House of Cards or Race to the Bottom?

While the series ‘‘House of Cards’’ depicts politics as a deeply corrupt charade in which key players scheme and backstab behind the scenes to get their way, recent developments in Annapolis depict a simpler reality: lawmakers will give you money if you publicly threaten them. The Maryland Senate voted overwhelmingly (45 – 1) to increase the amount of tax breaks available to film productions in Maryland after the makers of “House of Cards” threatened to take their stage sets elsewhere. If the House knuckles under too, this would be the second time in as many years that Maryland has increased these subsidies in response to such threats. Lawmakers ought to get some backbone and consider a more stable and long-term approach to economic development in the state.

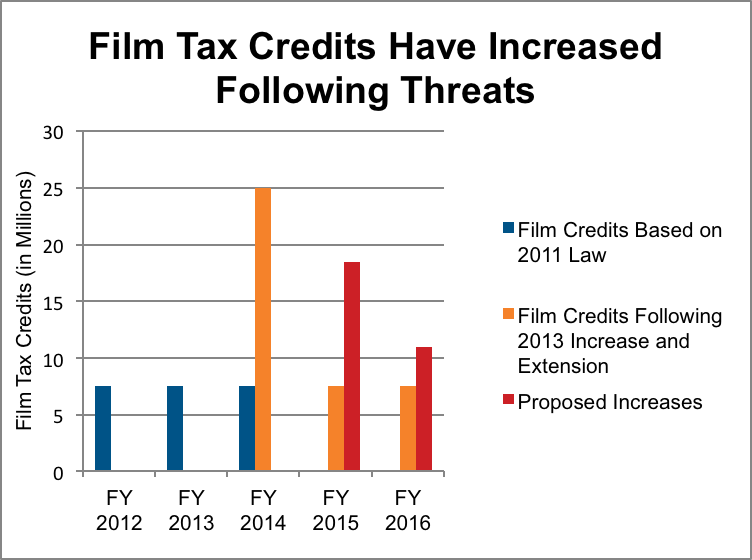

In 2011, the General Assembly enacted a system of tax credits that allows the Department of Business and Economic Development (DBED) to award a maximum of $7.5 million in credits each year to film productions. This system was scheduled to expire on June 30, 2014. But in last year’s legislative session, state lawmakers extended the sunset date through Fiscal Year 2016 and increased the amount of tax credits available for fiscal year 2014 to $25 million. They did so in an effort to keep “House of Cards” and another show filmed here, “Veep,” which threatened to move production to an unnamed other state with more generous tax credits.

Following last year’s extension, the tax credits were set to return to $7.5 million after FY 2014, but just last weekend, “House of Cards” star Kevin Spacey schmoozed with state lawmakers at a private event in Annapolis to woo the General Assembly into increasing the amount of film tax credits yet again, to $18.5 million in FY 2015 and $11 million in FY 2016. This charm offensive was complemented by a major threat: The show’s maker, California-based Media Rights Capital, refused to resume filming until Maryland ponied up higher tax credits.

Proponents argue that film tax credits are a good investment for Maryland because they generate more economic value than they cost as film companies hire local businesses and vendors. Others, such as the Maryland Film Office, contend that sustained investment in the film industry will attract other production firms to Maryland.

However, boosting the tax giveaways each year in response to threats from film companies is not a sound or sustainable policy. House of Cards spent just 53 days filming in Maryland in FY 2012 and 130 days filming in FY 2013. And no show, no matter how successful, lasts forever.

These threats themselves are evidence that states cannot count on the film industry as a long-term engine of economic development. Currently, 45 states and Puerto Rico offer film tax credits of some kind, and production companies will always be able to play states off against one another in this way. Maryland should make sound investments in its economy, but it should not do so in a race to the bottom with other states, fighting to see who can give the biggest tax breaks to film production companies. Besides, not all states are successful in their efforts to boost their economy via film tax credits.

Organizations as diverse as the Center on Budget and Policy Priorities (CBPP), The Mercatus Center, the Tax Foundation, and Maryland’s own Department of Legislative Services argue that the primary beneficiaries of these tax credits are companies based outside of Maryland. CBPP also points out that the best jobs often go to out-of-state residents.

The money spent on tax credits for film companies could be better spent on public services and investments in health, education, and transportation that would build a stronger, longer-lasting economic foundation for the state. Film tax credits actually remove funding from the state’s General Fund, the Higher Education Investment Fund and the Transportation Trust Fund, which will also result in less highway user revenues for local governments, as the Department of Legislative Services points out. DLS adds that only a portion of the tax credits are recaptured in state and local revenues.

These industry-specific credits add up. Last week, we highlighted a report on how some Fortune 500 companies are able to avoid paying state taxes. One way they do so is clever accounting, but another is through targeted tax breaks like the film tax subsidy.

Maryland’s experience with “House of Cards” shows that it cannot win the film subsidy war. After coming into the state knowing the legal limit on film tax incentives and after receiving $31 million already, the show’s maker nonetheless threatened –in a letter to Governor O’Malley – to “break down our stage, sets and offices and set up in another state” unless Maryland increased its film tax credits. It makes sense for Maryland to invest in economic development, but the state should do so in an equitable way that plans for the long-term rather than responding to the annual threats of film production companies.