Spending Affordability Committee Recommends Modest Budget Increase, Deficit Reduction

Yesterday, Maryland state lawmakers responsible for advising the Governor and General Assembly on spending levels for the state budget recommended that next year’s spending increase no more than 4 percent, from $37 billion to $38.5 billion. This relatively small budget increase is necessary to support inevitable growth in state spending to meet the needs of residents who, like the state itself, are still recovering from the Great Recession.

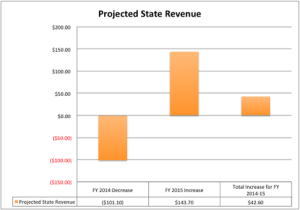

Revenue Down in Short Term, Projected Up in Long Term

The Spending Affordability Committee’s decision comes amid decreased revenue projections for the current fiscal year, but increased expectations for fiscal year 2015. The December Board of Revenue Estimates forecast that revenues for the current fiscal year will be $101.1 million less than expected, largely due to an economy that is still growing recovering from the Great Recession and hampered further by federal budget sequestration that kicked in at the beginning of 2013 and resulted in less revenue coming into Maryland, as well as the federal budget shutdown in October and general environment of uncertainty regarding federal spending. However, the December revenue estimates expect the state’s economy to grow and expect that revenue for FY 2015 will be $143.7 million more than initially forecast in September. This includes expectations for improved income and sales tax revenue that will result from the opening of the Amazon distribution center in Baltimore. The recent federal budget deal should reinforce these expectations by removing uncertainty and relieving sequestration cuts.

(Click to enlarge)

Source: Maryland Board of Revenue Estimates

Modest but Necessary Budget Growth

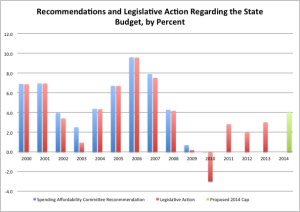

Warren Deschenaux, director of the office of policy analysis in the Department of Legislative Services characterized the projected FY 2015 $361 million structural deficit as “a small hole, certainly compared to what we have seen in the past.” As such, while taking action to reduce the state’s budget deficit is imperative, state lawmakers would be wise to do so in a way that does not drastically affect the ability of state programs to meet residents’ needs, and allow the budget to grow during crises as needed. In general, state spending on programs can be expected to increase from year to year as the population grows and particularly in times such as these when needs remain high. During times of normal economic growth, these increases in spending are more than covered by economic growth that leads to rising wages and revenue for the state. This is typically the case for Maryland. However, the 2008 recession caused Maryland lawmakers to reduce spending to respond to the 2008 recession and subsequent slow recovery (some of which was offset by new federal funds in the Recovery Act).

(Click to enlarge)

Source: December 2013 Spending Affordability Committee Report; 90 Day Reports for the 2011, 2012, and 2013 Legislative Sessions

Usually, the Spending Affordability Committee recommends a percentage growth goal for the governor’s budget. However, between FY 2011 and 2013, the committee instead proposed targets to reduce the structural deficit. (The Spending Affordability Committee’s recommendation for 2010 was 0 percent budget growth.) This year, the Spending Affordability Committee returned to form and recommended an increase of no more than 4 percent. This responds to the need to allow spending to rise to meet the needs of state programs while also reducing the structural budget deficit by $125 million. This recommendation is also in line with the expected growth of the Maryland economy during this time. Revenue grew by 4.4 percent between FY 2012 and 2013. Currently, the Department of Legislative Servi

ces forecasts FY 2014 revenue to be 2.4 percent more than FY 2013. Not increasing state spending at all, as initially proposed by some lawmakers during yesterday’s Spending Affordability decision meeting, would amount to a cut in support for state programs.

ces forecasts FY 2014 revenue to be 2.4 percent more than FY 2013. Not increasing state spending at all, as initially proposed by some lawmakers during yesterday’s Spending Affordability decision meeting, would amount to a cut in support for state programs.

Investment Income Growth Outpacing Earnings

Notably, while the economy is still struggling to recover from the Great Recession, some forms of income have grown faster than others. According to the Board of Revenue Estimates, capital gains income grew by 50 percent in 2012 and by 20 percent in 2013, outpacing the growth of income from wages.

Debt Increase Limited

In November, we discussedthe Spending Affordability Committee briefing on Maryland’s Capital Budget, in which the Department of Legislative Services advisedlawmakers not to increase Maryland’s borrowing authority by $75 million per year for the next five years, as requested by the O’Malley administration and approved by the Capital Debt Affordability Commission, out of concerns about the increasing costs of debt servicing for the state budget. The committee decided to recommend increasing borrowing authority by $75 million for only one year, out of concerns for the need to fund Maryland’s plans to clean up the Chesapeake Bay without diverting money from other transportation projects or unrelated parts of the state budget. It will be up to the next governor and legislature to decide whether to pursue additional debt authorization or to fund Bay cleanup through some other means.

Though the Spending Affordability Committee’s recommendations are not binding, the Governor and the General Assembly usually take action in line with its advice. Governor O’Malley will release his budget no later than January 15th.