Institute on Taxation & Economic Policy finds Maryland asks more of low and middle income taxpayers, still ranks Maryland highly compared to other states

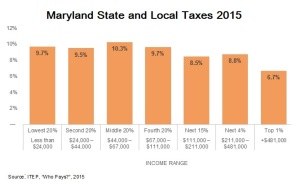

The Institute on Taxation & Economic Policy (ITEP) a Washington-based research organization that works on federal, state, and local tax policy issues, released its semi-annual Who Pays? report focused on the distribution of state and local tax systems. The report looks at who, according to income brackets, pays what share of each state’s taxes. Maryland, like the majority of other states, requires households with lower incomes to pay more in taxes, with the middle 20 percent—those making between $44,000 and $67,000—paying the highest share. The report found Maryland is the 38th most unfair state and local tax system in the country, indicating that Maryland has a more progressive tax structure than most.

The report listed Maryland’s graduated personal income tax structure, the recently expanded partially refundable state Earned Income Tax Credit, the refundable tax “circuit breaker” credit, and the exclusion of groceries from the sales tax base as progressive features of the tax code. On the other hand, the report cites Maryland’s failure to index income tax brackets to inflation and the lack of combined reporting as part of the corporate income tax as regressive features. Maryland failed to pass twin House and Senate bills last session which would have enacted combined reporting, leveling the playing field for local business.

“On the first day of the legislative session, this report is a timely reminder of the ways in which Maryland asks families in the middle and at the bottom of our economy to pay more than their fair share, “ said Benjamin Orr, Executive Director of the Maryland Center on Economic Policy. “ These figures are a benchmark against which taxpayers can evaluate future tax proposals.”

Sadly, the fact that Maryland requires more from low and middle income households is not new information. It played a large role in the state’s decreased revenue projections, as low and middle income earners wages continued to stagnate last year, slowing revenue growth.

The ITEP report, which analyzes data from all 50 states and the District of Columbia, is available at www.whopays.org