Maryland’s Revenues are up; Long-term Solutions are Needed to Maintain State Investments

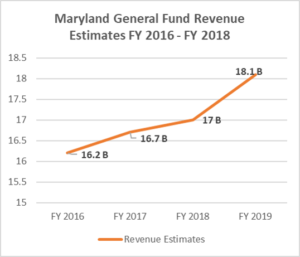

The recently announced state revenue estimates offer an opportunity to make some long-overdue investments in Maryland’s future. The Board of Revenue Estimates’ updated revenue estimates for the next budget year, which begins July 1, brought some welcome news after years of budget shortfalls and cuts. The board estimates are $18.1 billion for FY 2019, $434 million more than the assumptions Governor Hogan built his proposed budget around.

Source: Maryland Board of Revenue Estimates

These funds should support much-needed investments in the future of Maryland families, such as child care assistance, education funding, and income supports for low-income Marylanders. For example, this additional revenue would support expanding Maryland’s Earned Income Tax Credit (EITC), which gives a much-deserved break to thousands of Marylanders who work hard but still struggle to get by on low wages. Low-wage workers not raising children who would qualify for an expanded EITC were largely left out of last year’s federal tax bill. In addition, Maryland must make a long-overdue increase in its childcare subsidy rates in order to increase access to quality child care for working parents. In addition, the state could use some of the additional revenue to being meeting the state’s educational needs through the implementation of the Kirwan’s Commission recommendations.

At the same time, these revenue estimates should be celebrated cautiously. Most of the increase is likely due to the impact of individual income tax planning in light of the passage of the federal Tax Cuts and Jobs Act of 2017 and it is still too early to determine how the long-term tax planning of wealthy Marylanders will affect the state in future years. In addition, Maryland’s economic outlook – though growing, is still sluggish compared to the rate of growth before the Great Recession. In order for Maryland to continue to have sufficient revenue to meet the state’s needs, we must enact policies that support a growing and healthy economy and ensure our tax system asks everyone to pay their fair share.

Although it is too soon to definitively identify the long-term effects the federal tax changes will have on state revenues, preliminary modeling from the Institute on Taxation and Economic Policy (ITEP) shows that states are expected to see a combined $7.5 to $10 billion in revenue gains because of changes in federal tax laws this year.[i] This is reflected in Maryland’s latest revenue estimates, as state experts estimate that individual income tax revenue will grow by 9.3 percent compared to the previous year. This is three times the growth rate seen in the current budget year. Though the gains have meaningful impact for states, they are very small in comparison to the costly federal tax cut of $297 billion.[ii]

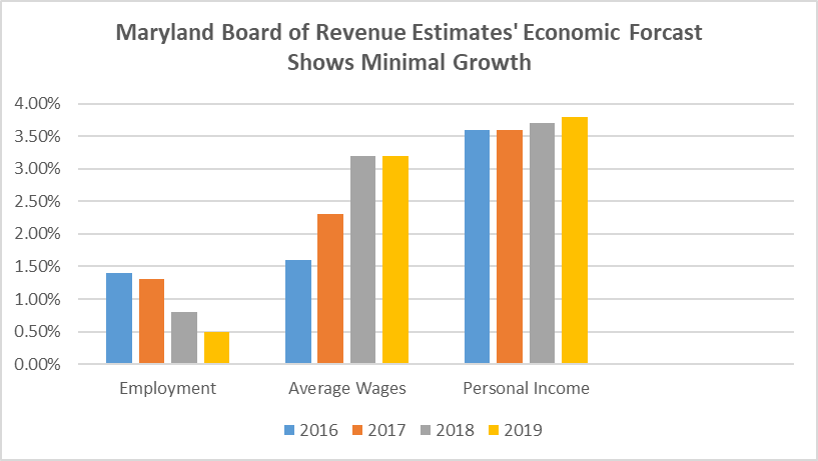

As shown in the chart, Maryland’s revenues estimates have experienced consistent growth – however, it is at a lower rate than previous periods of economic expansion. On all various economic indicators, employment, average wages, and personal income, Maryland economic growth has been minimal at best. As it stands today, Maryland’s economy is not producing the type of wage gains typically associated with a 4 percent unemployment rate.

Source: Maryland Board of Revenue Estimates

Public policies that support working Marylanders also support a healthy economy. Enacting policies such as gradually increasing the minimum wage to $15 per hour will have with multiple benefits. For instance, a $15 minimum wage would give 573,000 workers a raise, totaling $2.6 billion per year, by the time the minimum wage is fully phased in in 2023.[iii] This translates into stronger economic growth for Maryland, including an increase in general fund revenues from individual income taxes. Maryland should continue to pursue policies that support working families and a healthy economy.

This one-time increase in revenue should serve as a catalyst for Maryland to make the investments in our communities and enact public policies that provide long-term economic growth and supports working Marylanders. A healthy economy is only “healthy” if prosperity is widely shared.

[i] “What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options.” Institute on Taxation and Economic Policy. January 2018. https://itep.org/what-the-tax-cuts-and-jobs-act-means-for-states-a-guide-to-impacts-and-options/

[ii] “What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options.” Institute on Taxation and Economic Policy. January 2018. https://itep.org/what-the-tax-cuts-and-jobs-act-means-for-states-a-guide-to-impacts-and-options/

[iii] “What a $15 Minimum Wage Would Mean for Maryland.” Maryland Center on Economic Policy. February 2018. http://www.mdeconomy.org/wp-content/uploads/2018/02/MDCEP_FF15_report-2.pdf