Expanding the Renter’s Tax Credit Would Provide Residents Relief From Rising Housing Costs

Position Statement Supporting House Bill 340

Given before the House Ways and Means Committee

For nearly half of Maryland families, their rent costs more than they can reasonably afford. This makes it difficult to meet their other basic needs. Expanding the Renter’s Tax Credit would provide relief to Marylanders struggling to keep up with housing costs that are rising faster than wages. For this reason, the Maryland Center on Economic Policy supports House Bill 340.

Maryland residents are spending a higher proportion of their income on rent as a result of the combination of increasing housing costs and stagnant wages. Monthly costs for Marylanders who rent have increased by 24.2 percent over the seven years. The median monthly cost for households who rent was $1,242 per month in 2014, up from $1,000 in 2007.1

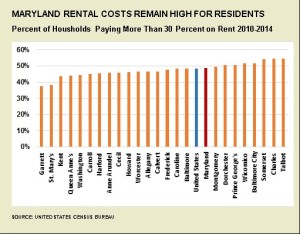

Nearly half of all renting households in Maryland spend over a third of their monthly household income on rent; one in four households spend more than half of their household income on rent. Experts generally consider having to spend more than 30 percent of household income on rent to be unaffordable, meaning it limits a family’s ability to pay for food, child care and other basic needs. Residents struggling the hardest to get by face some of the highest housing costs as a proportion of their incomes: 63.7 percent of Maryland households with incomes under $20,000 per year spend more than half of their total household income on rent each month.2

As currently constructed, the Renter’s Tax Credit is a small program with minimal impact for recipients. In 2014, just over 1 percent of all renting households received the credit. The average credit was just $310. The current credit helps families make ends meet by refunding a portion of the property taxes that their monthly rent payments help pay for. It only applies to people with low incomes who are not currently receiving housing assistance and are either living with children, over age 60, or have a disability. Those who qualify can receive a credit of up to $750 per year.

House Bill 340 would increase the amount of relief to renters by changing how household incomes are calculated and raising the maximum renter’s tax relief to $1,000.3 While the bill still focuses on the same categories of renters who are most in need of assistance, more residents will qualify because of the change to the net worth calculation. This bill also excludes retirement saving plans and life insurance policies from the net worth calculation, enabling more residents to receive the credit.

House Bill 340 is an important step in making it more affordable to live in Maryland as housing costs continue to increase. This bill would provide more relief for those renters who are eligible. In the future, Maryland should help more people struggling to make ends meet due to high housing expenses and further expand the eligibility for the Renter’s Tax Credit.

For these reasons, the Maryland Center on Economic Policy respectfully requests that the Ways and Means Committee give a favorable report to House Bill 340.

1 United States Census Bureau, American Community Survey, Table GCT2514

2 United States Census Bureau, American Community Survey, Table B25074

3 The Maryland Department of Legislative Services, House Bill 340 First Reader, Maryland General Assembly 2016 Session, http://mgaleg.maryland.gov/2016RS/bills/hb/hb0340f.pdf