Tax Cuts Should Focus on Need, not Age

This legislative session, some lawmakers are attempting to cut taxes across the board on retirement income, a strategy that would result in a financial gain for the wealthiest households and drastically reduce support for state services that all Marylanders rely on, like schools, roads, and public safety.

It is important to help retirees who struggle to make ends meet. But such efforts must be targeted by income, as well as age, so lawmakers don’t simply shift the burden for paying for the state’s needs from wealthy seniors to younger workers.

Policymakers often use tax breaks for seniors to appeal to this politically active demographic. However, implementing such tax breaks have been costly both to state governments and the people who depend on public services. For instance, a proposal in Iowa to phase out state taxation on retirement income over the course of five years was shown to cost the state about $200 million a year. Minnesota lawmakers have proposed a $2 billion tax cut that includes a tax exemption for all Social Security income and military pensions.

Here in Maryland, policymakers have justified the need to increase the pension income exemption limit, a change that could reduce state revenue by hundreds of millions of dollars, on the basis that people over age 65 are in desperate need of financial relief and that many elder residents have fled the state to avoid Maryland’s tax rates.

These claims could not be further from the truth. Despite the fact that poverty is often associated with advanced age, many seniors are living comfortably in retirement thanks in part to the benefits they already receive, like Social Security, Medicare and lower taxes. A 2015 U.S. Census report found that Americans over 65 are less likely to be poor than people in their prime working years, highlighting the mismatch between the tax breaks offered and the needs within the population.

Similarly, Maryland residents 65 and older are much less likely to be in poverty than younger adults. Marylanders 65 years of age and older have a 7.4 percent chance of living in poverty, while adults 18-64 have a 9.6 percent chance of being in poverty, according to the most recent Census Bureau statistics.

Many seniors’ wealth lies in their retirement savings and investments, as this income group has the highest value of household assets and net worth.

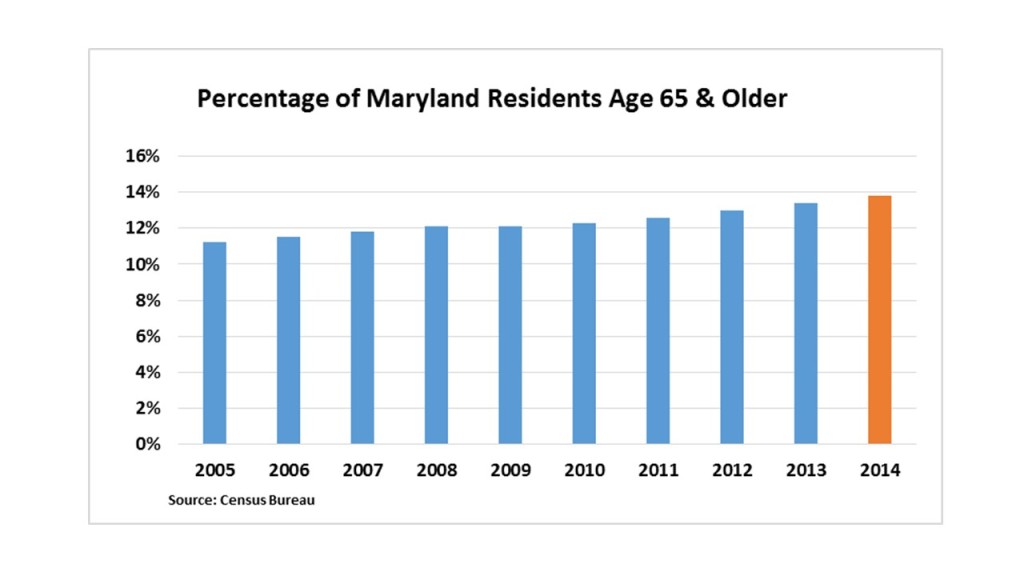

Furthermore, there is strong evidence to refute the claim that older residents are fleeing the state to avoid taxes. There were 824,744 Marylanders 65 and older in 2014 and 611,668 in 2005. That doesn’t look like an exodus and the growth isn’t all from baby boomers aging.

In fact, seniors tend to receive more attention from lawmakers than other groups, which means they already benefit from a number of tax breaks. Federal law gives people over 65 a higher standard deduction on their income taxes and a full or partial income-tax exemption for Social Security payments, depending on levels of income. In Maryland, a married couple over 65 could deduct as much as $58,000 from taxable income. In many cases wealthy taxpayers reap the biggest benefits from state income tax breaks that go to all older adults.

In fact, seniors tend to receive more attention from lawmakers than other groups, which means they already benefit from a number of tax breaks. Federal law gives people over 65 a higher standard deduction on their income taxes and a full or partial income-tax exemption for Social Security payments, depending on levels of income. In Maryland, a married couple over 65 could deduct as much as $58,000 from taxable income. In many cases wealthy taxpayers reap the biggest benefits from state income tax breaks that go to all older adults.

These scattershot tax breaks shift resources away from important public services that help residents who struggle to make ends meet, including some seniors. Lawmakers need to rethink these costly tax cut proposals and focus on policies that encourage economic growth and truly help Marylanders who need it most. The point is that millionaires shouldn’t get the same tax breaks as people who have to count every penny – regardless of their age.