Welcome Revenue Surprise Should Spur Speedy Help for Struggling Marylanders

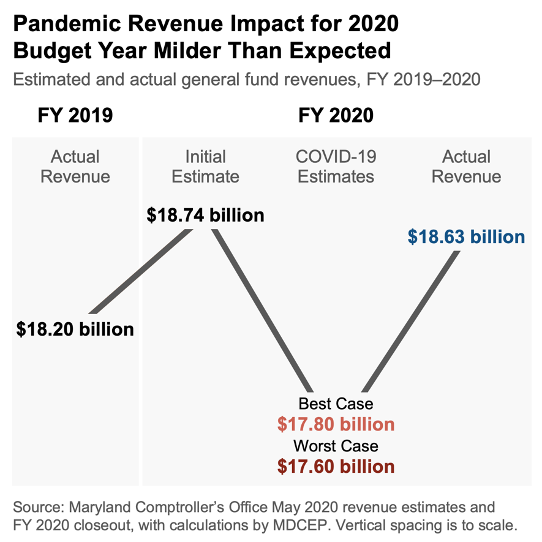

The economic fallout from the COVID-19 pandemic took a smaller-than-expected bite out of Maryland state revenues for the budget year that ended June 30, according to new data from the state Comptroller’s Office. General fund revenues for fiscal year 2020 totaled $18.6 billion – $100 million below pre-pandemic projections but $1 billion more than the worst-case scenario state analysts laid out in May. Policymakers should take heart from this encouraging news, but they must not become complacent. The General Assembly should convene a special session as soon as possible and take this opportunity to assist Marylanders who face the possibility of eviction or other urgent threats to their wellbeing. They also must reject harmful cuts to services like education and health care that support our economy, as well as take steps to improve the state’s tax code so that we can invest in thriving Maryland communities in the years to come.

Before the pandemic, state analysts predicted $18.7 billion in general fund revenue for the fiscal year ending July 30 of this year, an increase of 2.9 percent over FY 2019 revenues. This estimate was comparable to revenue growth in recent years, although not fast enough to keep up with the needs of Maryland communities. However, the coronavirus pandemic and necessarily drastic policy response caused unprecedented job losses and a sharp drop in household spending – resulting in a severe but highly uncertain economic downturn. State analysts predicted that the downturn could cost the state between $925 million and $1.1 billion in lost general fund revenue by June 30, acknowledging that quickly changing circumstances made these projections highly imprecise.

The short-term fiscal impact ultimately proved milder than expected, with final FY 2020 general fund revenues coming in only about $100 million below initial estimates and 2.4 percent higher than FY 2019 revenues (not adjusted for inflation). State analysts attribute this strong performance to three factors:

- Personal income and corporate profits grew quickly enough through December to significantly increase delayed tax payments on income earned in 2019. Both personal and corporate income tax revenues actually exceeded initial estimates, together adding more than $280 million above expectations.

- Strengthened unemployment insurance benefits and individual stimulus payments in the federal CARES Act partially cushioned the pandemic’s economic blow. Maryland workers were paid more than $800 million in unemployment benefits between April and June, money that went straight back into our economy. Each $1 in unemployment benefits can boost the economy by up to $2.10, according to the nonpartisan Congressional Budget Office.

- The state modernized Maryland’s sales tax in 2018 and 2019 after a Supreme Court ruling allowed states to tax all online purchases just like purchases made at brick-and-mortar stores. These reforms generated $100 million in general fund revenue, plus more than $200 million to support the Blueprint for Maryland’s Futureeducation reforms.

While this news is welcome, policymakers must still take action to support Maryland families through this crisis and preserve the state’s ability to respond. Because much of the unexpected increase in revenue was related to income earned in 2019, the fiscal shock will likely be more severe during the current budget year. These losses could prove especially large if a rushed reopening exposes more people to the virus and thereby prolongs the crisis. Furthermore, the Trump administration and congressional Republicans’ refusal to agree to smart steps such as universal stimulus payments and state and local fiscal aid have put negotiations for another federal stimulus package in limbo – which threatens to unnecessarily deepen the economic downturn.

Meanwhile, people across Maryland are facing extraordinary hardship:

- About 250,000 Maryland workers were unemployed as of July, roughly double the number who couldn’t find work at the same time last year.

- About 170,000 Marylanders likely lost employer-provided health insurance between March and April.

- More than 350,000 Marylanders – one in every 13 adults – did not always have enough to eat as of late August. Only 3 percent of white Marylanders did not always have enough to eat, compared to 13 percent of Black Marylanders and 14 percent of Latinx Marylanders.

- Nearly 290,000 Marylanders were behind on their rent or mortgage, or were not confident they could make their next payment on time, as of late August. More than 150,000 adults worried that they could be evicted or face foreclosure within the next two months.

- Nearly one-third of adults in Maryland (1.4 million altogether) had difficulty paying for household expenses as of late August. Two out of five Marylanders of color faced financial difficulty, including more than half of Latinx adults.

- COVID-19 had claimed the lives of more than 3,600 Marylanders as of August 28, 700 more than the total number of Americans killed in the September 11, 2001, attacks.

Maryland policymakers should consider both the recent positive news and the continuing risks as they respond to the pandemic:

- Policymakers should reject damaging cuts to services like education and health care that support our economy. Hogan called for deep, hasty budget cuts early this summer, before the magnitude of revenue losses was known. State Treasurer Nancy Kopp and Comptroller Peter Franchot rolled back some of these cuts, but it would have been more prudent to tap reserve funds and postpone drastic measures until more information came in. Each $1 million drop in state and local expenditures is associated with approximately five jobs lost, according to analysis by the Economic Policy Institute.

- Policymakers should use the unexpected revenue to assist Marylanders who face urgent needs. People across our state are currently facing extraordinary hardships, and Marylanders of color are being hit hardest. Lawmakers should provide assistance to ensure families are able to keep a roof over their heads without building up unaffordable debts, can get health care when they need it, and can put food on the table.

- Policymakers should clean up our tax code so we can invest in our state’s future. Even before the pandemic, Marylanders had a growing list of unmet needs including underfunded schools, a lack of affordable housing, and inadequate access to long-term care for older adults. While the recent good news on state revenues is welcome, the fact remains that we are not investing enough in the basics. We can do better by closing corporate tax loopholes and asking the wealthiest to pay their share.

- Policymakers should not wait until January to act. Legislative leadership has so far rejected calls to convene a special session to address growing policy needs, opting instead to wait for the legislature’s regular session, which starts in January. This delay is causing needless suffering for hundreds of thousands of Marylanders. Kids can’t wait until next year to eat. Families can’t wait until next year to pay rent. Marylanders who need medical care – for COVID-19 or for any other reason – can’t wait until next year to get treatment. Lawmakers must act now.