Choices and Challenges: Maryland's Budget Outlook & Governor's Upcoming FY 2015 Budget – Part II

By David McNear

Previously, we provided an overview of the Maryland budget process and the economic conditions that will impact the options available to state lawmakers as they work to craft the FY 2015 budget.

Today, we will delve deeper into the constraints that state lawmakers face in developing the budget for the coming fiscal year. To begin, legislators enter the session facing the need to make up for deficiencies that result from less-than-expected revenue collected during the previous fiscal year. We will discuss options for how state legislators can make up for these deficiencies.

State Budget Outlook

At end of 2013 session, the state’s structural budget deficit – the gap between ongoing spending and ongoing revenue – was projected at about $172 million, down from about $1.2 billion a few years ago, and the FY 2014 General Fund cash balance was projected at $294 million. One-time sources of money, like the Federal stimulus package, and state budget and tax action decreased the structural budget gap and eased pressure on the General Fund. As Federal budget and tax decisions dragged on the state economy, the growth in state revenue collections was slower than expected. In current budget, reduced revenue collections, lowered revenue estimates and projected deficiencies led to a projected FY 2014 General Fund gap of $189.5 million.

- $294 million estimated closing General Fund balance at end of 2013 session;

- $56 million less than expected in closing FY 2013 General Fund balance;

- $264 million in DLS estimated deficiencies for FY 2014;

- $62 million in reduced fiscal 2014 revenues in September BRE forecast;

- $102 million additional revenue FY 2014 write-down in December BRE forecast; led to

- $189.5 million current DLS estimate for FY 2014 General Fund shortfall.

(Click to enlarge)

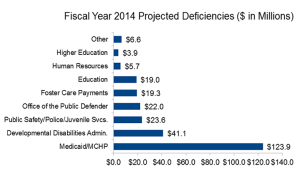

The Department of Legislative Services projected that FY 2014 deficiencies total $264 million in General Funds, including $124 million for Medicaid, $41 million for the Developmental Disabilities Administration, $22 million for Office of Public Defender, and $19 million each for Foster Care and K-12 Education.

(Click to enlarge)

Despite increased FY 2015 revenue estimates in December, when the BRE boosted its revenue forecast by $144 million from the September estimate to $16 billion, fiscal 2015 also sees a projected General Fund budget gap. DLS anticipates FY 2015 General Fund spending of about $16.5 billion, which is projected to outpace available money by $339.4 million. With the estimated $189.5 million budget gap in the current budget, combined current General Fund budget shortfall is estimated at $528.9 million.

(Click to enlarge)

Addressing Deficiencies

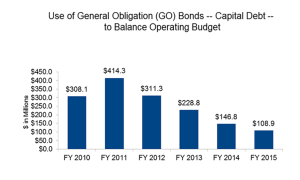

The Governor’s proposed FY 2015 budget plan will need to be balanced for both fiscal 2014 and 2015. For the current FY 2014 budget, the Governor’s upcoming budget does not have to include money for all or part of the $264 million in projected General Fund deficiencies, which could be funded in later Supplemental Budgets. The Board of Revenue Estimates updates their FY 2014 and FY 2015 revenue forecast in March, before Supplemental Budgets have to be introduced and balanced — and before the legislature has to pass the final budget. In addition to more available funds through boosted revenue estimates in March, the legislature could also raise revenues. Money could also be transferred to the General Fund from Reserves or Special Funds, like Bay Restoration Fund or the Transportation Trust Fund, which ended FY 2013 with a fund balance of $218 million, or $118 million more than expected. Increased capital debt, in form of General Obligation (GO) Bonds, has often been used to replace transferred Special Funds and provide General Fund fiscal relief.

(Click to enlarge)

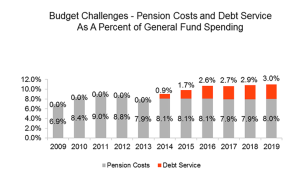

In addition, General Fund spending in the Capital Budget (PAYGO) could also be replaced by GO Bonds. Whether state lawmakers decide to replace PAYGO, or to make up for Special Funds transferred into the General Fund, the increased allocation of GO Bonds leaves limited flexibility in funding the Capital Budget increases debt service costs. In previous budgets, state property tax collections were sufficient to help pay for debt service costs, without the need for a General Fund contribution. Beginning with the current FY 2014 budget, an $83 million General Fund contribution is needed for debt service costs; and $233 million is forecast in General Fund debt service spending for FY 2015. As the fixed costs of pension and debt service grow to a larger portion of the General Fund budget, spending for other needs and priorities is squeezed.

(Click to enlarge)

We will conclude our preview of the budget with an overview of the state’s capital budget and more detail about the operating budget.