Job Creation Tax Credits Fail to Deliver

A pair of Maryland job creation tax credits is doing little to boost the state’s economy, at the expense of state investments that would support economic growth. The Job Creation Tax Credit and the Businesses that Create New Jobs Tax Credit provide breaks on local property and state taxes. After 20 years, the record shows these credits have done little to promote job creation and primarily benefit large businesses already present in the state – at the cost of investments proven to build the economy like education, healthcare and transportation.

A recently released Department of Legislative Services review of the tax credits found they are overly complex, help few businesses, overlap with existing credits, and primarily benefit very large companies.

Since 2001, the Jobs Creation credit has cost the state $21.8 million. While the companies claiming the credit certified about 17,700 new jobs during that period, there is good reason to believe these tax breaks went to companies that would have expanded with or without the credit. An average benefit of $1,232 is a drop in the bucket compared to the average salary for these certified jobs, $57,879 a year. Other factors like increased demand for a product or service are what really drive a business to expand. It is no surprise then that jobs created by this credit accounted for only 0.4% of the 4.6 million jobs added in Maryland since 2002.

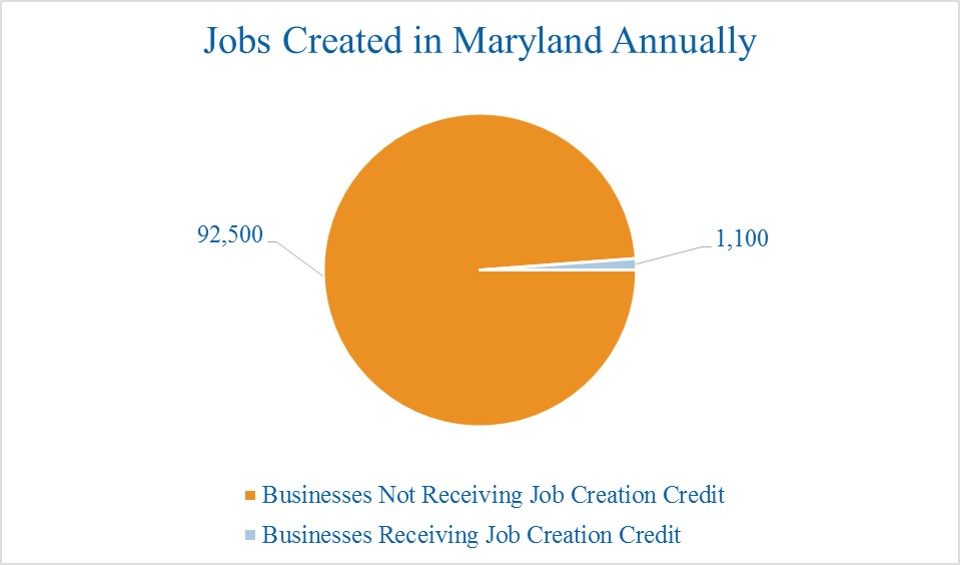

Of the 101 businesses eligible for a job creation tax credit, 10 businesses received more than half of all credits. The eligibility requirements, such as minimum job and investment requirements, prevent most businesses from claiming these credits. Each year, fewer than 10 businesses that create about 1,100 jobs cumulatively are certified for the job creation tax credit, compared to an average 11,400 new businesses that create 92,500 jobs a year, 40 percent of which are start-ups.

Giving tax breaks to large companies for doing something they would be doing anyway is not worth the millions of dollars these two tax credits cost each year. Rather than an uneven patchwork of credits that benefit a handful of large businesses, legislators should consolidate programs and focus on small, newly established businesses in high-growth industries.