Creating a Fairer Tax Code and Responsible Budget Practices

Our shared investments in good schools, a robust transportation network, and safe communities have made Maryland a great place to live, work, and do business. But over time, our tax code has become full of tax breaks put there by special interests, and that is hurting our ability to maintain critical services, let alone make new investments that move our state forward.

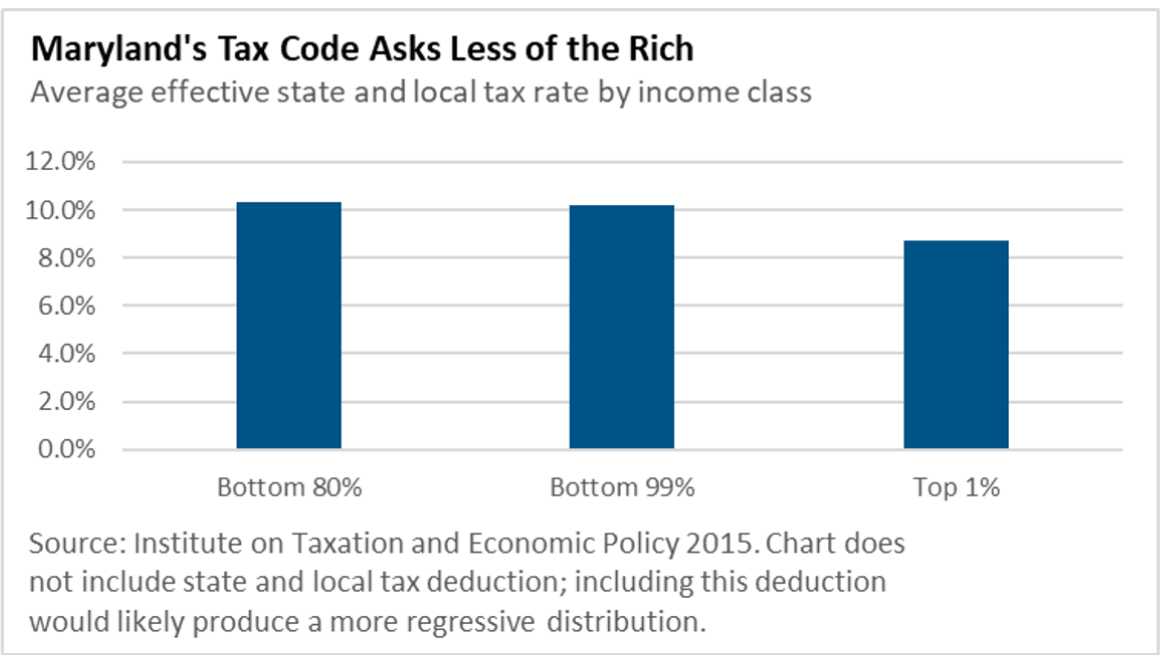

In addition, Maryland’s tax code asks the most of those least able to afford it. Low-and middle-income Marylanders pay nearly 10 percent of their incomes in state and local taxes, while the wealthiest 1 percent pay just 6.7 percent.[i] This inequality becomes even worse when you take race and gender into consideration.

By taking three steps to reform our tax code, we can make sure everyone pays their fair share, and ensure that we’re putting our shared resources into things that benefit all of us, rather than funding tax breaks for special interests.

- Clean up the tax code. We should clean up our tax code by getting rid of special tax breaks, like those that favor large, multi-state corporations over local businesses, and the loophole allowing investment managers to avoid paying their fair share of income taxes. We should also reverse recent cuts to our multi-millionaire estate tax, which costs upward of $100 million each year and does nothing to strengthen our economy[ii]. We should also evaluate the state’s many tax credits and business grants to make sure they are working as intended. Many of these programs favor large, already successful corporations that have the resources to apply for these credits. While these programs claim to create jobs, state reviews have repeatedly shown that they have virtually no impact on businesses deciding to locate or expand in Maryland and may not be accomplishing what policymakers set out to do when they enacted them.

- Modernize sales tax collection. We should modernize the way we collect sales taxes to reflect the increasing importance of services and online commerce to our economy. This includes taxing digital downloads at the same rate as physical copies and adding a sales tax on services like landscaping and housecleaners. This single step could bring in hundreds of millions of dollars in revenue.

- Increase income tax fairness. By making some changes to our state income tax, we can help ensure everyone pays their fair share in state and local taxes, and that low-income workers aren’t taxed further into poverty. To start, we should expand the Earned Income Tax Credit to include young workers and workers not raising children. Sales and payroll taxes can make it harder for low-wage workers to make ends meet. The EITC makes a real difference in these workers’ lives. Making it available to those who are left out under the current rules, despite having very low incomes, would help even more.

In addition, we should reinstate the top income tax bracket for the wealthiest Marylanders. Maryland’s millionaires are the only individual taxpayers likely to see a windfall from last year’s overhaul of our federal tax code. And people in this income group already don’t pay their fair share for the state services we all rely on. The wealthiest 1 percent in Maryland pay about 16 percent less in state and local taxes, as a share of their incomes, than the rest of us. Reinstating an additional tax bracket that helps ensure that people earning more than $1 million per year pay their fair share in state taxes would help ensure the state can continue to invest in things that support vibrant communities and a healthy economy.

Budget reforms

Maryland’s current budget process doesn’t work as well as it should. Today’s governor-dominated process, unique among the states, prohibits the General Assembly from adding money to the budget in almost every case. This rule prevents effective collaboration between the General Assembly and the governor and discourages negotiation to decide on shared priorities.

Our state granted this broad power to the governor under circumstances unlike the ones our state faces today. By adopting a process similar to the ones used in every other state, we can improve on the current system. Maryland’s governor and legislature could do a better job of working together to set priorities and make important investments in the state’s economy and quality of life if we adopted significant changes to the annual state budgeting process. These reforms would promote greater citizen involvement, put the public good ahead of politics, and increase accountability.

Policy Tools

- Constitutional amendment. Maryland should adopt a state constitutional amendment giving the General Assembly greater say in key aspects of budget-making. A constitutional amendment could allow the Maryland legislature to add spending items to the operating budget, within certain guidelines – like maintaining the requirement that the overall budget be balanced — and give the governor the limited right to veto specific items.

- Make budget changes easier to understand. State budgets are complex documents, and that can make it harder for average citizens to express their opinions about state spending priorities. A couple simple changes could make them easier to understand, such as:

- Explaining how a cut in funding will affect public services, rather than only giving the dollar amount. Budget documents commonly highlight new spending initiatives and program enhancements but often fail to include details of how cuts will affect the state’s ability to provide services at the current level or meet growing needs. Budget cuts or level-funding services often means that there is inadequate funding to meet residents’ needs. This leads to problems like higher student-teacher ratios, reduced maintenance on roads and bridges, and long waiting lists for services crucial to families’ wellbeing.

- Distributing an annual report that summarizes state spending and its impact on the public, and comparing it to previous years. One barrier to public understanding of the state budget is that the spending plan is broken down into somewhat arbitrary categories. A concise synopsis of expenditures broken down by major policy category, such as education, health, and the environment, could increase understanding and engagement with the budget process.

- Increase tax credit transparency and tracking. Only some of Maryland’s business tax credits are subject to public reporting requirements and periodic review. Expanding and improving the current procedures would make it easier for legislators and the public to determine whether these tax credits are actually stimulating job growth or giving unfair breaks to certain special interests.

- Provide more comprehensive fiscal notes. Every piece of legislation the General Assembly considers each year is subject to an analysis of how it will impact the state budget, as well as a handful of other policy outcomes. These documents are known as fiscal and policy notes. Adding a racial and ethnic equity impact assessment, as some other states have done, would allow for a more comprehensive understanding of proposed legislation and could make state policies more equitable over time. An environmental impact statement would also improve the usefulness of the notes.

< Addressing the Changing Nature of Work | Setting Up Future Generations for Success >

[i] http://www.mdeconomy.org/marylands-poor-taxed-more-than-wealthy-communities-of-color-feel-biggest-pinch/

[ii] http://mgaleg.maryland.gov/2014RS/fnotes/bil_0009/hb0739.pdf