The importance of childcare for working women

Working women and childcare

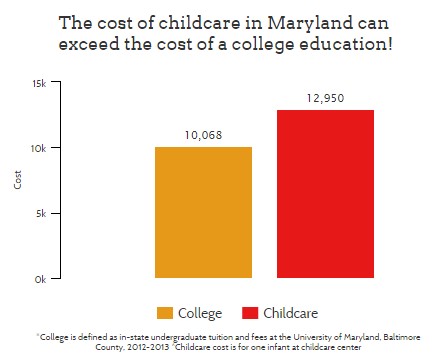

Funding for childcare is dwindling. The primary federal funding source, the Childcare and Development Fund, is awaiting reauthorization for the first time in 18 years. Childcare costs in Maryland have risen so drastically that it now costs more for a year of childcare than a year of undergraduate tuition at an in-state school. This cost can consume a major share of families’ incomes. Childcare is a necessity for single-parent households and Maryland has one of the highest percentages of low-income families headed by working women. Maryland cannot afford to wait for the federal government to fund quality programs. Maryland can choose to support working women and child development now.

Nearly 50 percent of Maryland working-age women are employed full-time. For mothers with children under 12, 79 percent are working. The share of women in the workforce has been on the rise since the 1940’s. Prior to World War II, women were less than 30 percent of the workforce. World War II brought a need for additional labor in stateside factories and women filled the void left by deployed men. Owners of the factories noted a high rate of absenteeism for working moms due to lack childcare options and brought the need for assistance to the government’s attention. The United States government recognized the benefit of supporting working moms and federally funded childcare centers across the U.S. The only qualifier was the employment status of mom. The centers operated until the government discontinued funding in December 1946.

Fast-forward 40 years to 1988 and the passage of the Family Support Act (FSA). The FSA was a major welfare reform, changing Aid to Families with Dependent Children (AFDC) to require an education, training, or work component for parents to receive aid. The FSA also guaranteed childcare support for participating parents. This led to the creation of the 1990 Childcare and Development Block Grant. In 1996 the block grant was renamed the Childcare and Development Fund (CCDF). The CCDF is still the most significant source of childcare funding for working parents today, assuming it is renewed.

Maryland provides childcare subsidies for working families through state general funds and the CCDF. Maryland’s spending on childcare peaked in 2003, at $134.6 million or $174 million in 2014 dollars, but has fallen to just $83 million during the current fiscal year. Maryland froze enrollment in the subsidy program in 2011 for those who are not receiving temporary cash assistance, supplemental security income, or have a child with a disability. Families were put on a waiting list, which was subsequently purged in November 2012, so families had to re-enroll.

The state prioritizes availability of the subsidy based on family size and income. Maryland last adjusted the income eligibility in 2002, when it set each level at 50 percent of the state median income for that year, but failed to tie the levels to changes in median incom e. For example: a family of four can make up to $35,702 and still receive childcare assistance. However, as the state median income levels rises, fewer families are able to participate in the program. If Maryland were to calculate 50 percent of the state median income at 2013 levels, a family of four should be able to make up to $52,674.

e. For example: a family of four can make up to $35,702 and still receive childcare assistance. However, as the state median income levels rises, fewer families are able to participate in the program. If Maryland were to calculate 50 percent of the state median income at 2013 levels, a family of four should be able to make up to $52,674.

The childcare subsidy program has two parts:

- Parents receive a childcare voucher for each child from their local Department of Social Services and the voucher is used to purchase childcare directly from providers of their choice

- Parents are assigned a co-pay, which they pay to the provider, and any difference between the voucher amount and what the provider charges

The voucher amount or subsidy rate is determined by the state and based on a survey of market rates. Federal guidelines recommend that the subsidy rate be at the 75th percentile of the market rate. Just like the eligibility levels, Maryland’s subsidy rates were last adjusted in 2002. Much like median household incomes increasing, provider charges have as well. Maintaining the subsidy rate from 12 years ago puts additional financial strain on households, who must pay the difference. Instead of paying for 75 percent of current market rates, Maryland’s subsidy pays just 10 percent. The U.S Department of Health and Human Services recommends that families pay no more than 10 percent of their household income on childcare. In Maryland, families can pay up to 3 times that.

Working moms in the U.S have contributed significantly to the American economy. Their increased work hours and productivity have benefited the nation and our state. To continue to support working mothers, Maryland should increase funding for childcare and implement new policies focusing on setting new eligibility and subsidy rates. The outdated state median income rates limit access to this important work support, and the deficient subsidy rates mean families have to contribute more of their already stretc