Higher Education is a Good Investment, but Debt Hurts Grads’ Economic Prospects

As students graduate from colleges and universities across Maryland, many are entering the next phase of their lives saddled with big debts, incurred to finance their education. Like most other states, Maryland has cut the amount of money it invests in higher education, forcing up tuition and fees paid by students and their families, forcing them to borrow more. While college is a valuable investment – Americans with bachelor’s degrees made 98 percent more an hour on average in 2013 than people without a degree – there are at least five reasons why student debt is a big problem.

- Student debt is increasing and has eclipsed most other forms of debt. Students graduating this year will owe an average of $26,500 in student loans. In total, Americans owe over $1.2 trillion in student loans, which surpasses all other forms of debt except for mortgages.

- Maryland has the highest levels of student loan debt. Maryland carries the highest average student loan debt per borrower, at $28,330, according to data compiled by the Federal Reserve Bank of New York.

- Student debt causes young adults to put off other investments that help build personal wealth, increasing inequality. Graduates with debt face much tougher economic circumstances than those who do not have to borrow to finance their education, in that they are starting their professional lives with negative net worth, as explained by the New America Foundation’s Kevin Carey.

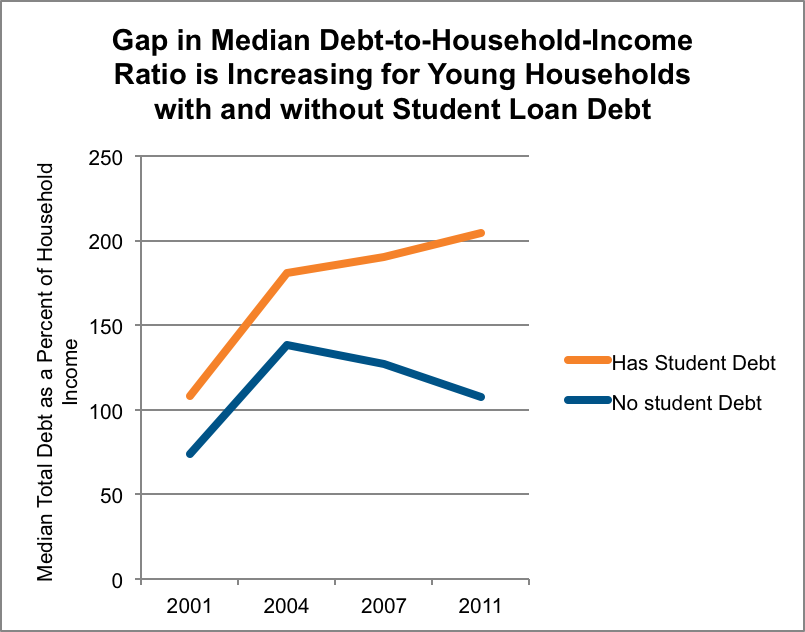

This holds back those with debt in a variety of ways. First, those with student loans are less likely to own a home than those without college debt. As a result, median net worth for young households (below the age of 40) without student debt is seven times greater than for young households paying off student loans. Young households with student debt are also more likely to have a greater overall debt burden due to higher levels of other forms of debt, such as credit cards, according to the Pew Research Center.

Over time, this means young households with student loans will have much more debt as a share of their median income than their counterparts without student debt, which is which is helping to drive increasing inequality.

Source: The Pew Research Center

- Less investment and wealth for those with student loans hurts the economy. Having less disposable income to spend and invest not only hurts indebted graduates, it holds back broader economic growth. Because of the need to find stable, high-paying employment right away in order to pay off loans, those with student debt are less likely to take the risk of starting their own business. Areas with higher levels of student loan debt have lower small-business growth, research indicates.

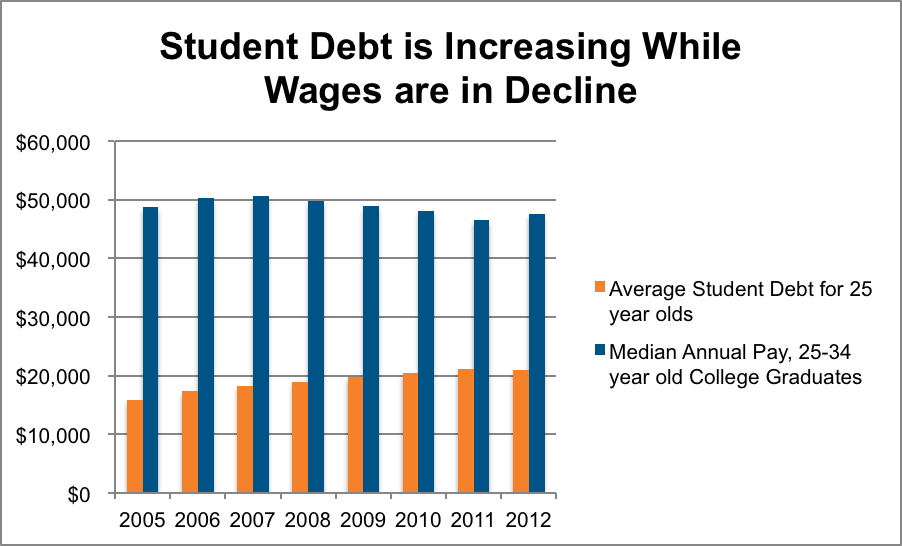

And because young adults with student debt have to delay other wealth-generating investments such as buying homes, this drags down the economy as a whole, and is one of the reasons the housing market has not fully recovered from the Great Recession. - Indebted graduates are entering a weak labor market. Students graduating today have both high levels of student loan debt and poorer prospects to pay it off, as they enter a labor market where good-paying jobs are harder to find than they were prior to the Great Recession. Indeed, as student loan debt is increasing, wages have actually fallen, even for many with a college degree.

Source: Data from the Federal Reserve Bank of New York and the US Department of Education, as compiled by Danielle Kurtzleben of Vox.com

Before the recession, home ownership rates were higher for those with student debt than those without – due to the higher average wages of those with college degrees, according to the Federal Reserve Bank of New York. But the Great Recession changed this. While home ownership rates fell for all groups, they declined most for 30 year olds with student debt.

While expanding access to college helps graduates increase their earning power, doing so via increasing levels of students loans creates new problems and higher levels of inequality. While we have previously talked about the importance of investment in public education, check back here soon for a more thorough discussion of how to address the high and increasing levels of student debt in Maryland.