Bursting the Bubble: National Capital Region’s Affluence Puts Cost of Living out of Reach for Many

We’ve been highlighting aspects of Bursting the Bubble, a new report we’ve released along with the Commonwealth Institute and the DC Fiscal Policy Institute showing how the unequal economic growth of the national capital region has not created broadly shared prosperity. Previously, we e described the kinds of disparities resulting from this highly uneven growth; today we will highlight one especially serious impact: housing prices growing too high for many people to afford.

The median value for homes in the region is $313,792 (based on 2012 data); well over double the national figure of $151,992. Without a high salary, it is difficult to keep up with housing costs in the national capital region. A four-person household needs to make over $81,900 a year to afford basic living expenses, according to the Economic Policy Institute’s family budget calculator.

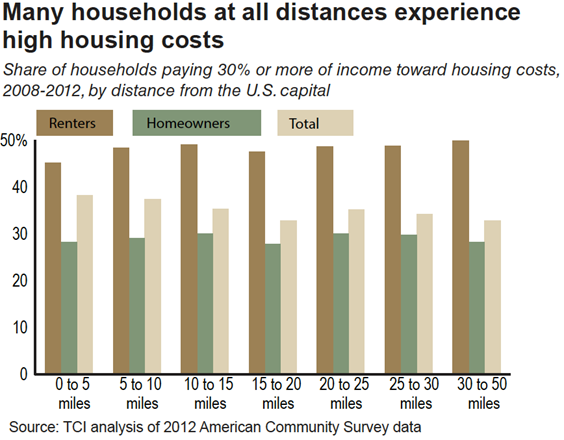

Not surprisingly, then, many pay a disproportionate share of their income on housing. In the national capital region, nearly a third of homeowners and half of renters pay more than 30 percent of their income on housing. That’s the point at which the federal Department of Housing and Urban Development considers a family to be “cost burdened,” which means they are less able to pay for other necessities, save or absorb financial.

In Maryland, Prince George’s County is especially beset by high housing costs. There, 66,259 homeowners – 43 percent – are cost burdened. Prince George’s also faces high rental costs along with Calvert and Montgomery counties.

In the wake of the Great Recession, persistently high housing prices coupled with stagnating incomes for many residents of the national capital region have led to high foreclosure rates. While the region generally has lower foreclosure rates than other parts of the country, some parts of the region have been hit much harder. In the Maryland parts of the national capital region, 3 percent of homes are in foreclosure, compared with .5 percent in the Virginia part of the region and just over one percent in the region as a whole. High foreclosure rates in Prince George’s and Charles Counties drive the Maryland figures.

Check back here for a discussion of the policy prescriptions that Bursting the Bubble proposes to address these disparities and the trouble that some residents in the national capital region, especially Maryland, face in keeping up with the high cost of living.