Tax Day 2015! Let’s Celebrate Our Investments

On April 15th our taxes are due and it’s a good time to pause and consider what we’ve invested in. To build a strong economy and create jobs, we need to invest in what works, like education, transportation, and family friendly workplace policies.

Where Our Money Goes

Education and health care are where we spend the most in Maryland. The return on our investment is a highly educated, healthy workforce. Nationally, of the 30 careers projected to have the largest job growth from now until 2022, over half of the jobs will require at least an associate’s degree, with 14 job categories requiring at least a bachelor’s degree. To help students get the education they need to compete in the job market, we need quality, affordable education from kindergarten to college. Maryland has made major investments in this area, increasing spending since 2008, while many states have made deep cuts to education.

In addition to highly-skilled workers, businesses want and need a state-of-the-art transportation systems so their employees can get to work and to get their products to market. For example, the Purple Line and the Red Line, two rail projects now under development, would help connect Marylanders to jobs in Baltimore and D.C. An accessible mass transit system would encourage families and business to move to Maryland. It would also help those already living here in areas where business growth and opportunity are stagnant. Our investments, made possible by taxes, encourage business and job growth, ensuring our state’s continued success.

Once families get working, we need to keep them working. Family friendly priorities, like affordable child care, ensure that parents are able to work and support their families, while knowing that their children are safe and cared for.

Who Pays

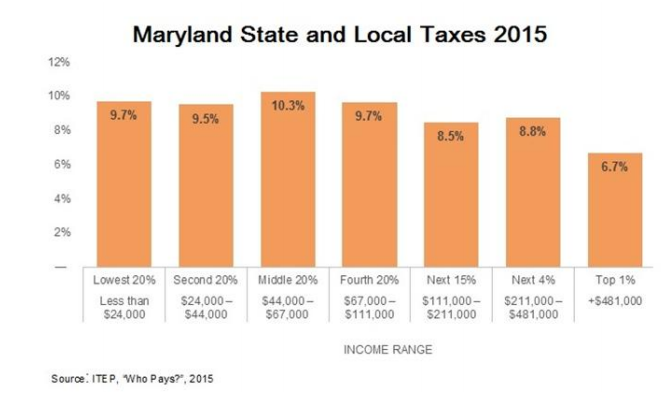

Our tax system asks those who earn the least to pay a greater share of their income in taxes while the wealthiest pay the smallest share. This system hurts Maryland’s economy and its ability to raise enough revenue for investments in schools and other priorities. In short, it’s bad policy.

When we rely on those who earn the least —those same workers whose wages have been stagnant for some time—state revenue is subject to the same stagnation. Wages for most Marylanders have barely budged since the recession. The Board of Revenue Estimates lowered its projections in December as a direct result of stagnant wages. In Maryland, this has had devastating effects on our state budget. Less revenue means potential cuts to education, health care and public safety.

The top 1 percent of Marylanders captured more than 80 percent of the income growth since the Great Recession. The other 99 percent saw less than 1 percent income growth. If we want our state to continue investments that make Maryland a great place to live — with consistently one of the highest median incomes and the most millionaires per capita — we need a tax system that supports those priorities.

The top 1 percent of Marylanders captured more than 80 percent of the income growth since the Great Recession. The other 99 percent saw less than 1 percent income growth. If we want our state to continue investments that make Maryland a great place to live — with consistently one of the highest median incomes and the most millionaires per capita — we need a tax system that supports those priorities.

Corporations also need to pay their fair share for the benefits they receive from operating in Maryland. Unfortunately, we missed an opportunity this year to close a loophole so that corporations would be required to do just that. By strengthening our income reporting system for multi-state corporations, we would also help create a level playing field for our small businesses located only in Maryland.

Our state became great because those who came before us made investments in education, transportation, and policies that support working families. These are the investments that work and help grow our economy. We owe it to the future of our state to support and continue these investments.