This Tax Day, Remember that Tax Policy Is Racial Justice Policy

This year’s Tax Day is unlike any other in recent memory. Thousands of Marylanders have recently lost loved ones, hundreds of thousands are out of work, and state and local governments are contemplating deep, damaging budget cuts to offset unprecedented revenue losses. Each one of these issues is doing outsized harm to Marylanders of color. Cleaning up our tax code would strengthen our ability to invest in public health, protect essential services like education and transportation, and build rather than undermine racial justice.

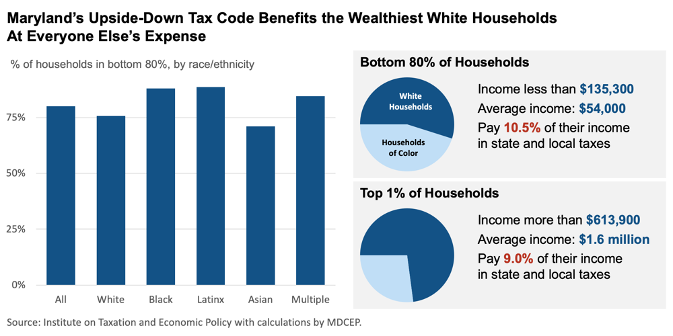

The tax code Maryland has today is upside-down: It lets the wealthiest 1 percent of households pay a smaller share of their income in state and local taxes than the rest of do. This lopsided structure benefits a small number of overwhelmingly white individuals who disproportionately gain their income from what they own rather than what they do, at the expense of working families of every racial and ethnic background.

- Four out of five Maryland households have income under $135,000 per year, including large majorities of every racial and ethnic group: 76 percent of white households, 88 percent of Black households, 89 percent of Latinx households, and 71 percent of Asian households. On average, these households pay 10.5 percent of their income in state and local taxes.

- One out of 100 Maryland households have income over $614,000 per year. Across racial and ethnic groups, only miniscule shares of households belong to this group. But white households are more than twice as likely as Black or Latinx households to be in this rarified class. White households in the top 1 percent together account for only 0.7 percent of all Maryland households, but they take home 12 percent of all income. On average, households in the wealthiest 1 percent pay only 9.0 percent of their income in state and local taxes.

Cleaning up Maryland’s tax code would strengthen the investments that keep Maryland communities running, such as health care and education. This, in turn, would support our economy by protecting thousands of good jobs and keeping income in the pockets of the families most likely to spend it on necessities rather than squirreling it away.

It would also make our revenue system more racially just, for two reasons:

- Because Marylanders of color are less likely than their white counterparts to be among the wealthiest households, asking more of those with the greatest ability to pay would help move us toward a more equitable distribution of income.

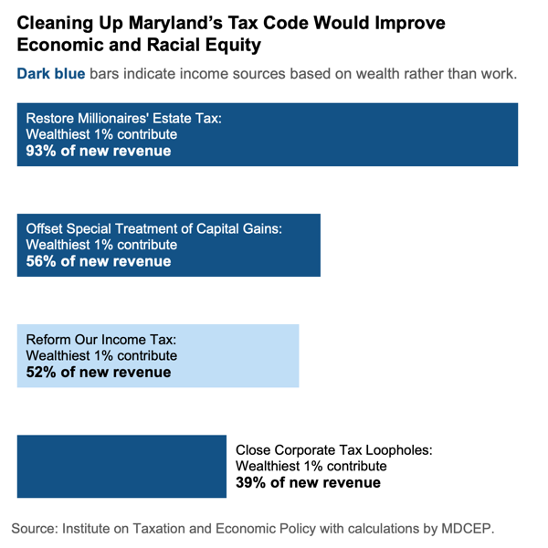

- White households are more likely to have significant built-up assets such as stocks and bonds than households of color – even when comparing households at the same income level. Closing corporate tax loopholes, restoring the millionaires’ estate tax, and offsetting special treatment of capital gains would ensure that those who gain their income from wealth rather than work pay their fair share.

Here are some steps Maryland can take to build a more effective, more just revenue system:

- Clean up our tax code: Close corporate tax loopholes that only benefit large, multi-state corporations and their shareholders so that these companies contribute to the services they rely on. Local Maryland businesses can’t take advantage of these tax gimmicks.

- Remove special interest tax breaks: Maryland gives away millions in business tax breaks each year, despite significant evidence that they do nothing to boost our economy.

- Improve our upside-down tax system: Restructuring Maryland’s income tax will enable us to raise significant revenue for schools, health care, and other needs and reduce income taxes on most low- and middle-income Marylanders.