GOP tax plan: A windfall for Maryland’s top 1 percent while many others see a tax hike

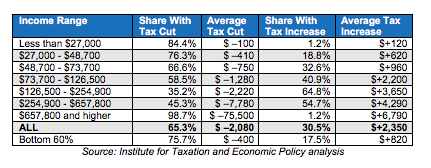

Nearly one-third of Marylanders would see their federal taxes go up while the wealthiest few would get massive tax breaks under the tax framework President Donald Trump and congressional leaders released last week.

Almost all Marylanders in the top 1 percent of incomes, those with incomes over $657,800 per year, would see their taxes go down, with an average tax cut of $75,500, according to new analysis from the Institute on Taxation and Economic Policy.

“The typical Marylander would need to work an entire year to earn the amount of money this plan gives away to ultra-rich individuals,” MDCEP Executive Director Benjamin Orr said. “At the same time, it would harm the rest of us as it would likely force cuts to critical programs like Medicare, Medicaid, education, and job training.”

“No matter how the GOP messages this plan, it is nothing more than an upward redistribution of wealth,” said Alan Essig, executive director of the Institute on Taxation and Economic Policy. “Not only does the plan boost the incomes of the wealthy with surgical precision, it also gives a pittance to most working people and it taxes some in the middle and upper-middle class more, essentially creating an even greater economic divide between the rich and everyone else.”

While most low-income Marylanders would see a small tax cut, paying for the massive tax cuts for the wealthy means that Congress is likely to make cuts in things like food and housing assistance and Medicaid that many families currently rely on to help afford the basics. A better approach to providing a break for low-income workers would be to build on effective strategies, such as expanding the Earned Income Tax Credit.

About 30 percent of all Maryland taxpayers would see their taxes go up under this tax framework, according to the ITEP analysis.

“While that includes many well-off households that might be able to absorb a small tax increase, it makes no sense to raise their taxes while at the same giving huge new tax breaks to millionaires,” Orr said.

To read the entire report or get more details about how the tax framework would affect Maryland, go to www.itep.org/trumpgopplan

###

Media Contact

Kali Schumitz, Director of Communications and Partner Engagement

410-412-9105, ext. 701

kschumitz@mdeconomy.org

About Maryland Center on Economic Policy

The Maryland Center on Economic Policy advances innovative policy ideas to foster broad prosperity and help our state be the standard-bearer for responsible public policy. We engage in research, analysis, strategic communications, public education, and grassroots alliances promoting robust debate and greater public awareness of the policy choices Maryland residents face together.