Study: Recent EITC Expansion in MD will Make Taxes More Fair, Reduce Inequality

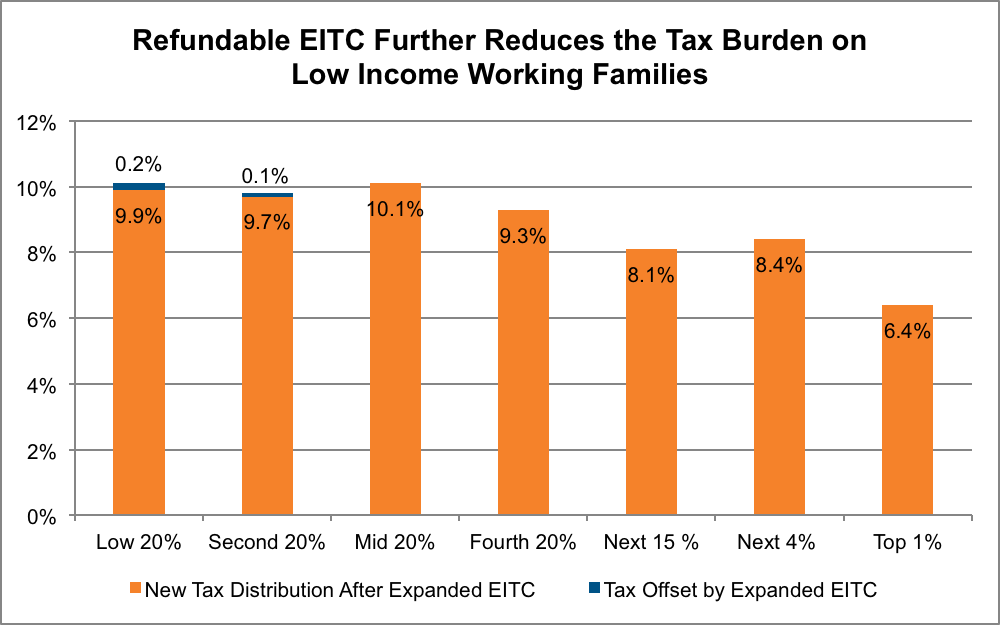

Working Marylanders with the lowest earnings will pay slightly less of their income in taxes — 9.9 percent compared to 10.1 percent now – once the expansion of the state’s Earned Income Tax Credit is fully phased in, according to a new study.

That’s a small change, and the top 1 percent of income earners in Maryland will still pay a lower percentage of their income in taxes than everyone else. Nonetheless, it is a move in the right direction that will make it a little easier for low-income working families to make ends meet.

The General Assembly’s recent decision to expand Maryland’s Earned Income Tax Credit (EITC) was an important victory for workers in the state (previously). The EITC helps families get by more easily on low-wage work by offsetting some of the taxes they pay (like sales and payroll taxes) and boosting their income. A new study from the Institute for Taxation and Economic Policy (ITEP) shows how expanding the EITC will make Maryland’s tax system fairer and help reduce inequality.

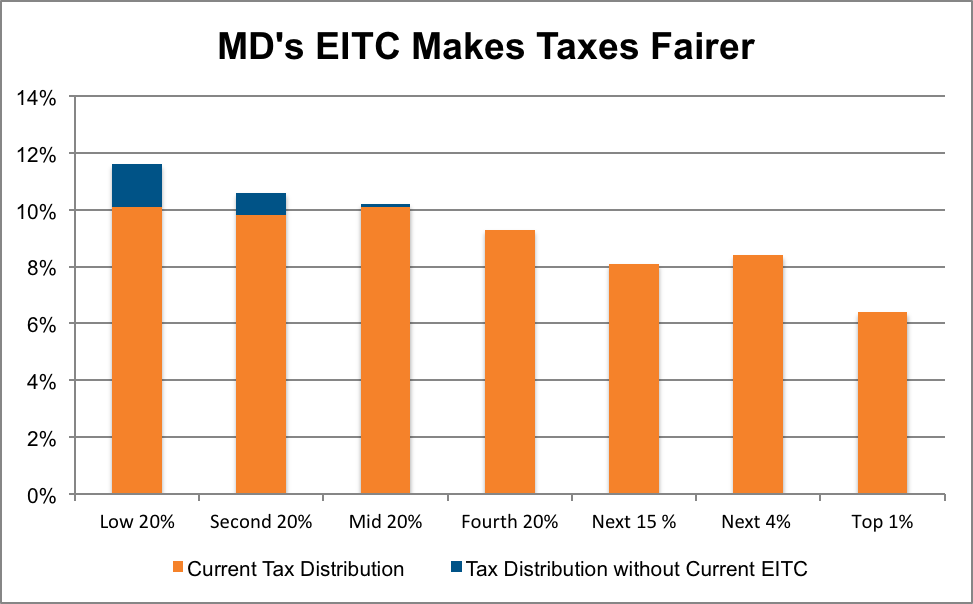

In general, residents with moderate and low incomes in Maryland pay a bigger share of their family incomes in state and local taxes than those with high incomes. But ITEP’s analysis shows how Maryland’s EITC helps reduce that disparity for those on the lower half of the income scale. In fact, without the state EITC, Marylanders making less than $23,000 per year would bay almost twice as much of their income in taxes as those making more than $444,000.

Source: Institute for Taxation and Economic Policy

Note: ITEP’s distributional analysis is divided by income group. More detailed information about each income groups appears at the bottom of this post.

Under legislation passed this year by the General Assembly, Maryland’s refundable EITC will eventually expand from 25 percent of the Federal EITC to 28 percent. ITEP’s study shows that this will further reduce the share of income that low-income families devote to taxes.

Source: Institute for Taxation and Economic Policy

As we have argued before, the EITC is not the only tool Maryland has to fight poverty and improve the economic prospects of its low-income residents. Rather, the EITC complements other policies such as the minimum wage, other targeted tax credits such as the renter’s tax credit and premium tax credits for the purchase of private health insurance through the Maryland Health Connection, and services such as Medicaid. ITEP’s analysis shows that the EITC succeeds at its part in the fight against poverty and inequality by reducing the percentage of taxes paid by those with low and moderate incomes in Maryland.

Detailed information on ITEP’s income categories:

|

Income Group |

Lowest 20% |

Second 20% |

Mid 20% |

Fourth 20% |

Next 15% |

Next 4% |

Top 1% |

|

Income Range |

Less than $23,000 |

$23,000 – $42,000 |

$42,000 – $65,000 |

$65,000 – $108,000 |

$108,000 – $202,000 |

$202,000 – $444,000 |

$444,000 Or More |

|

Average Income in Group |

$12,600 |

$32,400 |

$52,500 |

$83,800 |

$142,600 |

$292,300 |

$1,437,300 |