Spending Affordability Committee Meeting Addresses Spending on Mass Transit, Pensions, and the Reasons for Decreased Revenue Projections

Yesterday we discussedthe November meeting of the Spending Affordability Committee and highlighted its concerns about increased borrowing costs crowding out the ability to pay for new initiatives and savings that Maryland is seeing from implementing the Affordable Care Act. Today we will conclude our coverage of the November meeting by highlighting its findings regarding transportation spending and pension reform and look ahead to the committee’s final meeting before the start of the 2014 legislative session.

Department of Transportation Budget

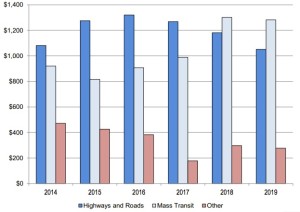

The Department of Legislative Services noted that the transportation budget ended the 2013 fiscal year with more money than planned, both due to less spending and more revenue than expected. Spending on mass transit, including the Red and Purple lines, will increase in the coming years and peak in 2018, though total spending on roads and highways remains higher than spending on mass transit during this time.

Capital Spending on Transportation by Category, 2014-2019

Note: “Other” comprises the Secretary’s Office, the Maryland Port Administration, the Motor Vehicle Administration, and the Maryland Aviation Administration. “Mass Transit” includes the grant to the Washington Metropolitan Area Transit Authority.

Data source: Maryland Department of Transportation, 2014 draft Consolidated Transportation Program; Image source: Spending Affordability Committee Briefing, November 2013, p. 14.

A recent panel of transportation experts convened by the Greater Baltimore Committee praised the recent passage of the Transportation Infrastructure Investment Act which increased transportation funding via a gas tax increase and other revenue-raising measures such as bus fares and vehicle registration fees. According to Maryland Reporter, the panel rightly agreed that “expanding public transportation was key to a prosperous and sustainable future for Maryland.”

Pension Reform and Local Taxes

DLS analysts showed that while unfunded liabilities have leveled off rather than continuing to grow after the state government shifted some of the costs of teacher pension contributions to country governments, “[l]imited revenue at the local level resulted in seven county governments raising at least one major local tax in fiscal 2014 in order to balance local budgets.”

Under the Spending Affordability process, which is established by Maryland law, the committee makes recommendations aimed at limiting the growth of the state budget for the upcoming year, though its recommendations are not binding. This month’s briefing focused on Maryland’s Capital Budget, which is composed of construction projects and other long-lasting assets. Last month, the Spending Affordability committee warned that the state is likely to face an $87.6 million budget deficit after initially expecting a surplus. DLS Policy analysis Director Warren Deschenaux said the new forecast of lower revenue can be blamed on “our colleagues down Route 50,” referring to the disagreements among federal lawmakers regarding the budget that have lead to policies and other actions that have hurt Maryland’s economy, such as sequestration and the recent Government shutdown. The Spending Affordability Committee will meet again on December 18 to make its final budget recommendations to Maryland lawmakers before the upcoming 2014 legislative session.