Report Gives MD Favorable Rating for Fiscal Planning

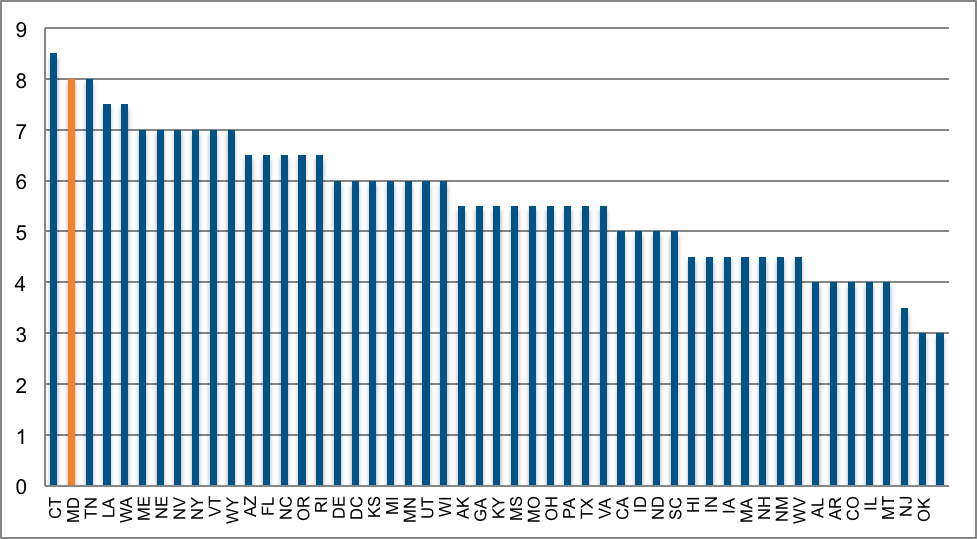

A newly released report by the Center on Budget and Policy Priorities gives Maryland high marks in its use of fiscal planning tools in creating the state budget. Maryland received a score of 8.0 out of 10 to rank second among all states, indicating that the state has strong systems in place facilitate both long-term planning and mid-course correction. As the authors of the report point out, having a sound method of fiscal planning is important in improving Maryland’s business climate, managing ups and downs in the economy, and effectively providing public services.

(Click to enlarge)

Source: Center on Budget and Policy Priorities

Like many states, Maryland’s budget has yet to fully recover from the Great Recession, which greatly reduced the amount of revenue coming into the state and challenged Maryland’s ability to invest in important public services such as education and health care. This is evident in the current efforts of lawmakers in Annapolis to close the $584 million budget shortfall. However, CBPP’s report indicates that Maryland effectively uses fiscal tools to generate information on the state’s needs and expected tax revenue that help inform lawmakers’ decisions.

The ten tools discussed in the report fall into three categories:

- A map for the future:

- Multiyear forecasts of revenue spending

- Fiscal notes with Multi-year projections

- Current services baselines

- Professional and credible estimates:

- Independent consensus revenue forecasts

- Legislative fiscal office

- Pension oversight

- Ways to stay on course:

- Well-designed rainy-day funds

- Oversight of tax expenditures

- Pension funding and debt level reviews

- Budget status reports

Maryland scored well on almost all of these measures, owing largely to the quality of the states nonpartisan Department of Legislative Services (Maryland’s ‘legislative fiscal office’) which is responsible for composing fiscal notes for General Assembly Bills as well as the analysis that informs Maryland’s Spending Affordability Committee briefings and decisions.

Maryland received lower marks on the bolded items above which relate to the state’s oversight of tax expenditures, pension oversight, and debt level. Indeed, during December’s Spending Affordability Committee briefing and January’s Fiscal Briefing, the Department of Legislative Services’ chief analyst, Warren Descenaux warned that Maryland should not authorize more debt and was critical of Governor O’Malley’s planned $100 million reduction in pension payments.

Despite these areas of improvement, this welcome news stands in contrast to other reports that are more critical of Maryland’s fiscal solvency and business climate. Compared with almost every other state, Maryland’s budget process employs tools that enable Maryland to make sound decisions on how to invest in public services and a strong economy.