The Growing Gap Between the Richest and the Rest in Maryland

The gap between the ultra-rich and the rest of us has been growing steadily since the 1970s throughout the United States. In Maryland, there is evidence that the problem has been getting worse since the recession.

Maryland is one of 15 states where the wealthiest 1 percent was the only income group to see its wages rise between 2009 and 2013, according to “Income inequality in the US by state, metropolitan area, and county,” a report published this week by the Economic Policy Institute (EPI).

Average wages for those in the top 1 percent went up by more than 7 percent during that time period and average wages for other Marylanders declined by 4 percent.

Additional findings of the study:

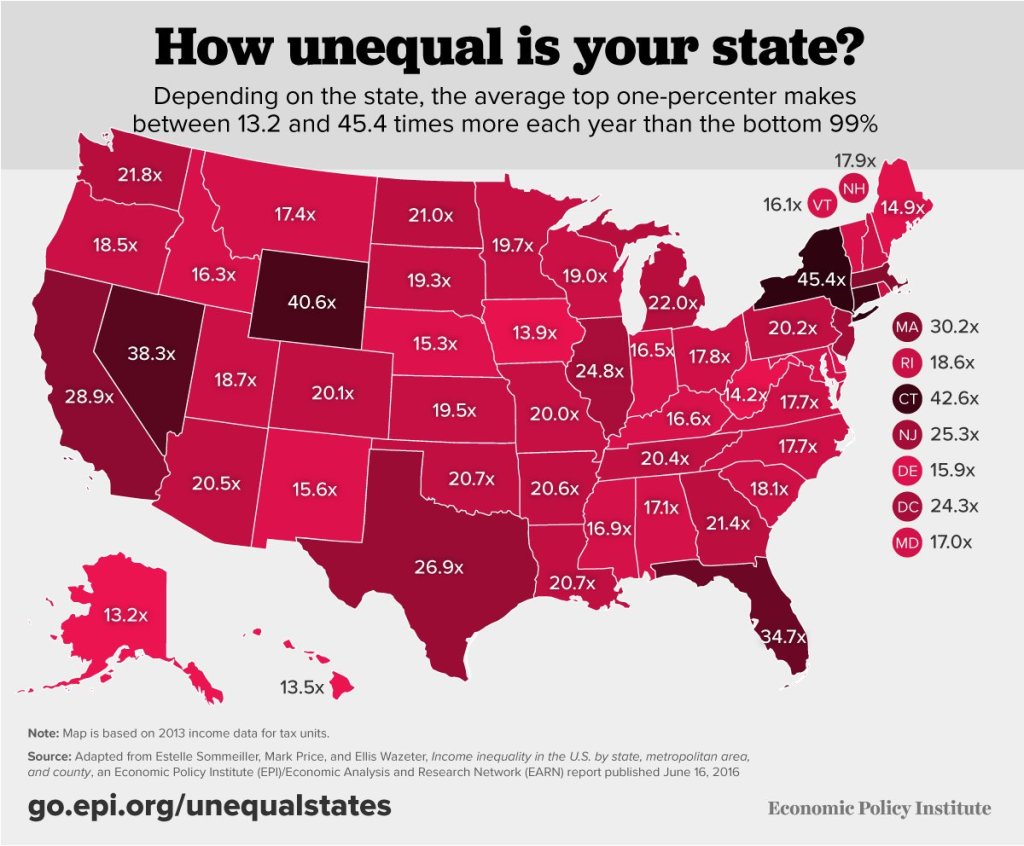

- The top 1 percent made 17 times more, on average, than the average salary of all other Marylanders.

- The average annual income of the top 1 percent was $1,024,110. To be in the top 1 percent in Maryland, one would have to make $421,188.

- Talbot County had the highest level of inequality. The average income of the top 1 percent in Talbot County is $1,504,912, almost 28 times higher than the average income of everyone else in the county, which is $54,139.

Why does this matter? Our economy works best when there is opportunity for everyone. If the benefits of a growing economy aren’t widely shared, families and the economy as a whole are worse off.

While this is a national problem, there are things that we can do in Maryland to help.

Maryland can strengthen the state Earned Income Tax Credit, which helps people who work but struggle to get by on low wages. Right now the state EITC leaves behind younger workers and workers without dependent children; closing that gap would help families, communities, and local economies.

Policymakers could also revisit the minimum wage, as Baltimore City and Montgomery County are doing, to ensure that workers are paid enough to afford their basic needs.

Making sure that all Marylanders are able to take paid time off when they or a family member are sick would also help protect incomes of the state’s lower-wage workers.

This new information also reemphasizes the huge drawbacks that would accompany tax cuts for the wealthiest Marylanders, being considered by some policymakers. The approach the state Senate took during the past legislative session would have disproportionately benefitted the top 1 percent– the only group that saw an increase in earnings during the 2009-2013 period the EPI study reviewed.