Governor O’Malley Releases FY 2015 Budget

This morning, Governor O’Malley released his FY 2015 Budget in a speech at the statehouse. In his proposed $39 billion budget, the Governor seeks to close Maryland’s $584 million revenue shortfall with no tax or fee increases while also increasing investments in education, innovation, public safety, and healthcare.

Addressing the Gap between Revenue and Spending

To close Maryland’s $584 million revenue shortfall, Governor O’Malley’s budget seeks to close the deficit without raising taxes. Instead, 74 percent ($457 million) of the revenue is made up through spending cuts while 26 percent (163 million) comes from the sale of old helicopters and other transfers and payments. The budget also leaves $800 million (5 percent of the General Fund balance) in Maryland’s Rainy Day fund and leaves $37 million unallocated.

Over the longer term, the O’Malley administration projects that with this budget, the state will close its structural deficit by FY 2017 with a $31 million surplus.

Making Investments in Public Services and Economic Development

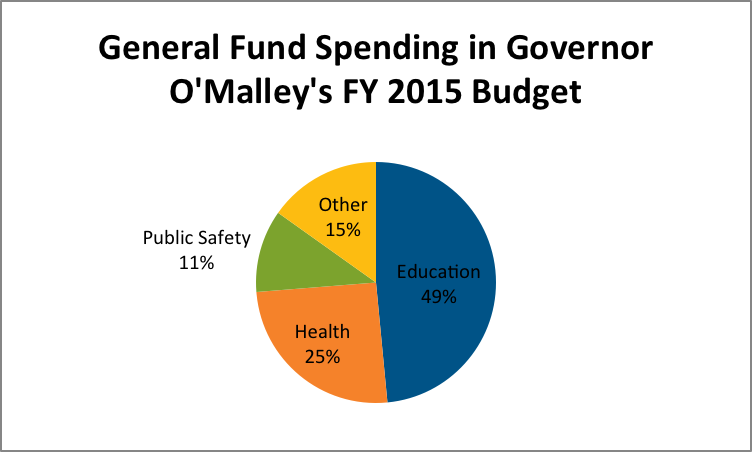

In addition to closing the budget gap, Governor O’Malley proposed making targeted investments in a number of areas. According to the Governor, 48 percent of General Fund spending goes to education, 25 percent to health, and 11 percent to public safety.

(Click to enlarge)

Source: The Office of Governor Martin O’Malley

The Governor’s proposal emphasizes education, and includes $6.12 billion in K-12 education (which the Governor describes as an increase of 37% since his FY 2007 budget), $4.3 million to phase in universal pre-k education by 2010, and $289 million in school construction. Finally, Governor O’Malley intends to increase the university system’s funding by 6.7 percent while capping tuition increases at 3 percent and freezing tuition at Morgan State University and St. Mary’s College. The Governor also proposes to increase funding for community colleges by $297.5 million, including a 4.9 percent increase in direct aid.

Governor O’Malley also calls for investments in innovative industries through increases in specific tax credits, including a 20 percent increase ($12 million) in the Biotech tax credit, a 33 percent increase ($4 million) in the Cyber Tax Credit, and a 12.5 percent increase ($9 million) in the Research and Development tax credit. The Governor’s budget also proposes targeted investments in healthcare, including $13.25 million to Academic Health Centers for cancer research and $30 million for a Prince George’s County medical center.

Regarding public safety, Governor O’Malley plans to increase police aid by $67.9 million and spending on correctional facilities by $20.3 million, which includes funding for 100 additional corrections officers.

Finally, Governor O’Malley hopes to add $42.4 million to the Bay 2010 Trust Fund.

Overall, Governor O’Malley argues that the FY 2015 budget will create 48,000 jobs in areas such as school construction (7,400 jobs), Bay cleanup (280 jobs), the Rental Housing Works program (2,500 jobs), corrections (100 jobs), and transportation projects through the capital budget (16,300 transportation jobs and 21,600 additional jobs through capital spending).

Check back here at Maryland’s Money Matter for more information and analysis of the Governor’s Budget, including our Instant Analysis, which we will release on Friday, January 17.