Senate Tax Bill Cuts Health Care, Raises Taxes on Working Families; Wealthy Few Get a Windfall

As they return from the Thanksgiving break this week, Congressional Republicans’ top legislative priority is to pass a massive tax cut for the top 5 percent of households. And the bill senators are currently negotiating would do much more than that. It raises taxes on working families, puts health insurance out of reach for millions, and creates large deficits lawmakers can later use to justify damaging cuts. If this bill passes, it will do lasting harm to many Maryland families.

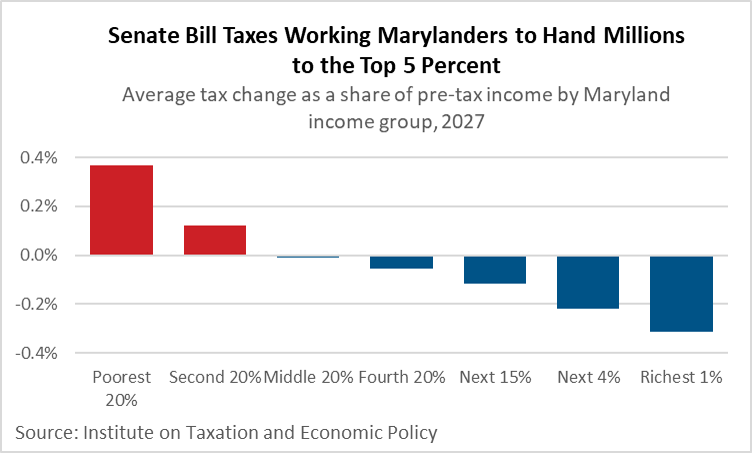

The Senate bill would bring large benefits to the wealthiest households, cutting taxes on the top 1 percent of Marylanders by $8,000 in 2027 and more in earlier years. It accomplishes this through numerous lopsided provisions, like drastically cutting the multimillionaire estate tax and permanently reducing corporate tax rates. Meanwhile, one in four Maryland families would pay higher taxes under the bill. Families who are already struggling to afford the basics are singled out for the biggest hikes as a share of their income.

The bill also guts a key provision of the Affordable Care Act, which would ultimately result in 13 million Americans, including 226,000 Maryland residents, losing their health coverage. The Senate added this provision in order to pay for permanent corporate tax cuts (Senate rules require other parts of the bill to expire after 10 years).

Despite raising taxes on millions of Americans and taking health insurance from millions more, the bill still increases deficits by $1.5 trillion over 10 years. While the current federal deficit is not a pressing problem for the U.S. economy, sharply increasing the deficit would create pressure to cut the federal budget. Experience from the last decade shows that Republicans would likely use the higher deficits this bill creates to call for damaging cuts to Medicare, Medicaid, Social Security, and other federal investments in families.

Our federal tax code could certainly stand to be improved. Real tax reform would focus on allowing more workers to access the Earned Income Tax Credit, closing the carried interest loophole for hedge fund managers, and making sure the wealthy pay their fair share. Big breaks for the wealthy paid for by the rest of us don’t cut it.