Maryland rental housing—running hard to keep up

This post is written by guest blogger Ann Blyberg

Maryland is one of the wealthiest states in the country, yet large numbersof people here struggle each month to pay their rent. The state government has launched a project, Rental Housing Works, which the Department of Housing and Community Development (DHCD) says is making real progress toward ensuring that affordable housing will be within the reach of those who need it. However, while the state is helping finance record levels of construction of affordable housing, the percentage of renters in the state who spend 30% or more of their household income on housing – considered too high by most experts — has remained relatively unchanged over the past five years.

A recent DHCD report details the state’s accomplishments under Rental Housing Works. The 80 affordable housing projects underway in the state are “an unprecedented number – more than we have had in play at any time in DHCD history,” acting DHCD Secretary Clarence Snuggs said. “Just as importantly, those projects will allow us to leverage many times that amount from federal and private sources, so that we will put nearly a billion dollars into the state’s economy.” The current work represents a tripling over three years in production of affordable housing units through state initiatives.

DHCD has, however, been struggling against some strong headwinds, namely, the Great Recession. In 2012 renters occupied more than a third of the 724,000 household units in the state, which was a 3 percentage point uptick from 2006. The sharp decline in the housing market in 2007 and the resulting foreclosures sent large numbers of people into the rental market. In addition, tighter credit requirements facing potential home buyers meant that young people who, before the recession, might have bought their first homes instead have crowded into the rental market.

That has sent rents soaring, forcing people to spend greater shares of their income to put a roof over their heads. The share of Maryland households paying 30% or more of their income on rent has remained just above half for the past five years, according to the Census Bureau’s 2013 American Community Survey. Higher rents hit lower-income families and individuals particularly hard, because they are forced to choose between paying rent and other necessities, like buying enough food or getting adequate health care.

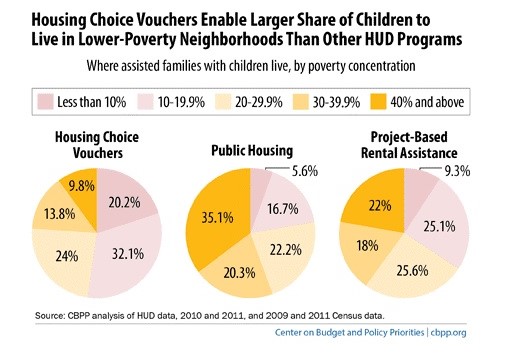

For every 100 Maryland households whose income is 30% or less of the Area Median Income (AMI), there are only 38 affordable units available, according to the DHCD report. Striking facts like this are behind the strong push by the state to build more affordable housing. However, because of the very substantial shortfall and the significant lead time needed to build housing and put it on the market, other efforts are needed to ensure that affordable housing is available for everyone in the state in the short- and medium-term. As our June 2014 report, Bursting the Bubble, recommends, housing subsidies are necessary if families are to be able to afford housing that would otherwise be out of their income range. In addition, more houses and apartments needs to be built closer to where the jobs are to minimize transportation costs, which are paid for by the same scarce dollars as rent.