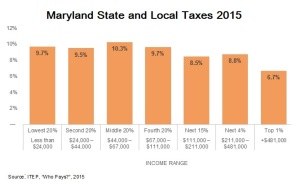

Low-Earners Paying More in Taxes than the Well-Off in Maryland

Those earning the most in Maryland pay the lowest share of their income in state and local taxes, at just 6.7 percent, according to the Institute on Taxation and Economic Policy’s (ITEP) new “Who Pays?” report. Those in the top 1 percent, making over $481,000, pay the least in sales and excise taxes and property taxes. Those in the middle 20 percent (earning between $44,000 and $67,000) pay the most.

In states where lower earners pay a higher share of the taxes, revenue growth – which we depend on to fund schools, health care and other necessities — tends to be slower, and that is exactly what we are currently witnessing in Maryland. As many will remember, the Maryland Board of Revenue decreased revenue estimates twice in the past year and cited “a decreased outlook for aggregate wage growth and therefore income tax withholding” for the reduction. This isn’t expected to change any time soon. Wages have not risen in Maryland since before the Great Recession. And considering the increase in low-wage jobs, they are unlikely to in the near future.

The top 10% of earners “took [home] more than half of the country’s total income in 2012, the highest level recorded since the government began collecting the relevant data a century ago,” according to a study by two prominent economists. Incredibly, those at the top also managed to capture 95 percent of the income gains since the recovery from the recession began. With the share of taxes disproportionately paid by low earners, Maryland’s revenues can be expected to remain at decreased levels, forcing harsh cuts to vital state investments in education, health, and public services like police and fire departments.

Maryland’s tax code does a lot right for its residents, like a personal income tax rate that rises along with ability to pay; no sales tax on groceries, which helps low-income and elderly residents; and an Earned Income Tax Credit for working families that was recently expanded. However, the state could do more to reduce taxes on its citizens who earn the least.

One criticism from ITEP is Maryland’s failure to treat a business composed of a parent corporation and one or more subsidiaries as a single corporation for tax purposes, a concept known as “combined reporting.” Adopting combined reporting would nullify an array of tax-avoidance strategies large multistate corporations have devised and could raise about $70 million in revenue each year (see our report “Resources for New State Investments”).

Last legislative session, lawmakers failed to pass twin bills in the Maryland House and Senate on combined reporting, disadvantaging small local businesses compared to their large multi-state corporate competitors, and depriving the state of much needed resources. With a new session starting today and the need for increased state revenue, it is beyond time for the legislature to pass a combined reporting bill, as 23 other states and the District of Columbia have done.

The ITEP report concludes that every state has an unfair tax system. Maryland is doing a better job than most – 37 other states were judged more unfair – but there’s room for improvement. As we move into the new legislative session, we need to protect what’s been put in place to create a close-to-fair tax system. Our Governor-elect last week stated that tax cuts are going to happen this session, which begs the question, tax cuts for whom? As ITEP put it, “Shortsighted tax cuts can be a long-term drag on development”. We should work to create a more fair tax system, not increase the share of taxes for low- and middle-earners.