Earned Income Tax Credit Legislation Would Improve an Already Effective Tool

Maryland’s General Assembly has a unique opportunity to help the working poor in a variety of ways this session—including by expanding the refundable portion of the state’s Earned Income Tax Credit.

On Wednesday, the Senate Budget and Taxation Committee heard testimony on a bill to expand Maryland’s Earned Income Tax Credit (EITC), which fights poverty while encouraging people to work more hours in low-wage jobs. If passed, the bill would increase Maryland’s refundable EITC to 28 percent from 25 percent of the federal EITC, giving an additional boost to 422,019 Maryland households and lifting more Marylanders out of poverty. A portion of Maryland’s EITC is refundable, meaning that if it exceeds the amount of taxes owed, the balance is returned to the taxpayer.

By providing a credit that increases as earnings increase up to a certain amount, the EITCencourages work. It is also an effective tool to decrease inequality and lift families out of poverty by leaving low-wage workers with more income to spend on food, clothing and other necessities.

To claim the federal EITC in tax year 2013, a taxpayer must have a modified federal adjusted gross (earned) income of less than $14,340 if the family has no dependent children, $37,870 with one dependent child, $43,038 with two dependent children, and $46,227 with three or more dependent children. The Center on Budget and Policy Priorities provides a useful tool to calculate the expected EITC for households of various sizes and income levels.

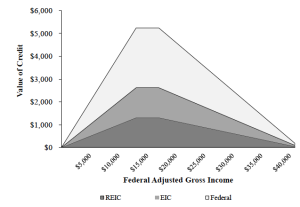

Maryland’s Refundable Earned Income Tax Credit amplifies the federal EITC. Maryland’s refundable EITC currently provides a credit for up to 25 percent of the federal EITC, which is $2,300 on average. Below, a chart from Maryland’s Department of Legislative Services illustrates the relationship between the state and federal EITC and earnings for a single parent with two children.

The darkest colored area at the bottom represents Maryland’s refundable EITC. By increasing from 25 percent of the federal EITC to 28 percent, Maryland’s refundable credit will do more for working Marylanders. Given the average EITC amount and the number of households that benefit from the EITC, this expansion could result in an additional $19 million for working families in Maryland.

Further, because Maryland’s refundable EITC is tied to the federal credit, any expansion to the federal credit will only increase the power of Maryland’s EITC. Earlier this week, we highlighteda promising proposal in President Obama’s budget that would expand the federal EITC to many more childless adults (very few of whom currently qualify). Taken together, these proposed expansions to the federal and state EITCs will provide needed assistance to Maryland’s workers.

The EITC gives low- and moderate-income workers the opportunity to catch up on bills and debts, and to begin accumulating savings. The increased income the EITC provides workers also benefits local economies as families quickly spend the funds on necessary household expenses. More broadly, studies have shownthat the EITC helps move young adult men into the workforce and boosts their effective income, and may improve marriage rates, reduce crime, and reduce incarceration.

Finally, the EITC complementsanother important issue on the 2014 legislative agenda in Maryland – boosting the minimum wage. Workers earning the minimum wage would greatly benefit from being able to keep more of their increased earnings due to an expanded EITC, and that would also help Maryland’s economy.