Recommended Cuts Threaten Maryland’s Prosperity; Alternatives Needed

As a flurry of recommended cuts by state fiscal analysts come down like quickly falling snow it’s becoming ever more important for lawmakers to avoid the temptation of tax cuts and preserve essential services when they develop the state’s spending plan for the coming fiscal year.

In particular, two proposals being talked about – cutting the corporate income tax and reducing the number of wealthy heirs that would pay estate tax – should be taken off the table. Supporters claim these measures would help the state’s economy. Instead they shoot the state’s prospects in the foot by taking away millions of dollars needed for schools, transportation and other investments that create jobs and promote prosperity. Those two tax cuts alone would cost the state over $100 million next year and more than $400 million after five years.

These proposals are especially troubling in light of reportswarning that upcoming official revenue estimates might be lower than expected.

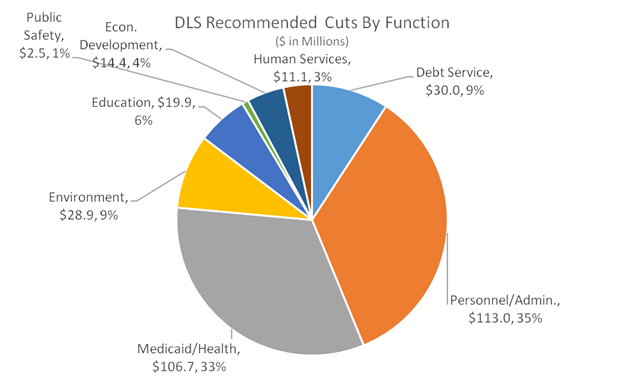

In response to those reports and their own analysis, the Department of Legislative Services now is suggesting more than $325 million in cuts from the budget Governor O’Malley proposed for the fiscal year that starts July 1. That’s an increase of about $225 million since early last week. The suggested cuts target both public services and benefits for state police, health care workers, and other public employees.

The DLS recommendations include reductions in Medicaid provider rate increases, which could threaten access to medical care for low-income Marylanders. That would be a big step backward, which highlights the need for the state to take a balanced approach to the budget – one that includes revenue instead of a cuts-only approach that threatens economic recovery.

State lawmakers should consider the full range of available revenue options. One sensible way would be to end the ability of large, multi-state corporations to shift income made in Maryland to other states as a way to avoid taxes. Called combined reporting, this reform has been adopted in 23 states and the District of Columbia and makes it so big businesses can’t use subsidiaries to shift profits, harming local businesses and the state. Another option is to increase the cigarette tax.

So where exactly are the recommended cuts? DLS’s detailed Fiscal Year (FY) 2015 budget briefings include $113 million in reductions in personnel and Administration expenses in state agencies and $106.7 million in cuts to Medicaid and other health spending.

Proposed cuts in public employee pay come on top of Governor O’Malley’s proposedpermanent $100 million cut in funding for their pension systems, partially stepping back from a 2011 promiseof additional funding for state employee pensions.

Source: Department of Legislative Services; MDCEP staff broke out cuts by function. (Click to Enlarge)

As more cuts are recommended and new revenue projects are made by the state we will continue to blog about the impact on prosperity in Maryland and what the state should do to stay on track. Stay tuned.