Maryland’s Investment in TANF Falls Short of Meeting Core Program Goals

When the federal government created the Temporary Assistance for Needy Families (TANF) program as part of “welfare reform” in the mid 1990s, it gave states some choices about how to best to support families that are struggling to make ends meet. In recent years, Maryland has opted to use most of its TANF dollars to fill gaps in the state budget, rather than focus on the core goals of providing cash assistance to families so they can meet their basic needs, childcare assistance that makes it financially feasible for parents to get and keep a job, and helping parents find work. Today, these core programs make up less than half of TANF federal and state spending in Maryland.

Federal TANF funding may be used for four purposes: (1) providing assistance to low-income families so that children can be cared for in their homes; (2) promoting job preparation, work, and marriage; (3) preventing and reducing out-of-wedlock pregnancies; and (4) encouraging the formation and maintenance of two-parent families. In Maryland, TANF’s core-programs are cash assistance, known as Temporary Cash Assistance (TCA); the job-training program, known as the Work Opportunities Program; and the self-sufficiency program for TANF recipients, the Family Investment Program.

The following point-in-time analysis of how Maryland is investing its federal and state TANF dollars shows that the state is not investing in core welfare reform programs. In particular, state dollars attributed to the TANF program are largely spent on non-core programs and services. While these non-core programs and services support other important state priorities and should not be eliminated, policymakers should fund them with non-TANF dollars.

TANF offers a critical lifeline of cash to low-income families, as well as crucial work supports to help parents find and keep jobs. A strong investment into core TANF programs that support working families is important to the health of Maryland’s whole economy.

TANF Spending

The funding for TANF includes both federal and state funding streams. The federal government block grant, known as the State Family Assistance Grant, funds Maryland’s TANF program at $229 million dollars. States are also required to spend a certain amount on TANF programs, known as Maintenance of Effort (MOE). This amount is based on the state’s share of Aid to Families with Dependent Children (AFDC), the program that preceded TANF. Maryland’s MOE requirement is approximately $177 million annually. States are allowed to spend more than their MOE requirement. In fiscal year 2016, Maryland spent $572 million[1] in state and federal funds attributed to TANF. This included the state’s $229 million federal block grant, an additional $22.5 million in federal contingency funds, and $316 million in state MOE expenditures.

Core Spending

Maryland spends only 40 percent of its combined TANF dollars on core programs. Most of that is for Basic Assistance (24 percent of combined TANF spending), followed by Work Opportunities and Family Investment[2] programs (16 percent of combined spending). It appears from state budget documents that Maryland did not spend any TANF federal or state funds on child care, but other federal reports suggest that that a small amount of funds (less than 5 percent) have gone to child care (see footnote for additional explanation). [3]

Non-Core Spending

Maryland spends the majority of its combined TANF dollars in non-core programs (54 percent). The state Earned Income Tax Credit (EITC) and Montgomery County Earned Income Tax Credit make up the largest portion of the combined TANF non-core spending, at 28 percent. Montgomery County’s EITC comes from county funds, not state, but the state still counts it when reporting TANF spending to the federal government. The remaining 26 percent of the combined TANF spending is spent on pre-kindergarten programs (13 percent), and various social service programs, including child welfare/foster care, community and adult services, and utility assistance. These are important supports for Marylanders, some of which – such as the state EITC – should be expanded. However, they are not core to TANF’s goals.

Federal Spending

Total TANF federal spending in Maryland was $256 million in 2016. The state spent most of its federal dollars in cash assistance and the Work Opportunities program (73 percent). The remaining 16 percent of federal TANF dollars are spent in non-core areas, such as Child Welfare/Foster care (12 percent), and Local Adult Services[4] (4 percent). Administrative and Operations support make up 11 percent of expenditures.

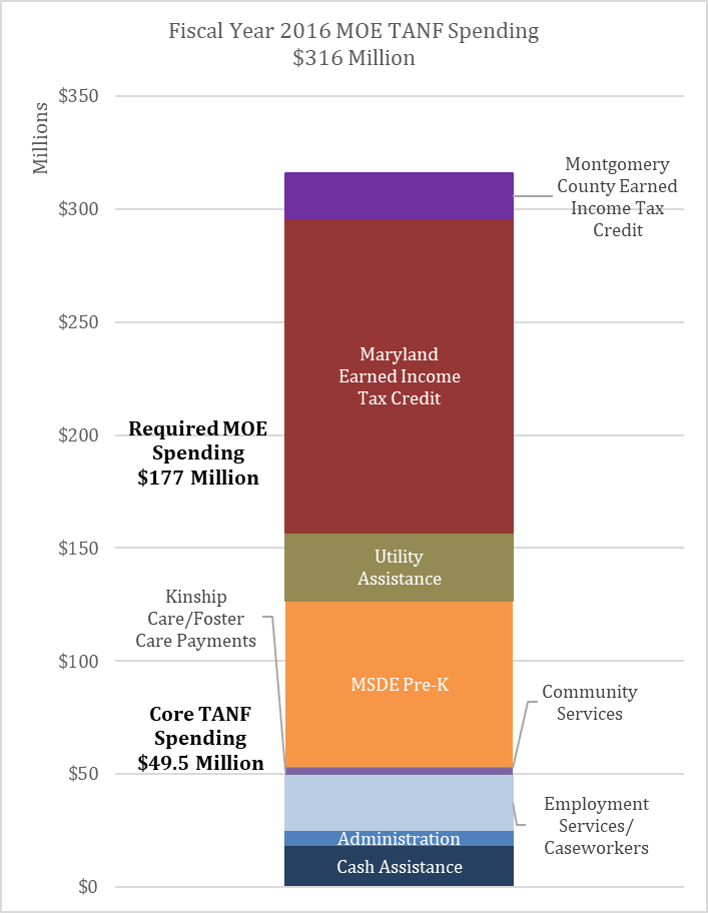

Maryland’s Maintenance of Effort Spending

Maryland’s MOE spending in core and non-core TANF areas varies significantly from the state’s federal spending. In fiscal year 2016, Maryland spent $316 million to meet its TANF Maintenance of Effort obligation. Cash Assistance (6 percent) and Employment Services (8 percent) were the only core spending under MOE, a total of 14 percent. The majority of spending, 84 percent, was in non-core programs and services. Administration costs made up the final 2 percent of spending.

EITC, including Montgomery County’s local EITC, make up half of the primary MOE spending areas. This is followed by pre-K spending, at a nearly a quarter of the spending (23 percent). The remaining 11 percent of spending is on non-core areas, such as utility assistance, kinship and foster care, and community services programs and services.

| How Maryland meets its MOE requirement

To meet MOE requirements, states are expected to report spending 80 percent of the amount of nonfederal funds that the state spent in federal fiscal year 1994 under TANF’s predecessor, Aid to Families with Dependent Children (AFDC) and related programs. Congress did not adjust this requirement for inflation and therefore its value has declined over the past two decades. If the requirement was 100% and was adjusted for inflation, Maryland would be required to spend at least $389 million annually. Furthermore, if the state meets its work participation requirements, as is the case in Maryland, the MOE requirement is reduced to 75% of the state’s historical expenditures. Maryland is only required to spend $177 million in state dollars for TANF. Yet states can and do spend more than their required spending in order to either access additional federal funds or to help meet the federal work participation rate requirement. In Maryland’s case, it counted $316 million toward its MOE spending in 2016. Under AFDC, Maryland’s state spending went entirely to what are now known as core programs and administration services. Today, Maryland’s spending is contributing much less to the core goals of the program. MOE spending on core and administration is only $49.5 million, well below the required $177 million. Instead, Maryland meets and exceeds its MOE requirement by counting spending on non-core areas, primarily the EITC and pre-K programs. While these are very important programs that should be maintained and expanded, they represent existing state expenditures as opposed to new state investments in low-income families. |

Maryland’s Core TANF Spending

To help improve the lives of working families, it is crucial that Maryland invests more in TANF’s core programs: Cash Assistance, childcare subsidies, and the Work Opportunities/Family Investment programs. TANF reaches a very small share of low-income Maryland families, a sharp contrast from AFDC, which reached nearly all low-income families in the state. In 1995-1996, AFDC cash assistance reached 97 of every 100 families with incomes below the federal poverty line in Maryland. In contrast, in 2015-2016, TANF cash assistance reached only 30 of every 100 Maryland families experiencing poverty.[5] It is important that the state invest in core TANF areas to help families afford housing, food, and other necessities as they transition to work and climb the economic ladder.

Cash Assistance

Currently, Maryland spends 24 percent of its combined funding on Cash Assistance. More investment into Cash Assistance is needed in order provide families in poverty with meaningful financial assistance. The maximum benefit of $648 for a family of 3, which is 38 percent of the federal poverty line[6], is insufficient to support a family in today’s economy. Increasing our investment into Cash Assistance would greatly benefit families that are experiencing poverty, and their local communities. Furthermore, there is increasing evidence that giving greater support to families in poverty helps improve children’s long-term outcomes.[7]

Work Opportunities

In fiscal year 2016, Maryland spent 16 percent of its combined funding on the Work Opportunities and Family Investment programs. The Work Opportunities Program is essential for families to get the job training skills needed for full employment. According to the University of Maryland–Baltimore School of Social Work’s Life After Welfare report, adult recipients’ earnings after exiting TANF are low and many families remain poor.[8] Therefore, it is necessary to fully fund high-quality job training programs to help families exiting TANF earn family-supporting wages.

Childcare Subsidies

Access to high quality and affordable childcare is essential for working families. Maryland spending on childcare has not kept up with the childcare needs of Maryland’s families. In fact, the subsidy is so small that it now only covers the cost of childcare that the cheapest 9% of childcare providers in the state[9]. It is crucial that Maryland expands funding for childcare subsidies to assist working families in receiving childcare services, particularly as parents have listed cost as the number one reason why they cannot find childcare in Maryland.[10]

Increase Funding for Core TANF Programs

Maryland can be a state with opportunity for everyone if we make sufficient investments in programs and services that support working families. Given that Maryland’s TANF program primarily spends on non-core areas, it is vital that Maryland prioritizes core TANF areas: Cash Assistance, childcare subsidies and Work Opportunity programs. These programs are proven tools to help working families get a foothold in today’s economy so they can support their children and build a future.

Maryland policymakers should work to ensure state supports for families conform to the original goals of the 1996 federal overhaul – so the money is used for those who need it the most. The majority of combined spending should support the three core elements of the TANF program.

[1]The Department of Human Resources (DHR) has run a deficit of the TANF federal funds since fiscal 2011. In fiscal year 2016, Maryland received $251 million for its base TANF grant and Contingency TANF funds. DHR appropriated $256 million in TANF expenditures, resulting in Maryland spending $4.5 million higher than Maryland’s base grant.

[2] Family Investment programs (FIP) is the state’s program for serving TANF recipients. It encompasses the provision of Temporary Cash Assistance (TCA) in efforts to divert potential applicants through employment, move recipients to work, and provide retention services to enhance skills and prevent recidivism. The goal of the FIP is to assist TCA applicants/recipients in becoming self-sufficient.

[3] There is conflicting information about how much the state spends in state or federal TANF funds on child care, as opposed to pre-K. There appears to be a discrepancy between the state’s spending data used in this report and the data that the state reports to the U.S. Department of Health and Human Services (HHS). This analysis is based on Maryland’s Department of Human Resources Fiscal 2018 Budget Overview’s state budget data for 2016. These state data do not include a break-out line for child care but do include a line for pre-K spending through the Maryland State Department of Education. It appears that the funds reported as state spending for pre-K do not include any child care. The US Department of Health and Human Services requires separate reporting categories for pre-K spending and for child care spending. In 2015, the state reported to HHS $23.7 million in child care spending (wholly separate from pre-K spending), representing 4 percent of total TANF and MOE spending. The comparable data that the state reports on the ACF-196 form has not yet been publicly posted by HHS for 2016, so it is not clear whether Maryland reported any child care spending in 2016 but it likely claimed at least some state MOE spending on child care for its match to federal Child Care and Development Block Grant funds.

[4] Maryland’s Office of Adult Services include Adult Protective Services, In-Home Aides Services, Social Services to Adults, Respite Care, Project Home and Project Safe.

[5] Center on Budget and Policy Priorities. Maryland’s TANF Cash Assistance Disappearing for Poor Families. https://www.cbpp.org/sites/default/files/atoms/files/tanf_trends_md.pdf

[6] Center on Budget and Policy Priorities. Maryland’s TANF Cash Assistance Disappearing for Poor Families. https://www.cbpp.org/sites/default/files/atoms/files/tanf_trends_md.pdf

[7] Sherman, Arloc and Tazra Mitchell. Economic Security Programs Help Low-Income Children Succeed Over Long Term, Many Studies Find. https://www.cbpp.org/research/poverty-and-inequality/economic-security-programs-help-low-income-children-succeed-over

[8] Passarella, Letitia Logan and Lisa Thiebaud Nicoli. Life After Welfare 2017 Annual Update. http://www.familywelfare.umaryland.edu/reports1/life2017.pdf

[9] Childcare subsidy values comes from the Baltimore Sun’s “Child care subsidy for working parents — neglected for decades — gets election-year attention” article. http://www.baltimoresun.com/news/maryland/politics/bs-md-child-care-subsidy-20180126-story.html

[10] Maryland Family Network. Child Care Demographics 2017. http://www.marylandfamilynetwork.org/wp-content/uploads/2016/01/Demographics_FullBook_2017.pdf