable to afford basic necessities.

Policy Solutions

Addressing the challenges facing the Eastern Shore’s economy will require a multipronged approach with cooperation from state and local policymakers.

Invest in Education and Training

High-quality education and training systems are part of the backbone of Maryland’s economy. A skilled workforce consistently ranks among business owners’ top priorities when choosing where to locate, and is key to enabling existing businesses to succeed and expand. Greater investments in each component of the Eastern Shore’s educational system will help the region’s economy thrive.

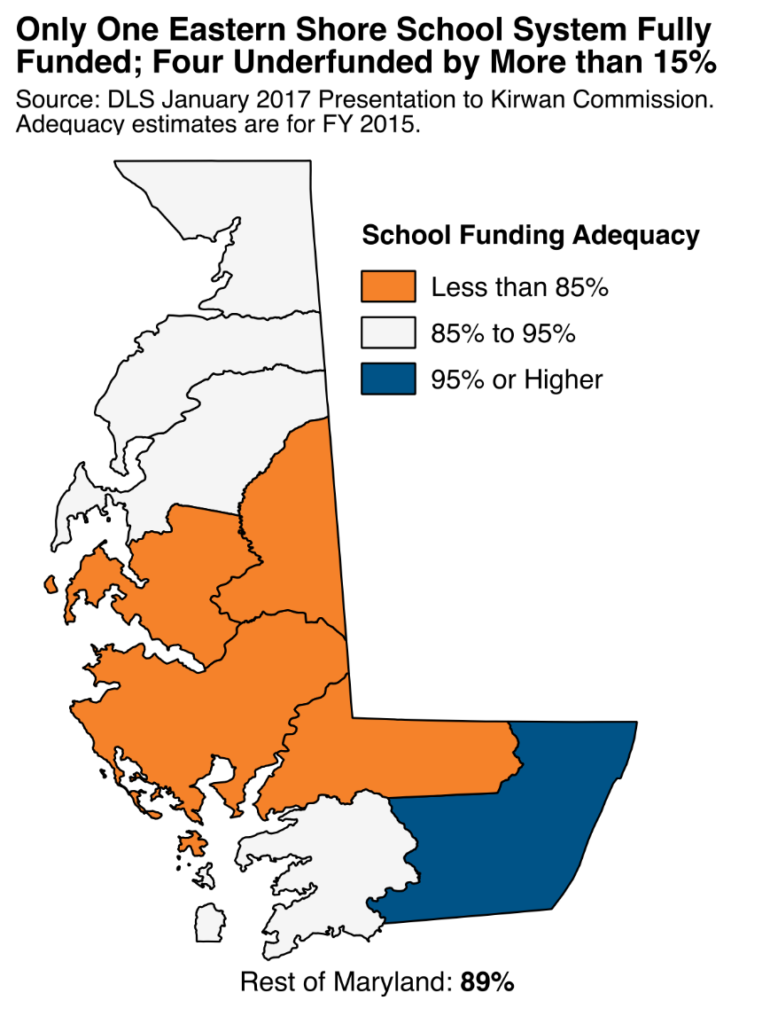

- Fully fund public schools. The state and most

counties cut back on public school funding to close revenue holes after the Great Recession, and these cuts are now baked into the state’s school funding formula. As of 2015, all but one of the Eastern Shore’s school systems were underfunded in comparison to state standards, and four were underfunded by 15 percent or more.[viii] The state’s Commission on Innovation and Excellence in Education (the Kirwan Commission) poses a once-in-a-generation opportunity to guarantee all Maryland children a great education, from prekindergarten through graduation. A robust, fully funded reform package will bring especially large benefits to the Eastern Shore. A well-designed package would bring significant new state resources into Eastern Shore schools and require county governments to fully fund the local share of school system costs.

counties cut back on public school funding to close revenue holes after the Great Recession, and these cuts are now baked into the state’s school funding formula. As of 2015, all but one of the Eastern Shore’s school systems were underfunded in comparison to state standards, and four were underfunded by 15 percent or more.[viii] The state’s Commission on Innovation and Excellence in Education (the Kirwan Commission) poses a once-in-a-generation opportunity to guarantee all Maryland children a great education, from prekindergarten through graduation. A robust, fully funded reform package will bring especially large benefits to the Eastern Shore. A well-designed package would bring significant new state resources into Eastern Shore schools and require county governments to fully fund the local share of school system costs. - Expand meaningful access to community college. Somerset and Wicomico counties took the lead in expanding access to community college through grant programs to bring students’ net tuition to zero after counting all financial aid. For example, a Wicomico County student at Wor-Wic Community College (full-time tuition $3,750 in fall 2017) might receive $2,000 in need-based financial aid and a $750 merit-based scholarship, bringing their net tuition to $1,000 for the semester. The county would provide a grant in this amount, making the student’s education essentially tuition-free. The state in 2018 passed a law to expand tuition-free community college to residents of all parts of Maryland using state funds.[ix] This is a strong step in the right direction and the state should consistently provide the funding needed for this program to succeed. To further strengthen these programs, the state should consider expanding them to cover costs other than tuition. Ensuring that students can buy books and put food on the table will give them the greatest possible chance at succeeding in school.

- Continue and strengthen successful approaches to workforce development. Workforce development services are the final component of a complete educational system, enabling adult learners to acquire new skills and connecting businesses with qualified workers. The state currently has effective workforce development strategies like EARN Maryland. The state should continue investing in these services and strengthen supportive services like transportation and child care assistance.

Protect and strengthen investments in economic security

Federal and state investments in economic security such as Medicaid and nutrition assistance bring enormous benefits to the Eastern Shore. Medicaid provides health insurance to 93,000 Eastern Shore residents (21 percent of all residents), while 24,000 households in the region are able to put food on the table because of food assistance (14 percent of households). When families are able to feed their children and see a doctor without going into debt, their entire community benefits. However, the unpredictable federal policy climate now puts these policies at risk. The state should take three steps to protect and strengthen these investments:

- Continue planning for federal sabotage. The state took the smart step of proactively planning its response to a potential repeal of the Affordable Care Act in 2017. While a wholesale repeal now seems unlikely, federal moves like repealing the individual insurance mandate and promoting rigid work requirements continue to put families at risk. Planning will put the state in the best position to protect families while continuing to invest in the foundations of our economy.

- Expand access to health insurance. While the Affordable Care Act has enabled thousands of Marylanders to get the care they need without worrying about crushing bills, more than 20,000 Eastern Shore residents still lack health insurance.[x] The state should use innovative approaches like a Medicaid buy-in, basic health plan, or state-based Medicare for all to guarantee all Marylanders meaningful access to health care. We can achieve the greatest immediate gains through policies to help Marylanders born outside the United States obtain health insurance. One in three Eastern Shore residents born outside the United States lacked health insurance between 2012 and 2016, compared to one in four statewide.[xi]

- Invest in deeply affordable housing. One-third of Eastern Shore households spend at least 30 percent of their incomes on housing, above the threshold the U.S. Department of Housing and Urban Development considers affordable.[xii] Those struggling to afford housing on the Eastern Shore are more likely to be low-income. Statewide, a significant number of households who pay more than they can afford for housing have incomes above $50,000. Eastern Shore households in these higher-income groups are less likely than households elsewhere in the state to face high housing costs. However, a larger number of Eastern Shore households taking home less than $35,000 annually are spending more on housing than they can afford. For this reason, an effective housing strategy for the Eastern Shore should focus on housing affordable to these low-income households.

Pair Evidence-Based Support for Businesses with Protections for Workers

Too often, Maryland’s economic development policies rely on costly and ineffective approaches like corporate tax breaks. Because state and local taxes represent a small part of most businesses’ cost structures, tax breaks do little to promote business growth. In a series of evaluations, state legislative analysts have also concluded that most state tax credit programs intended to grow the economy do not work. The state should move toward evidence-based economic development strategies and put in place safeguards to ensure communities benefit from these policies:

- Shift the focus to customized business services: Research shows that customized business services deliver the most bang for the economic development buck.[xiii] For example, training workers in the specific skills growing businesses need both reduces business costs and enhances workers’ productivity. To the extent that services like these already exist (such as partnerships between community colleges and expanding businesses) the state should use savings from cutting down on ineffective subsidies to increase access.

- Pair business support with worker protections. The end goal of economic development is to raise living standards for residents. Well-designed policies to support business growth work best when they are intentionally targeted to create jobs with salaries that can support a family. Pennsylvania’s Keystone Research Center has developed recommendations for incorporating job quality standards into workforce development programs.[xiv] These recommendations, such as targeting greater support to businesses that go beyond their legal requirements to create good jobs and educating learners on their rights in the workplace, translate naturally to customized training programs.

Improve state and local tax policies

Maryland’s state and local budgets reflect where our priorities lie. Effective responses to the challenges facing Eastern Shore communities will require increased state and local investments, which is possible only with a well-functioning revenue system. Both the state and local governments should enact tax reforms to create an effective, equitable tax code:

- Clean up the tax code: Large corporations and other powerful interests have inserted loopholes into our tax code that allow them to avoid contributing to the services we all rely on. Getting rid of tax breaks for large multistate corporations will strengthen local businesses on the Eastern Shore and throughout Maryland and will allow the state to invest more in the foundations of our economy.

- Rebalance the tax code: Maryland currently has an upside-down tax code in which the wealthiest individuals pay a smaller share of their income in state and local taxes than the rest of us do. Rebalancing the tax code to ensure that wealthy and powerful individuals are contributing to the services we all rely on will make the state’s tax code more equitable for communities on the Eastern Shore.

- Expand access to the Earned Income Tax Credit. The Earned Income Tax Credit provides a meaningful boost to low-wage workers, allowing them to pay for one-time expenses like car repairs or put money away for an emergency. But workers who don’t claim dependent children on their taxes receive a minimal credit. Increasing the value of the tax credit to these workers will have the biggest benefits in communities where low-wage work is most common.

- Repeal ineffective tax limitations. Four Maryland counties have strict limits on how much property tax revenues can increase in a given year, and the two most rigid limitations are in Talbot and Wicomico counties. These limitations gradually eat away at counties’ ability to invest in things like schools, roads, and fire protection. They make it harder to respond to an emergency. And they can harm a county’s bond rating, leading to higher costs to improve infrastructure. These limitations hold back the counties that have them on the books, and the counties should leave them behind.

< Overview and Profile | Sustaining a Healthy Shore >

[i] MDCEP analysis of Quarterly Census of Employment and Wages.

[ii] Local Area Unemployment Statistics.

[iii] Because its economy is based heavily on summertime tourism, Worcester County’s unemployment rate shows a great deal of seasonal variation. Its lowest point in 2017 was 5.1 percent (September) while its highest point was 14.2 percent (January). On average, 8.5 percent of the county’s workers were actively looking for a job but unable to find one.

[iv] MDCEP analysis of 2012–2016 American Community Survey five-year estimates and 2012–2016 IPUMS American Community Survey microdata. These high-level industry summaries mask variation between different types of employers. For example, professional services employers typically pay higher wages than those in administrative and waste management services. However, wage and employment data for more detailed industries are often unavailable or unreliable for small or sparsely populated areas.

[v] Because these are industry-wide medians, it is possible that differences in occupational composition still contribute to the difference in median earnings.

[vi] MDCEP analysis of 2016 American Community Survey one-year estimates.

[vii] Small Area Income and Poverty Estimates.

[viii] “Adequacy of Education Funding in Maryland,” Department of Legislative Services presentation to the Commission on Innovation and Excellence in Education, January 2017, http://dls.maryland.gov/pubs/prod/NoPblTabMtg/CmsnInnovEduc/2017_01_09_DLS_Presentation_Adequacy.pdf

[ix] House Bill 16 of 2018, http://mgaleg.maryland.gov/webmga/frmMain.aspx?pid=billpage&tab=subject3&id=hb0016&stab=01&ys=2018RS

[x] 2016 American Community Survey one-year estimates.

[xi] 2012–2016 American Community Survey five-year estimates.

[xii] Ibid.

[xiii] Timothy Bartik, “Who Benefits from Economic Development Incentives? How Incentive Effects on Local Incomes and the Income Distribution Vary with Different Assumptions about Incentive Policy and the Local Economy,” W.E. Upjohn Institute, 2018, https://research.upjohn.org/cgi/viewcontent.cgi?referer=&httpsredir=1&article=1037&context=up_technicalreports

[xiv] “High Road WIOA: Building Higher Job Quality into Workforce Development,” Keystone Research Center, 2015, http://keystoneresearch.org/sites/default/files/KRC_WIOA.pdf