To Support a Strong Economy, All Marylanders Must Pay Their Fair Share in Taxes

Maryland’s success today is due to our past public investment in good schools, a strong transportation system and other building blocks of a prosperous economy. As another “tax day” rolls around, it’s worth remembering that the income taxes we pay help make these investments possible.

Cutting state income taxes or corporate taxes would undermine our ability to support these important services that businesses and families rely on every day.

Where is the money going?

Our federal taxes mainly pay for national defense and vital aids to well being such as Social Security, Medicare, Medicaid, and the Children’s Health Insurance Program. In Maryland, most of our state income tax dollars go to education and healthcare. The return on our investment is one of the most highly educated and healthiest workforces in the country.

To ensure that the next generation of Marylanders has the education needed to compete in the job market – and so businesses can hire the skilled people they need — we need to provide superior education from kindergarten to college. Out of 30 job categories that are expected to have the biggest job growth over the next decade, more than half require at least a bachelor’s degree and the remainder require at least an associate’s degree. While it’s good news that the state budget that goes into effect July 1 includes $140 million more than last year for K-12 education spending, that essentially only covers the growth in the student population. Many school districts will still not be able to reverse the growth in class sizes that took place during the recession or address other needs.

A well-functioning transportation system is also necessary for a strong economy –helping people get to work enabling businesses to deliver their products. In Maryland, the newly approved Purple Line light rail is one example of a major public investment that will help connect Marylanders to jobs and also create new business hubs by making areas easier to get to. Quick and accessible mass transit in more Maryland communities would encourage more families and businesses to locate here. The delays and emergency maintenance on the aging Metrorail system that have caused massive headaches for commuters in the D.C. region is one example of how neglecting these public investments can hurt the community and the economy.

Not having the resources to pay for these essential projects could be potentially dangerous to the health and safety of the community. A tax code that makes sure everyone – including the wealthiest — pay their fair share can improve the situation. Our investments, made possible by taxes, encourage business and job growth, which make Maryland’s economy stronger.

Who pays?

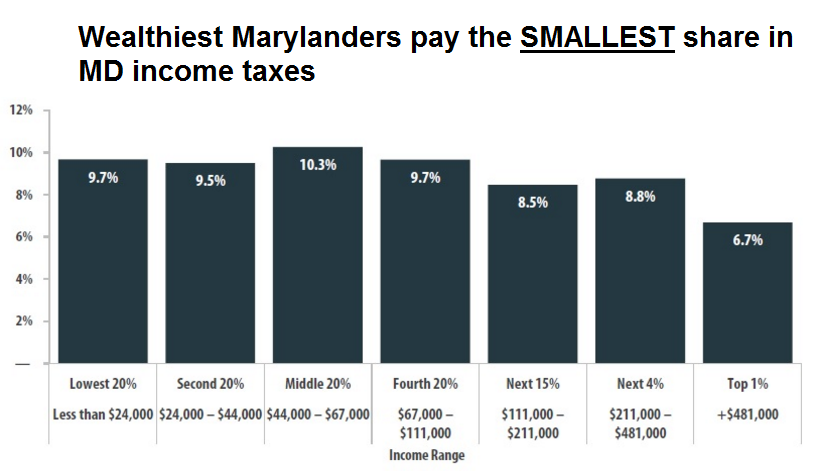

While the wealthiest have seen their incomes skyrocket in recent decades, incomes have stagnated for the middle class and those who struggle hardest to make ends meet. Our state tax system makes this problem worse because it asks those who earn the least to pay a much greater percentage of their incomes in taxes than the wealthiest. The investments that taxes pay for improve the lives of every Maryland resident, and the tax code determines who pays for these investments, and how much.

Maryland’s tax code includes some beneficial components for working Marylanders, such as the state Earned Income Tax Credit which complements the federal Earned Income Tax Credit. But in general the tax code favors the rich. Like almost every other state in the country, those who are struggling to make ends meet pay a larger share of their incomes in state and local taxes than the wealthy residents do.

This imbalance in our tax system disproportionately harms women and people of color, who are much more likely to have lower incomes and therefore pay a greater share of their incomes in state and local taxes. It isn’t right that the more than 1.4 million female workers in Maryland tend to shoulder a greater share of the burden than men do when it comes to supporting our community’s schools, infrastructure, and other services.

Allowing the wealthiest residents to pay the smallest share of their income in taxes hurts Maryland’s ability to invest in education and other priorities that are vital to maintaining a strong economy. Maryland is the wealthiest state in the nation in terms of median household income and concentration of wealth (we have the most millionaires per capita). In a state where the top 1 percent saw income growth of more than 80 percent since the Great Recession and the other 99 percent saw less 1 percent income growth, our tax policy should reflect that.

To ensure that Maryland can continue to meet the state’s growing needs and make the investments that support a strong economy, we need a tax system that calls on everyone to pay their fair share.