A Roadmap for Tax Justice in Maryland: Boost Opportunity and Equity through Tax Reform

No matter what we look like or where we come from, most Marylanders believe in caring for our families and leaving things better for the generations to come. However, the upside-down tax system we have today makes it harder for our communities to thrive. For decades, wealthy corporations have rigged the rules to avoid paying taxes, putting most of the responsibility for funding our schools, health care, roads and transit on working families and small businesses.

Now, one-third of the largest corporations in the state pay zero income taxes in a typical year, and the wealthiest 1% of Marylanders pay a smaller share of their income in taxes than the rest of us. Our tax system also reinforces the racial inequities built into our economy and squanders an opportunity to reduce the racial wealth gap.

To truly leave no one behind, we must reform our tax system so that large, profitable corporations and the wealthy pay what they truly owe. At the same time, we can transform our communities and expand opportunity by creating robust working family tax credits that help families make ends meet.

Elements of a Fair Tax System

- Income tax reform: The most effective way to address the inequities in our tax system is through reforming the income tax. This memo models adding a 7% millionaires bracket and gradually increasing rates for individuals taking home more than $250,000 per year and married couples taking home more than $300,000 per year. See Supplement for details.

- Corporate tax reform: Our state continues to put our small, Maryland-based businesses at a disadvantage compared to their large competitors by maintaining loopholes that allow large, multi-state corporations to use accounting gimmicks to avoid state taxes. The majority of states have already closed these loopholes. It’s past time we level the playing field for small businesses by adopting combined reporting and the throwback rule.

- Millionaires’ estate tax: Taxing inherited wealth is one of the most effective ways to advance racial equity through tax policy. However, Maryland in 2014 weakened its estate tax by exempting many multi-millionaire heirs from paying anything and handing a large tax cut to the few who still pay. Much of the built-up wealth passed through estates has never been subject to tax at all. Reinstating the previous $1 million exemption would be a step forward for racial justice.

- Capital gains surtax: Income earned from wealth rather than work is subject to a special low federal income tax rate, providing lopsided benefits to people who are already well off. Maryland can partially offset the federal government’s special treatment by adding a 1% surtax on capital gains.

- Child Tax Credit: The federal Child Tax Credit helps millions of families with children afford necessities, but it currently leaves out the very children who need help most. We can fix that by guaranteeing kids in struggling families a $2,250 benefit ($2,500 during crucial early childhood years). See Supplement for details.

- EITC simplification: The Earned Income Tax Credit is a powerful tool to increase working families’ incomes, but the structure makes it complex to administer. We can strengthen Maryland’s EITC by making the full credit amount refundable and combining it with the poverty level credit. Baseline for EITC simplification assumes that recent temporary EITC improvements are made permanent. See Supplement for details.

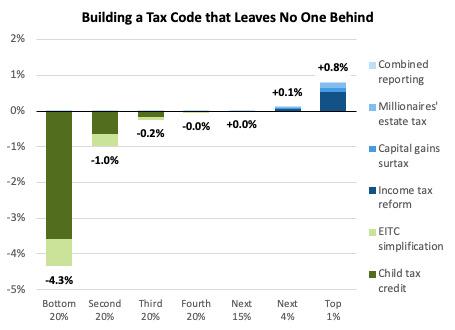

| A Tax Code that Leaves No One Behind | |||||||

| Tax change as % of income | |||||||

| Bottom 20% | Second 20% | Third 20% | Fourth 20% | Next 15% | Next 4% | Top 1% | |

| Child tax credit* | –3.6% | –0.6% | –0.2% | > –0.1% | ~ | ~ | – |

| EITC simplification | –0.8% | –0.3% | –0.1% | ~ | – | – | – |

| Income tax reform | – | – | – | – | ~ | < +0.1% | +0.5% |

| Capital gains surtax** | – | ~ | ~ | < +0.1% | < +0.1% | < +0.1% | +0.1% |

| Millionaires’ estate tax** | – | – | – | – | – | < +0.1% | +0.2% |

| Combined reporting** | ~ | ~ | ~ | ~ | ~ | ~ | < +0.1% |

| Total | –4.3% | –1.0% | –0.2% | > –0.1% | < +0.1% | +0.1% | +0.8% |

| Source: ITEP, except where otherwise noted.

Note: Entries marked ~ indicate an impact smaller than 0.01% in either direction. Entries marked – indicate zero impact. * Distributional estimates for CTC and EITC do not account for filers and children without SSNs. ** Distributional estimates for the capital gains surtax, millionaires’ estate tax, and combined reporting are based on ITEP estimates, with adjustments by MDCEP for changes in policy and/or timing. These adjustments required significant analytical discretion. While errors are likely to be small in magnitude, these estimates should be treated with caution. Distributional estimates for the throwback rule are not available. |

|||||||

| Tax Reforms | Revenue ($m) | Source |

| Income tax reform | $409 | ITEP* |

| Combined reporting | $160 | DLS |

| Throwback rule | $62 | DLS |

| Capital gains surtax | $121 | DLS |

| Millionaires’ estate tax | $121 | DLS |

| Total | $873 | |

| Working Family Tax Credits | Cost ($m) | Source |

| Child tax credit** | $689+ | ITEP |

| EITC simplification | $209 | ITEP |

| Total | $898+ | |

| Total | –$25+ | |

| * Institute on Taxation and Economic Policy

** Cost estimate for child tax credit does not account for children without SSNs. |

||

Tax Policy as a Tool to Advance Racial Justice

Because of deep-seated structural barriers in our economy, Marylanders of color – in particular, but not exclusively, Black Marylanders – generally have lower incomes and less household wealth than their white counterparts. In fact, the wealthiest 10% of white households nationwide control nearly two-thirds of household wealth, according to analysis by the Center on Budget and Policy Priorities.

As one example of the potential of sound tax policy to advance racial equity, the Institute on Taxation and Economic Policy (ITEP) analyzed the distributional impacts of the proposed income tax reform by race and ethnicity. This analysis found that:

- 20% of Maryland households have annual income over $155,600. These households account for 57% of all household income. Under the proposed income tax reform, 100% of new revenue would come from this income group.

- Across all income groups, 52% of Maryland households are white. However, 62% of households in the top 20% are white. White households with annual income over $155,600 account for 12% of all households statewide and 36% of household income. Under the proposed income tax reform, more than 60% of new revenue would come from white households among the wealthiest 20%.

- 80% of Maryland households have income under $155,600. This includes:

- 76% of white households

- 85% of Black households

- 71% of Asian households

- 87% of Latinx households

- 81% of multiracial households

- Households with annual income under $155,600 account for 43% of Maryland household income. No household in this group would pay a dollar more in taxes under the proposed reform.

| Households | Income | New Revenue | |

| Wealthiest 20%: White | 12% | 36% | > 60% |

| Wealthiest 20%: All Others | 8% | 21% | < 40% |

| Everyone Else | 80% | 43% | $0 |

Other components of the proposed package would also significantly advance racial equity and help close the racial wealth gap. For example:

- The capital gains surtax, corporate tax reform, and millionaires’ estate tax all affect income gained from wealth rather than work. Because of structural barriers built into our economy, the bulk of household assets nationwide are controlled by a small number of wealthy, white households.

- A well-designed child tax credit is crucial to support families who are left out of the current federal credit because their income is too low – the very families most in need of help. Marylanders of color are overrepresented in this group, and decades of harmful policy decisions have been motivated by a racist desire to exclude these families from tax credits.

- While racial distributional analysis is not currently available for the child tax credit proposed here, analysis of the Build Back Better reform of the federal credit shows the power of a well-designed CTC to advance racial equity. This reform would have benefited 1.1 million Maryland children, including 352,000 children who were ineligible for the historical CTC or received only a partial credit because their family income is too low. This includes:

- 148,000 Black children

- 85,000 Latinx children

- 82,000 white children

- 13,000 Asian children

- 24,000 belonging to other racial or ethnic groups.

Supplement: Details of Tax Reform Proposals

| Single Filer / | Married Filing Jointly / | Current Law | Proposal | ||||

| Married Filing Separately | Head of Household | ||||||

| $0 | to | $999 | $0 | to | $999 | 2.00% | 2.00% |

| $1,000 | to | $1,999 | $1,000 | to | $1,999 | 3.00% | 3.00% |

| $2,000 | to | $2,999 | $2,000 | to | $2,999 | 4.00% | 4.00% |

| $3,000 | to | $99,999 | $3,000 | to | $149,999 | 4.75% | 4.75% |

| $100,000 | to | $124,999 | $150,000 | to | $174,999 | 5.00% | 5.00% |

| $125,000 | to | $149,999 | $175,000 | to | $224,999 | 5.25% | 5.25% |

| $150,000 | to | $249,999 | $225,000 | to | $299,999 | 5.50% | 5.50% |

| $250,000 | to | $499,999 | $300,000 | to | $599,999 | 5.75% | 6.00% |

| $500,000 | to | $999,999 | $600,000 | to | $1,199,999 | 5.75% | 6.50% |

| $1,000,000 | and up | $1,200,000 | and up | 5.75% | 7.00% | ||

Child Tax Credit

The proposed child tax credit has the following provisions:

- Max benefit (0-5): $2,500

- Max benefit (6+): $2,250

- Max benefit indexed to inflation

- Subtract federal credit

- Max age 17

- Include children without SSN

- Phaseout start: $75k single/$110k joint

- Beneficiaries may elect to receive benefits as a lump sum or in 12 monthly installments following tax filing

Altogether, the proposal would benefit 1.5 million individuals including 777,000 children, with more than half of benefits going to households with annual income under $31,000.

Cost and distributional estimates for the proposed child tax credit do not account for the inclusion of children without Social Security numbers.

EITC Sunset Repeal and Simplification

Summary of Proposal

| Provision | Current Law | EITC Sunset Repeal

Separate Legislation |

EITC Simplification |

| REIC Match Rate

No child dependents |

28% | 100% | 100% |

| REIC Match Rate

All Others |

28% | 45% | 50% |

| REIC Max. Credit

No child dependents |

NA | $530 | $530

Adjust for inflation |

| REIC Income Thresholds

Phase-in end Phase-out start, end |

Same as federal EITC | Same as federal EITC | Federal thresholds + $2,000 |

| REIC Max. Age | 64

(same as federal EITC) |

64

(same as federal EITC) |

None |

| Nonrefundable EIC Match Rate | 50% | 50% | None |

| Poverty Level Credit | Yes | Yes | No |

| Non-SSN Filers | Ineligible | Eligible | Eligible |

| Net Cost | Included in Baseline | +$209 million |

Distributional Impacts

While the proposed EITC simplification would benefit all effected income groups on net, a small number of households with unusual circumstances will see a tax increase/benefit reduction due to elimination of the poverty level credit. Altogether, 1.2 million individuals including 451,000 children will benefit from the proposal. Meanwhile, 7,600 individuals including 280 children will see tax increases/benefit reductions. These individuals belong to less than 0.3% of Maryland households.

Reliability of Distributional Estimates

Wherever possible, this policy memo reports distributional impacts estimated by the Institute on Taxation and Economic Policy (ITEP). ITEP’s sophisticated microsimulation tax model incorporates actual tax return data and can therefore produce highly reliable estimates.

In some cases, MDCEP adjusted ITEP estimates to account for differences in policy design or timing. These estimates required significant analytical discretion and should therefore be treated with caution. These estimates account for a small share of the package’s total distributional impact. The following proposals required adjustment by MDCEP:

- Capital gains surtax

- Millionaires’ estate tax

- Combined reporting

The table below breaks down distributional impacts by their relative degree of reliability.

| Bottom 20% |

Second 20% |

Third 20% |

Fourth 20% |

Next 15% |

Next 4% |

Top 1% |

|

| More reliable | –5.5% | –1.2% | –0.3% | > –0.1% | ~ | < 0.1% | +0.5% |

| Treat with caution | ~ | ~ | ~ | < +0.1% | < +0.1% | +0.1% | +0.3% |