MD’ers Fleeing from State and Local Taxes? Not So Fast.

While anti-tax groups like to draw on diffuse arguments that Maryland’s state and local tax levels are driving people out of the state, the evidence says otherwise.

Recently, Center Maryland posted an article citing a recent Gallup poll finding that, compared with other states, Maryland residents express a high desire to move. The article also highlights that Maryland residents cite taxes as their reason for wanting to leave at a rate “higher than the national average.” [Update: The Annapolis Capital and the Gazette have also published similar articles.]

But unlike the headlines, the actual evidence says taxes play but a negligible role in anyone’s decision to leave a particular state. Center Maryland’s article also draws on data and analysis from the website How Money Walks and the Tax Foundation to argue that Maryland is losing billions in wealth to other states. But this data is represented in a way that distorts and grossly overstates its meaning.

First, the “migrated income” numbers that these studies present are inflated. When someone that moves from one state to another is replaced in their job by someone already in Maryland who is entering (or re-entering) the labor force, their replacement’s income will not be counted in the IRS’ interstate data. The same is true when someone moves out of Maryland for whatever reason and is replaced in the work force by someone arriving in Maryland from another country. Also, Maryland may not lose taxable profits and salaries from small business owners and self-employed people that leave the state if they sell their businesses – as many retires do — to another Marylander. In other cases someone just closes their business, but the customers are picked up by another in-state business, and that income isn’t counted.

In other words, huge amounts of new income aren’t counted by those focusing only on “lost’ income to make the bogus argument that Maryland and other states are being bled dry.

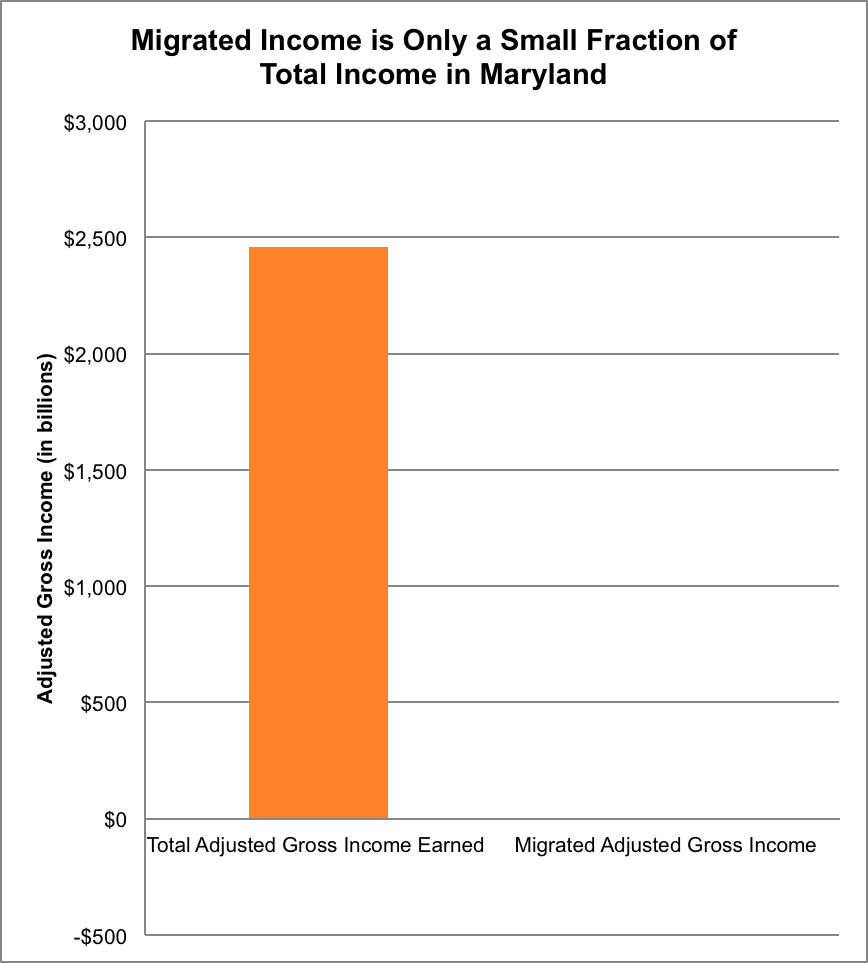

Center Maryland also presents these numbers without any meaningful context. . While the reader is told that Maryland has lost “$7.27 billion in wealth, as measured by taxpayer adjusted gross incomes, to other states between 1992 and 2011” we are not told how small this is in the context of Maryland’s total economy. The same IRS income data that says Maryland lost $8 billion in migrated income between 1992 and 2010 also shows that total income earned during this period was $2.548 trillion. So the income purported to leave Maryland represents three tenths of one percent of total income in Maryland during this time. That’s all.

Then there is the other huge flaw; these studies do not even attempt to capture why residents leave one state for another. Center Maryland uses the Gallup poll as evidence, but this evidence is unconvincing. Gallup’s data shows that taxes ranked much lower than reasons such as wanting to be with family or friends or seeking better weather for why Maryland respondents wanted to leave the state.

There is a place to get a much clearer picture of really is happening. In a new paper, the Center on Budget and Policy Priorities analyzes more detailed interstate migration data compiled by the Internal Revenue Service and finds that, in fact, specific tax policies aren’t driving people out of Maryland or any other state. Yes, this complicates the over-simplified story that some want to tell about how taxes causing people to flee. But facts have a way of doing that.

When viewed in full context, it’s clear that Americans have been moving out of the northeast to the south and southwest for decades. The general pattern is for movement, especially by retirees, from colder northern states to Sunbelt states regardless of tax levels in either the origin or destination state. Even more generally, most Americans do not move out of state at all. Only 1.5 to 2 percent of U.S. residents move to a different state and the vast majority do so for job or family reasons.

Also, while those who want to portray Maryland as having tax levels that drive people out like to point to statistics like those in the Gallup poll, they leave out data on residents actually moving into the state (Gallup didn’t poll on whether people in other states want to move to Maryland. And yet 97.3 percent of households that moved out of Maryland between 1993 and 2011 were replaced by people moving in from another state, the IRS data shows.

Of course, this should not preclude a discussion of the factors that make a state desirable to live in and efforts to keep residents and attract new ones. The best ways to do that are through long-term investments in schools, transportation, safe communities and other building blocks of a vibrant economy. These investments helped make Maryland’s public schools the highest ranked in the country, for example.

So let’s reject a misguided focus on demonizing tax policies. That can only lead to a race to the bottom with other states. It will not encourage economic growth and that will hurt Maryland’s ability to make the kind of investments that benefit its economy and its people