No Cause for Panic in Montgomery County

A recent report on Montgomery County’s economic outlook painted a misleadingly bleak picture and prompted misguided calls for tax cuts and deregulation. The truth is that Montgomery County has a fundamentally strong local economy and at the same time faces challenges. If policymakers panic and rush to cut taxes or weaken protections for working people, it will be harder for the county to achieve broadly shared prosperity.

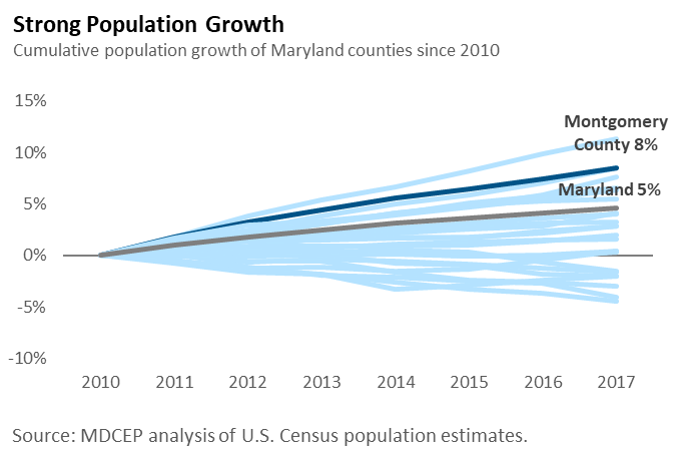

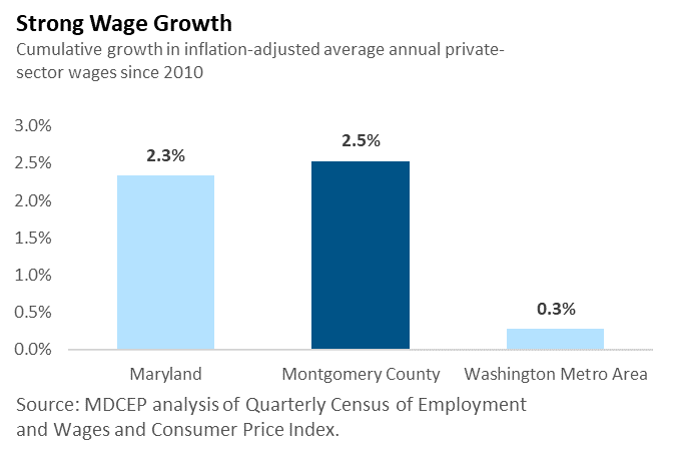

Montgomery County is in a fundamentally strong economic position. The county continues to attract residents at a healthy pace, increasing in population significantly faster than the state as a whole. The county has also seen strong private-sector wage growth in recent years, outpacing the Washington metro area by 2.3 percentage points. Montgomery County’s property values are now 4 percent higher in nominal terms than they were in 2010 when statewide property values peaked, while property values statewide have not yet returned to their 2010 level. As of 2016, Montgomery County’s total property value per capita was 47 percent higher than the state’s overall.

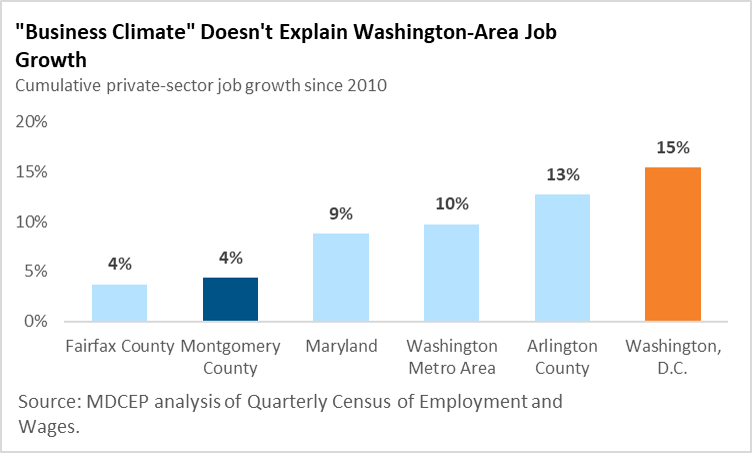

There is no question that the county faces challenges. It has seen slower private-sector job growth than other jurisdictions in the Washington metro area or elsewhere in Maryland. However, a prescription that relies on tax cuts and costly giveaways to large corporations is not likely to improve matters. There is a substantial body of evidence that these strategies are not an important determinant of where companies choose to do business. In fact, the District of Columbia—with the third-highest tax levels of any state and a minimum wage on its way to $15 one year ahead of Montgomery County’s—has seen some of the fastest private-sector job growth in the region.The county is also in good fiscal health. As of fiscal year 2015, the county’s local-source revenues amounted to 5.5 percent of personal income, barely over the statewide level of 5.4 percent. Among the 10 most populous Maryland counties (which together are home to 85 percent of the state’s residents), Montgomery County’s tax effort ranked fifth, putting it right in the middle of the pack. The county’s public debt payments are also in line with other Maryland jurisdictions. As a share of personal income, debt service in Montgomery County is 0.03 percent higher than in Maryland overall, placing it fourth among the state’s 10 most populous counties.

Montgomery County faces other challenges as well. One-third of residents (122,000 households), including nearly half of renters, devote 30 percent or more of their income to housing costs – meaning they are spending more of their income on housing than typically considered affordable. This leaves families with less money for other necessities like food and health care. And while Montgomery County is one of Maryland’s most diverse, it also has some of the state’s widest racial income gaps. A typical Black household in Montgomery County takes home 43 percent less than a typical white household, and a typical Hispanic/Latinx household takes home 44 percent less. Among the 10 largest Maryland counties, this puts Montgomery County last for Latinx pay equity and second-to-last for Black pay equity. To address these challenges, the county government will have to invest in thriving communities: affordable housing, quality schools, and enforcing worker protections like its local minimum wage. A misdirected strategy focused on tax cuts and deregulation would make these investments more difficult and move Montgomery County away from broadly shared prosperity.