Trump Tax Framework Would Give Away Trillions in Tax Breaks to Millionaires

The Trump administration and congressional leaders are gearing up to overhaul the federal tax code this fall. While many of the details remain fuzzy, one thing is clear: the administration’s top priority is to hand out big tax breaks to millionaires. These tax cuts would cost trillions in lost revenue and build pressure for damaging cuts to essential services—all while doing little to boost the economy or help working families. Congress should vote down any tax package resembling the one outlined by the administration.

The Trump administration has never released a detailed proposal that fully explains the White House’s vision on taxes. Nonetheless, a brief statement of principles issued earlier this year calls for unbalanced cuts that would predominantly benefit millionaires. Some of the most egregious cuts include:

- Cutting the corporate tax rate by more than half and allowing a larger group of businesses and wealthy individuals to take advantage of this special rate.

- Repealing a 3.8 percent investment tax that applies only to the wealthiest filers and is used to fund health care.

- Repealing the estate tax on ultra-wealthy heirs, which applies to only two out of every 1,000 estates.

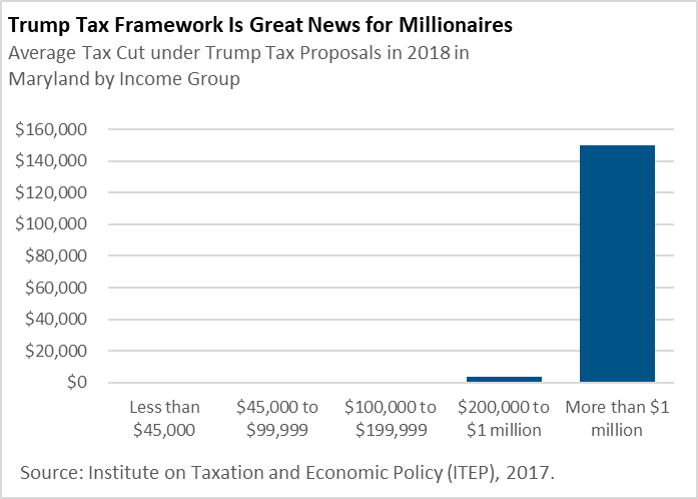

In Maryland, 62 percent of the plan’s tax cuts would go to the tiny minority of tax filers with annual incomes over $1 million. Meanwhile, those with incomes under $45,000—more than one-third of the state—would get only 4 percent of the cuts. To put things in perspective, the average Maryland millionaire could use his or her tax cut to buy four-and-a-half new cars.

The cut for families earning less than $45,000 would cover less than half of one average monthly car payment.

In total, the tax plan would cost the federal government $4.8 trillion in lost revenue over 10 years. That’s money we could be using to repair the country’s infrastructure, shore up access to health care, or invest in sustainable energy technology. These kinds of investments would create jobs and bring meaningful improvements to millions of Americans’ lives. The same can’t be said of a plan that mainly lines the pockets of the wealthiest.