Choosing Meaningful Investments in Temporary Cash Assistance can Change the Trajectory for Maryland Families Living in Poverty

When families go through a challenging period, income support programs are vital to helping them keep food on the table and a roof over their heads as they get back on their feet. The federal Temporary Assistance for Needy Families (TANF) program helps families afford the basics when they are experiencing employment insecurity, sudden health complications, or other economic distress from personal or familial emergencies.

In Maryland, the TANF core programs are cash assistance, known as Temporary Cash Assistance (TCA) and the job-training program, known as the Work Opportunities Program. Families receive these benefits and services through the Family Investment Program. Core programs are meant to serve the four purposes of TANF which include:

- Providing assistance to low-income families so that children can be cared for in their homes;

- Promoting job preparation, work, and marriage;

- Preventing and reducing out-of-wedlock pregnancies; and

- Encouraging the formation and maintenance of two-parent families

TANF is currently financed through a fixed federal block grant that has not been adjusted since TANF’s inception, and through required nonfederal state dollars; the dollar amount for both sources is based on federal and state expenditures on welfare programs preceding TANF. Notably, the first two purposes of TANF are designed to assist “needy” families as defined by the state, but funding for reduction of out-of-wedlock pregnancies and the maintenance of two-parent families are not restricted to families living in poverty. Because states have flexibility in allocating their TANF dollars, there is no guarantee that money is being spent on families that need it the most.

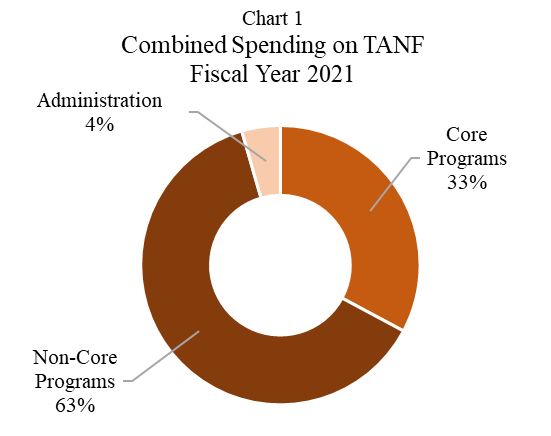

In recent years, Maryland has opted to use most of its combined TANF dollars on programs and services that are not part of its core goals of providing cash assistance to families so they can meet their basic needs, or helping parents find work. Today, these core programs make up only one-third of TANF federal and state spending in Maryland.

Maryland’s choices about where to use its federal and state TANF dollars show that the state is not investing as much as it can and should in core programming. It is clear that we need to expand the amount and reach of cash assistance to children and families most in need, particularly those who are living in deep poverty. This is especially important given that in 2021, 1 in 4 children in Maryland had parents who lacked secure employment, and almost one-third lived in households with a high housing cost burden.[1] TANF offers a critical lifeline of cash to low-income families, as well as crucial work supports to help parents find and keep good quality jobs. Both a comprehensive investment into core TANF programs and a holistic effort to improving such programs are essential to making sure no one is left behind.

TANF Spending in Maryland

TANF funding structures include both federal and state funding streams. The federal government block grant, known as the State Family Assistance Grant, funds Maryland’s TANF program at $228 million per fiscal year. The block grant, set at $16.5 billion for all states, has remained unchanged since 1996 and therefore lost its value by more than 40% despite changes in demographics and population growth.[2] This current funding structure disproportionately harms families of color as states with higher numbers of Black children tend to receive the least amount of funding per child.8 States are also required to spend a certain amount of state revenue on TANF programs, known as the Maintenance of Effort (MOE). This amount is based on the state’s share of Aid to Families with Dependent Children (AFDC), the program that preceded TANF. Importantly, states are allowed to spend more than their MOE requirement. In fiscal year 2021, Maryland spent $616 million[i] in state and federal funds attributed to TANF. This included some of the state’s $228 million federal block grant, an additional $27 million in federal contingency funds,[ii] and $376 million in state MOE expenditures.

TANF funding structures include both federal and state funding streams. The federal government block grant, known as the State Family Assistance Grant, funds Maryland’s TANF program at $228 million per fiscal year. The block grant, set at $16.5 billion for all states, has remained unchanged since 1996 and therefore lost its value by more than 40% despite changes in demographics and population growth.[2] This current funding structure disproportionately harms families of color as states with higher numbers of Black children tend to receive the least amount of funding per child.8 States are also required to spend a certain amount of state revenue on TANF programs, known as the Maintenance of Effort (MOE). This amount is based on the state’s share of Aid to Families with Dependent Children (AFDC), the program that preceded TANF. Importantly, states are allowed to spend more than their MOE requirement. In fiscal year 2021, Maryland spent $616 million[i] in state and federal funds attributed to TANF. This included some of the state’s $228 million federal block grant, an additional $27 million in federal contingency funds,[ii] and $376 million in state MOE expenditures.

Combined Core Spending

In fiscal year 2021, Maryland spent only 33% of its combined[iii] TANF dollars on core programs.[3] Most of the core spending is for Basic or Cash Assistance (22% of combined TANF spending), followed by the Work Opportunities program (5%), which are operated through the Family Investment Program[iv] and its related services (6%). Child care is also a core programming category that many other states include as part of their core spending. Although it appears that Maryland did not spend any TANF federal or state funds on childcare, other federal reports suggest that less than 1% of TANF funds have gone to childcare.[v] It is important to note that while Maryland TANF spending on childcare appears nonexistent in budget analyses from the Department of Human Services (DHS), this is largely due to the fact that the Maryland State Department of Education, not DHS, handles funding for early childhood services including the Child Care Scholarship program, which greatly benefits and prioritizes families receiving cash assistance.

Combined Non-Core Spending

Maryland spends the majority of its combined TANF dollars in non-core programs (63%). The state refundable Earned Income Tax Credit (EITC) and Montgomery County Working Families Income Supplement make up the largest portion at 33% of total funds, though the credits are solely funded by state or county dollars. Although Montgomery County’s income supplement is funded from county not state dollars, the state is still able to count it as part of its MOE requirement when reporting TANF spending to the federal government on the technicality that the county has residents who benefit from cash assistance. The remainder of the combined TANF spending is spent on child welfare/foster care payments (11%—though funds were solely federal), pre-kindergarten programs (9%), and various social service programs, including community and adult services (2%), and utility assistance (7%).

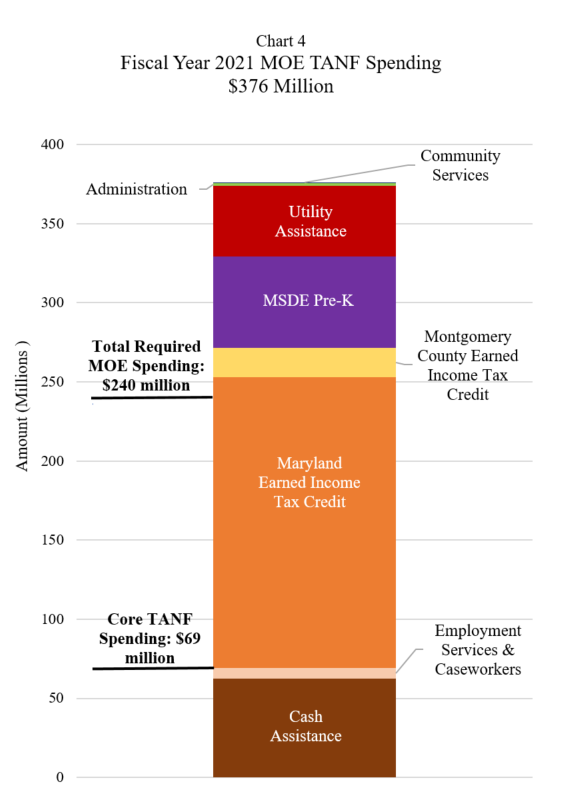

Maryland MOE Spending

Maryland’s MOE spending in core and non-core TANF areas varies significantly from the state’s federal spending, in part due to differences in requirements for spending and the state’s decisions of what to count under its MOE. In FY 2021, Maryland spent $376 million to meet its TANF MOE obligation. Cash Assistance (17%) and Employment Services (2%) were the only core spending under the MOE, a total of 19%. The majority of spending, 81%, was in non-core programs and services. Administration costs made up less than 1% of spending. MOE non-core expenditures include pre-K programs (16%), utility assistance (12%) and community services programs and services (less than 1%). No state MOE funds were used for kinship or foster care payments in FY 2021.

Maryland’s MOE spending in core and non-core TANF areas varies significantly from the state’s federal spending, in part due to differences in requirements for spending and the state’s decisions of what to count under its MOE. In FY 2021, Maryland spent $376 million to meet its TANF MOE obligation. Cash Assistance (17%) and Employment Services (2%) were the only core spending under the MOE, a total of 19%. The majority of spending, 81%, was in non-core programs and services. Administration costs made up less than 1% of spending. MOE non-core expenditures include pre-K programs (16%), utility assistance (12%) and community services programs and services (less than 1%). No state MOE funds were used for kinship or foster care payments in FY 2021.

The refundable Earned Income Tax Credit, including Montgomery County’s Working Families Income Supplement, a match of the state EITC, make up over half (54%) of the primary MOE spending areas. In federal fiscal 2021, 16 states (including Maryland and the District of Columbia) reported expenditures from their state EITC as part of their MOE spending.10 However, the EITC accounted for more than one-fifth of states’ MOE spending in only 5 states, and more than one-third in two states, one of which was Maryland. The national share of spending on refundable tax credits, whether EITC or non-EITC was 9%.[4]

Maryland’s TANF Core Spending

To help improve the lives of low-income families, it is crucial that Maryland invests more of its TANF dollars in core programs such as cash assistance, supports that enable participants to gain employment, and to boost its child care system. Today, TANF reaches a very small share of low-income Maryland families, a sharp contrast from AFDC, which reached nearly all low-income families in the state. Much of this resulted from the implementation of harsh work requirements and time limits which primarily impacted Black families and other people of color. In 1995-1996, AFDC cash assistance reached 97 of every 100 families living in poverty in Maryland. In contrast, in 2019-2020, TANF cash assistance reached only 29 of every 100 Maryland families experiencing poverty—a 68-point difference that is much higher than the drop at the national average.[5] It is important that the state invest in core TANF areas to help families transition to work and climb the economic ladder.

| Key Recommendations

Based on expenditure analyses and research on best practices, the report makes the following recommendations to maximize TANF’s potential to lift families out of poverty in Maryland:

|

To learn more, please see the full report.

[i]Although Maryland ran a TANF deficit from fiscal years 2011 through 2016, the state generated a positive balance in the following years allowing FY 2021 to open with close to $20 million. It was anticipated that funds would be depleted within that year due to anticipated higher TCA caseloads during the COVID-19 pandemic. In FY 2021, Maryland received a combined $255.5 million from its TANF base grant and contingency TANF funds. DHS appropriated $239.7 million in TANF expenditures, with an ending balance of $35.8 million.

[ii] Contingency funds were meant to account for economic downturns. The federal fund is available to states that meet certain conditions: 1) they have an unemployment rate of at least 6.5%, that is 10% higher than in a three-month period compared to the same three-month period in either of the two prior years, or 2) their Supplemental Nutrition Assistance Program (SNAP) caseload over the most recent three-month period is at least 10% higher than the caseload in the corresponding period in fiscal 1994 or 1995. Maryland meets the latter.

[iii] “Combined TANF funds” include the federal block grant and funds appropriated for TANF-allowable services from the state’s own money such as revenue from its general fund.

[iv] Family Investment Program (FIP) is the state’s program for serving families in TANF. It encompasses the provision of Temporary Cash Assistance (TCA) in efforts to divert potential applicants through employment, move adults to work, and provide retention services to enhance skills and prevent recidivism. The goal of the FIP is to assist TCA applicants/recipients in becoming self-sufficient.

[v] There appears to be a discrepancy between the state’s spending data used in this report and the data that the state reports to the U.S. Department of Health and Human Services (HHS). This analysis is based on Maryland’s Department of Human Services Fiscal 2023 Budget Overview’s state budget data for FY 2021. These state data do not include a break-out line for child care but do include a line for pre-K spending through the Maryland State Department of Education. It appears that the funds reported as state spending for pre-K do not include any child care. HHS requires separate reporting categories for pre-K spending and for child care spending. In federal fiscal 2021, the state reported to HHS $5.4 million in childcare spending (wholly separate from pre-K spending), representing 0.9% percent of total TANF and MOE spending based on HHS calculations.

[1] Annie E. Casey Foundation. (2023). 2023 KIDS COUNT® Data Book: State trends in child well-being. https://assets.aecf.org/m/resourcedoc/aecf-2023kidscountdatabook-2023.pdf

[2] Haider, A., Goran A., Brumfield, C., & Tatum, L. (2022). Re-envisioning TANF: Toward an anti-racist program that meaningfully serves families. Georgetown Center on Poverty and Inequality. https://www.georgetownpoverty.org/issues/re-envisioning-tanf/

[3] Office of Policy Analysis. (2022). Department of Human Services fiscal 2023 budget overview. Department of Legislative Services. https://mgaleg.maryland.gov/Pubs/BudgetFiscal/2023fy-budget-docs-operating-N00-DHS-Overview.pdf

[4] Center on Budget and Policy Priorities. (2023). Maryland TANF spending. https://www.cbpp.org/sites/default/files/atoms/files/tanf_spending_md.pdf

[5] Center on Budget and Policy Priorities. (2022). TANF cash assistance should reach many more families in Maryland to lessen hardship. https://www.cbpp.org/sites/default/files/atoms/files/tanf_trends_md.pdf