Many Americans are still feeling the effects of the Great Recession, and the recovery thus far has been skewed toward the wealthy. As the economic and employment prospects of moderate and low income Americans remains tenuous, safety net programs for those who face economic hardship are increasingly important, but remain under attack.

Yesterday, the Washington Post highlightedthe difficulties that moderate and low-income Americans continue to face in an uncertain economy. In an article that centered on the findings of a University of Virginia survey and others, the Post vividly described the anxiety that workers face, and how their feelings about their prospects have worsened over time. To summarize:

|

Current Attitudes

|

Comparison from Previous Surveys

|

|

54 percent of workers making $35,000 or less worry “a lot” about losing their jobs

|

37 percent of workers making $35,000 or less worried “a lot about losing their jobs in 1992 and 1975

|

|

85 percent of lower income fear that their families’ income will not be enough to meet expenses

|

60 percent of lower income feared that their families’ income will not be enough to meet expenses in 1971

|

|

32 percent of low income workers worry all the time about meeting expenses

|

This is almost three times the number of people who felt this way in the 1970s

|

|

More than 6 in 10 workers worry they will lose their jobs because of the economy

|

According to the Post, today’s worries exceed those in 1975, a time of recession marked by high unemployment and high inflation.

|

These finds bring into stark relief the way in which low and moderate income workers have been left out of the economic recovery since the great recession. At a time when the stock market is reaching record highs, the University of Virginia survey shows that many feel like their economic prospects have only worsened in recent years.

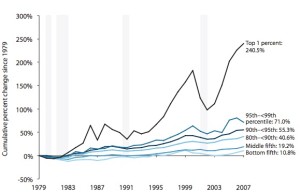

Economic anxiety is particularly acute among low income workers. Intense worry about possible job loss is 29 percent, among workers with incomes between $35,000 and $75,000, and drops to 17 percent for those with incomes above that level. This is the result of increasing inequality, stagnating wages, and declining wages among those with low incomes. Since 2000, average household incomes for the poorest 40 percent of workers have fallen by more than 10 percent, according to the Post. As we showed in our State of Working Maryland 2012 report, while incomes for most have stagnated, incomes for the wealthiest residents have increased dramatically:

Change in Real Annual Household Income by Income Group, 1979-2007

(Click to Enlarge)

Data source: Congressional Budget Office, 2010

In this context, government safety net programs play an important role in assisting those whose worst economic fears are realized. However, these programs face erosion and attack, as unemployment benefits for 2.1 million workers are set to expire at the end of the year absent Congressional action, and nutrition assistance benefits have already decreased after being expanded by the post-recession economic stimulus and face calls for further reductions from lawmakers. In their ‘Hardship in America’ series, the Center on Budget and Policy Priorities highlights the tough times that many workers face and the programs that help alleviate poverty, such as the Earned Income Tax Credit, housing and food assistance, and unemployment benefits.

Fortunately, Maryland maintains important programs to help moderate and low-income workers such as its own Earned Income Tax Credit and expansion of Medicaid which starts in 2014. As state lawmakers face tough decisions on the state’s budget in the upcoming legislative session, it is important that they prioritize the economic security of Maryland’s workers and maintain and expand programs that help workers amid an economic recovery that has largely excluded them.