What’s In the Mayor’s Proposed Budget for Baltimore City?

As the Baltimore City Council considers the mayor’s proposed budgets for city programs and services for the next budget year, which begins July 1, Baltimore faces a mixed economic forecast as the city emerges from the COVID-19 pandemic stably but is heading into cautious territory. Inflation, rising interest rates, and international conflicts are shaking the stability of the global economy at a time when most officials expected the country to bounce back to pre-pandemic norms. Despite the continued uncertainty, the city’s main revenue sources have continued to grow, allowing the city to fund new investments like additional school funding and a guaranteed income pilot program. Additionally, the influx of federal relief funds provides the city with historic levels of aid through 2026, preparing it for the road ahead.

Revenue

The city has significantly more revenue available to support public services in the upcoming budget year because of the influx of federal relief funds, increases in property values, and higher incomes. General fund revenues – the pool of money that funds most city services – are at $2.15 billion, up 7% compared to the current budget year. Early projections also indicate that the city will have additional unallocated funds left at the end of the current budget year, which ends June 30. Below are the major sources of revenue:

- Property tax receipts increase 1.8%, with strong residential assessment growth

- The growing value of residential homes since the pandemic hit has grown the tax base enough to offset reduced tax revenues from declining assessments of some commercial properties, predominantly hotels and office buildings, that have remained vacant throughout the pandemic.

- Property values in North Baltimore and the Central Business District grew 6.6% over three years, with 3.3% increase in commercial property and 8.7% increase in residential. 97.7% of properties in the North Baltimore and Central Business District that grew in assessment were residential, representing stable growth in property value since fiscal 14 when value was assessed at a 3.1% decline in value.

- The downtown area office vacancy rate is around 19%, due to a combination of increased teleworking and businesses relocating. The net change in occupied retail office space has fluctuated between positives and negatives since early 2021, showing a slower rebound for office space utilization.

- Recordation and transfer taxes, paid as part of real estate transactions, reached new record highs as the housing market has heated up, with a 7.7% increase from the current year’s budget.

- Baltimore City and the Baltimore Metro area both retained robust real estate activity in the months between October and December of 2021, with projected revenues at $130 million, $46 million higher than budgeted for the current budget year, continuing the boom in real estate sales since early in the pandemic. However, the recordation and transfer tax revenue estimate for the proposed budget is a more conservative $90 million as future interest rate hikes are expected to slow real estate activity, albeit with a higher average price. $30 million from this fund was appropriated to the capital budget.

- Income tax revenues grew 11.7%

- Despite its continuing decline in population, the city’s tax base includes a growing number of residents with incomes between $60,000 – $150,000. Overall, the city’s taxable income is steadily growing as wages rise and the state’s economy recovers from the pandemic.

- The city’s unemployment rate fell to near pre-pandemic levels of 5.8%, with a steady increase in employment in the past year.

- State aid reached $104.8 million an increase of 3.1% from the current budget year

- The new funds include increased police funding and additional funding for ongoing public health programs.

- This does not include $1 billion in state funding for Baltimore City Public Schools, which is not part of the main city budget.

- Other

- $40 million in funds from Emergency Services Payment program in the current year’s budget will be transferred to the general fund. This was a Medicaid reimbursement to the city for using its ambulances to transport Medicaid patients.

- Federal relief funds

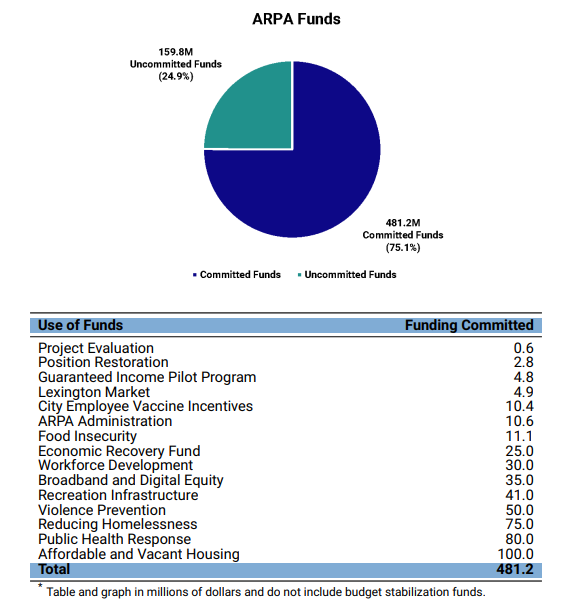

- The American Rescue Plan Act, the largest federal economic recovery program, awarded the city $641 million. The Mayor’s Office of Recovery Programs is awarding these funds to city agencies and nonprofits based on eligible projects. So far, the office has committed $481 million of ARPA funds and spent $29.8 million, per the ARPA dashboard. These funds do not show up in the proposed budget and will instead show up in the Fiscal 2023 financial report. Major categories of committed projects include:

Going forward, evolving global situations such as possible new COVID-19 variants, continued supply chain issues, the Russian-Ukraine war, and rising interest rates leave the city in a precarious position to head cautiously into fiscal year 2023, which begins July 1. As the economy responds to these events, the city must adequately plan with future disruptions in mind.

Operating Budget

The city’s proposed operating budget, $3.3 billion, is significantly smaller than the current year by 13.7%. However, that difference mostly reflects federal ARPA funds, which were fully appropriated to MORPS for the current budget year and are not reflected in the proposed budget, even though there are still funds left to use. Additionally, expiring CARES Act and FEMA funds for the COVID response and economic recovery and slightly lower enterprise funds (sewage, water, and wastewater utilities), slightly contributed to decline. Most city agencies are still seeing slight increase in funding to support new and ongoing programs and services, such as the Mayor’s Guaranteed Income Pilot Program, which was funded with federal recovery funds. Furthermore, while not fully represented in the budget, ARPA funds are appropriated to city agencies across the next several fiscal years and are expected to show up in later fiscal reports.

Baltimore City Health Department

- The city’s health department’s proposed budget totals $208 million, an increase of 0.1% from the current budget year. Major highlights include:

- The agency will utilize $26.2 million in ARPA funds for COVID-19 response, including contact tracing, personal protection equipment, testing, vaccination, and providing emergency food assistance.

- The budget removes $29.75 million of CARES funding that expired on December 2021 after the city did not expend these funds, which supported various COVID response programs.

- BCHD expects 1,400 admissions to the Crisis Stabilization Center, a place where people experiencing serious health issue related to substance use can receive short-term care and referrals to ongoing behavioral health and social services

Public Safety

- The Baltimore Police Department’s proposed budget totals $579 million, an increase of $24 million (4.3%) compared to the current budget. Advocates voiced concerns about the increasing budget of BPD and have continued calls to defund BPD and reinvest funds in communities that have a long experienced a lack of public investment. Major highlights include:

- Replacing 30 vacant sworn officer positions to fund 35 civilian investigator positions to supplement detective, investigator, and auditing functions that are currently performed by sworn officers.

- 9 positions to support the implementation of the Group Violence Reduction Strategy throughout BPD operations

- Reduces overtime by $4 million.

- $15 million in state funds supporting:

- $500,000 for police recruitment and retention.

- $8 million in State Block Grants

- $6.2 million for warrant apprehension activities and

- Salaries for new recruits would be raised to start at $60,000, while other programs would offer incentive pay for education and patrol work.

- $8 million in new federal funding.

- New telephone reporting unit aims to reduce patrol response to low priority calls for service such as auto collisions, follow-up calls, and civil matters.

- $10 million in state capital aid for two police station renovations.

Baltimore City Fire Department will use $5 million of revenue from ambulance fees to try to improve emergency medical services. This includes new ambulances, quality assurance and training staff to improve patient outcomes, a population health program to better connect patients with appropriate care, and a 911 nurse triage program for low-harm service calls.

- The department will also receive $10 million in state capital aid for two fire station renovations.

Baltimore City Public Schools

- The proposed city support for Baltimore schools in fiscal year 2023 totals $332 million, an increase of $57 million, with the increase reflecting new education funding formulas .

- The Blueprint for Maryland’s Future Act is making significant new investments of state funds in city schools and expects the city’s required contribution to increase in turn over the next eight fiscal years, growing from $325 million in fiscal year 2023 to $446.1 million in fiscal year 2030, the highest increase of local support among Maryland’s jurisdictions.

- The Office of Youth and Trauma targets reaching 3,500 participants in Trauma-Informed Care trainings – a significant increase from the 939 participants served last year – and 368 students in School-Based Violence Prevention education.

- Other funds include $15.8 million for school health services and $5 million for school crossing guards.

- $10.8 million in General Fund support for the Family League of Baltimore, including $7.2 million to support community schools and before- and after-school programs and $3 million to support additional youth programming in coordination with the Mayor’s Office of Children and Family Success, which is funded at $28 million.

- Combining city, state, federal, and other funding sources, the City Schools budget for the fiscal 2023 totals $1.4 billion.

Housing and Community Development

- The proposed budget for the Department of Housing and Community Development totals $85.7 million, a decrease from the $112 million in the current budget year. The higher funding level in the current budget was due mainly to one-time federal funds for housing. Major highlights include:

- $1.7 million to assist with services related to acquisitions of vacant properties across the city.

- $100 million ARPA award to address housing issues throughout Baltimore City. Funding will assist the creation of new affordable housing units, address vacant properties, and support low-income renters and homeowners. The year-by-year allocation of this funding is not available in the proposed budget nor has the funding been spent by the department, however the expenditures report lists the funding sources as:

- $39,687,904 for Blight Elimination and Prevention

- $4,000,000 for Resident Protection

- $56,312,096 for Strategic Capital Investment.

Capital Budget

The proposed capital budget for fiscal year 2023 totals $792 million, a 62.6% increase from this year’s budget. The capital budget is used to fund major repairs and new construction of city facilities. City leaders are proposing shifting surplus funds from the federal relief programs, recordation and transfer taxes, and emergency medical service payments to support public construction projects. Other sources include $102.1 million in state aid and $94 million in federal aid. The proposed capital budget would take advantage of the surplus cash to finance fewer projects through bond debt and instead use “pay-as-you go” funding – essentially the equivalent of paying with cash rather than a credit card. Major highlights include:

- $90.5 million in pay-as-you-go funds, an increase of $75 million from the current budget, fund a variety of capital improvements, including:

- $3 million to address public facilities that don’t meet the accessibility standards of the Americans with Disabilities Act

- $25 million to upgrade fire stations

- $17.4 million for sanitation yard renovations.

- $19 million for school building upgrades. There is also $28 million in state funding allocated to improve city school buildings

- $7 million for homeownership and home repair incentives and $9 million for major redevelopment projects through the Department of Housing and Community Development.

- State funds:

- $10 million for adding ADA-compliant sidewalks and crossings.

- $17 million Druid Hill Park reservoir

- Federal:

- $30 million in Highway Transportation funds plus an additional $10 million from the Infrastructure Investment and Jobs Act to help repair roads and bridges.

- $8 million in Community Development Block Grants used for capital investments serving low- to moderate-income city residents.

It’s important to recognize the need for systematic facility repairs in the city. According to the planning department’s Facility Condition Index score, the city has about $1.3 billion in deferred maintenance cost. This means that to keep up broad city infrastructure at a basic maintenance level would cost an additional $1.3 billion, or $153 million over 10 years, in capital funding.

Glossary of Budget Terms

AMERICAN RESCUE PLAN ACT

- Signed into law in March 2021, The American Rescue Plan Act (ARPA) is a $1.9 trillion economic stimulus package. ARPA includes State and Local Fiscal Recovery Funds (SLFRF), which provides direct aid to state, local, and Tribal governments to support the response to and recovery from the COVID-19 public health emergency.

ASSESSED VALUATION

- A valuation set upon real estate and other taxable property by the State Department of Assessments and Taxation and utilized by the City of Baltimore as a basis for levying taxes. Completed on a three-year basis.

APPROPRIATION

- The legislative authority to spend and obligate a specified amount from a designated fund account for a specific purpose.

BUDGET

- A proposed plan of revenue and expenditure for a given year

CAPITAL BUDGET

- A set of budget accounts established to plan for specific capital projects financed by revenues received from City funds, bond loans, State, federal, and other miscellaneous funds.

CAPITAL FUND

- A set of budget accounts established to plan for specific capital projects financed by revenues received from City funds, bond loans, State, federal, and other miscellaneous funds.

FACILITY CONDITION INDEX

- A formula of the ration between deferred maintenance costs and reproduction cost (the cost of replacing current buildings) of the city’s real estate portfolio.

GENERAL FUND

- A central fund into which most of the City’s tax and unrestricted revenues are budgeted to support basic City operations and pay-as-you-go (PAYGO) capital projects.

GRANT

- A contribution made from either the private sector to the City or by one governmental unit to another unit. The contribution is usually made to support a specified service, function, or project.

OPERATING BUDGET

- A plan, approved by the Mayor and City Council, for appropriating funds to agencies for operating costs during the fiscal year.

PAY-AS-YOU-GO (PAYGO)

- Capital projects funded from current year General Fund revenues.

REVENUE

- Income generated by taxes, fines, penalties, notes, bonds, investment income, property rental, user charges, federal grants, State grants, private grants, county grants, and miscellaneous services.

The following funds cannot be budgeted for purposes other than their indicated use.

STORMWATER UTILITY FUND

- Established to budget for the operating and capital expenses of the City’s stormwater management system.

WASTEWATER UTILITY FUND

- Established to budget for the operating and capital expenses of the City’s sewage facilities.

WATER UTILITY FUND

- Established to budget for the operating and capital expenses of the City’s water supply system