Maryland Families Stand to Lose from Part 2 of Congressional Republicans’ Fiscal Agenda

Last week, Senate Majority Leader Mitch McConnell called for harmful cuts to federal investments that help millions of families access essential health care and a decent retirement, and provide support for people with disabilities. Coming less than a year after a massive package of tax breaks for large corporations and wealthy individuals, these cuts demonstrate congressional leaders’ upside-down priorities—and would make Marylanders worse off if enacted. Congress should protect and strengthen the bedrock income security and health care protections we all rely on, not take from them to pay for tax cuts benefitting a wealthy few.

One in three Marylanders benefits from one or more of the federal investments that are now on the chopping block:

Medicare

- About 1 million Maryland residents are insured through Medicare, including 94 percent of people ages 65 year or older and more than 120,000 people under age 65.

- Thanks to Medicare, 99 percent of Marylanders ages 65 or older have health insurance—more than any other age group.

- More than half of people under age 65 who are insured through Medicare live with a disability.

Medicaid

- More than 1 million Maryland residents are insured through Medicaid.

- Cuts to Medicaid would disproportionately harm people of color. About one in four Black or Latinx Marylanders get their health coverage through Medicaid.

- One in five Marylanders who are insured through Medicaid lives with a disability.

- Thanks to our state’s choice to expand Medicaid under the Affordable Care Act, Marylanders who struggle to afford the basics because of low incomes are less likely to go without essential medical care than their counterparts in states that didn’t expand Medicaid.

Social Security

- Nearly 1 million Maryland residents have Social Security income, including a large majority of people ages 65 years or older and nearly 150,000 younger Marylanders.

- Among Marylanders under age 65 with Social Security income, 44 percent live with a disability.

- Nationwide, Social Security lifts more than 15 million aging adults out of poverty. If not for Social Security, four in ten aging adults would struggle to make ends meet.

- Guaranteed retirement income is more critical than ever in an era when few working people have a pension or enough income to build a decent retirement through a 401(k).

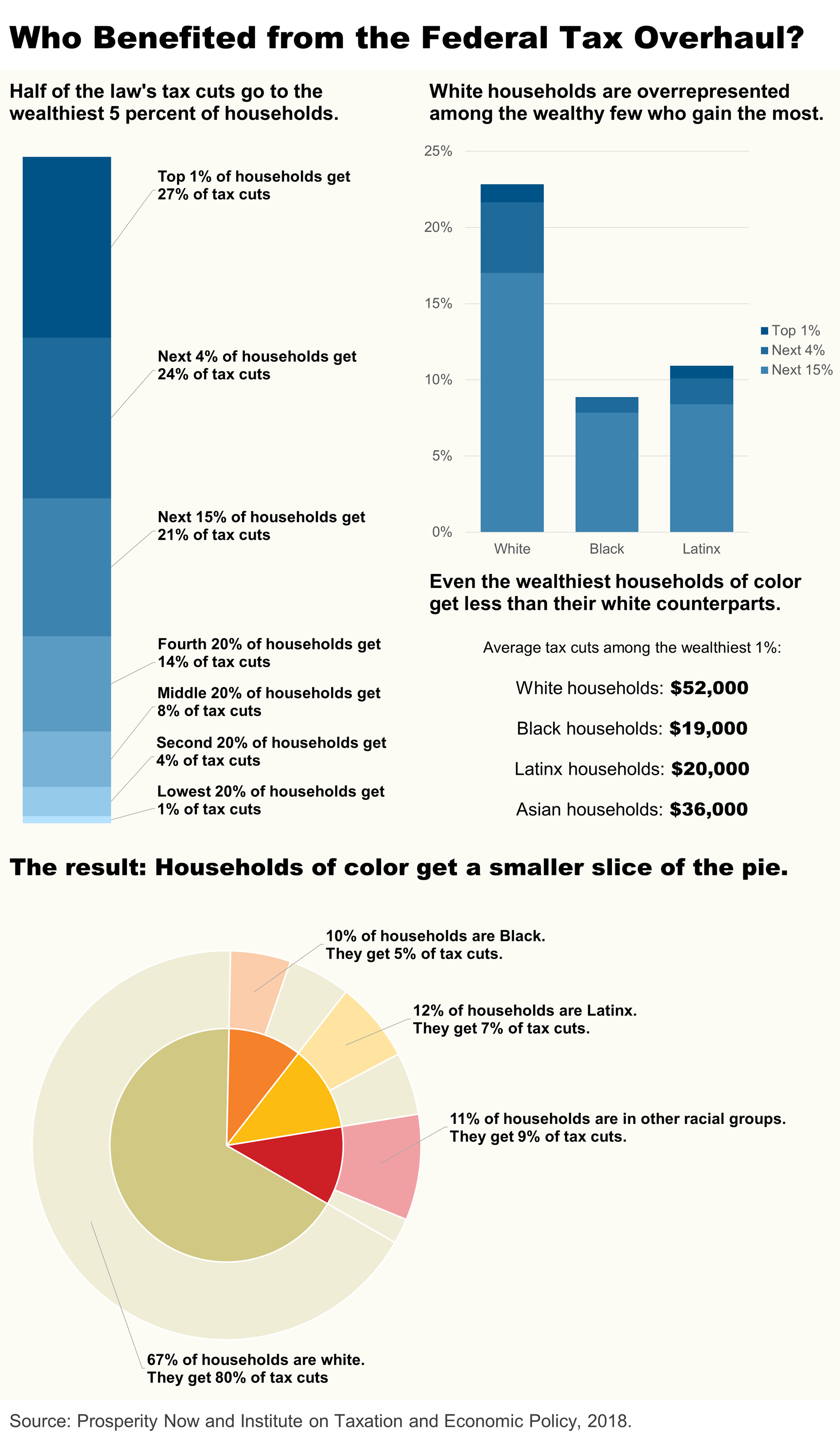

Cutting Medicare, Medicaid, and Social Security would do lasting harm to families in Maryland and nationwide, and it would bring no offsetting benefit. The stated motivation for cutting these investments does not make sense on its own terms. Federal policymakers like Sen. McConnell who justify these cuts as a way to reduce the federal budget deficit just last year passed a massive package of tax cuts for large corporations and wealthy individuals. This tax overhaul shifts income from working people of all racial and ethnic backgrounds to a small number of wealthy, predominantly white households—and in the process increases the deficit by $1.9 trillion over 10 years. While the deficit does not pose an urgent threat to the U.S. economy, policymakers who create trillions in deficits while handing tax breaks to a few—and then cite those same deficits to justify cuts borne by the rest—demonstrate deeply misplaced priorities.

A better fiscal agenda would flip those priorities on their head, asking the wealthy to contribute equitably to the services we all rely on. At the federal level, this means repealing the lopsided tax cut package and strengthening basic investments in health care and a retirement security. As a state, we should clean up and rebalance our tax code and invest in the pillars of our economy like great schools, health care, and transportation.