Earned Income Tax Credit Leaves Single Taxpayers Behind

Over the next couple of months, as Marylanders file their income taxes and many anxiously wait for state refunds, legislators will be considering whether to expand the state’s Earned Income Tax Credit (EITC). The EITC is widely hailed by Democrats and Republicans alike as a critical, effective, and fair program that rewards hard work and boosts the economy. Yet, Maryland’s credit leaves out thousands of low-wage workers. Young people and workers without children get little or no benefit from the existing credit, even if they have very low incomes.

Many people who work for low wages go deeper into poverty because they don’t qualify for meaningful tax breaks.[i] Proposed legislation (Senate Bill 14 and House Bill 2) would be a step in the right direction. These bills would:

- Eliminate the requirement that an individual must be at least 25 years old to claim the credit

- Increase the income thresholds at which the credit phases out

- Increase the percentage value of the credit (which is calculated as a percentage of federal EITC)

- Make the credit fully refundable to taxpayers

Expanding the credit would help more than 355,000 Marylanders who are struggling to get by on low wages, most of whom do not currently receive the credit. This proposal would increase their average annual tax credit to about $300.

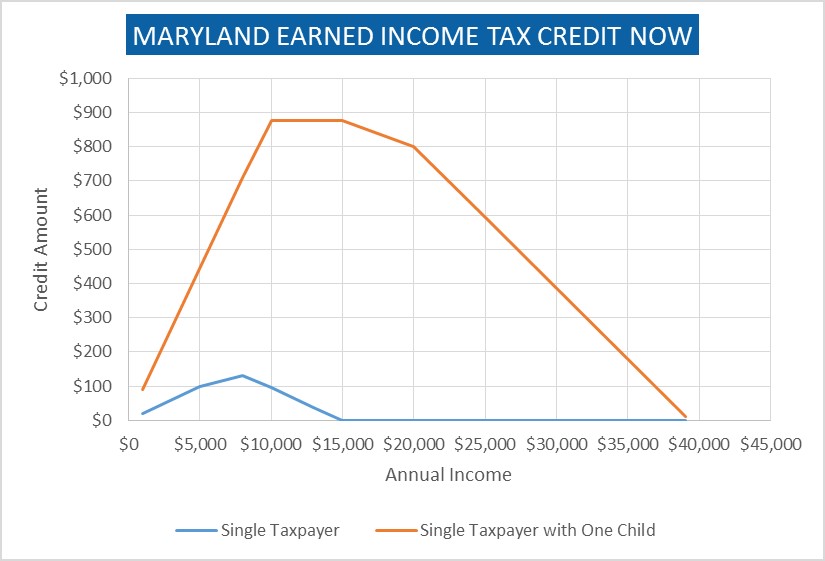

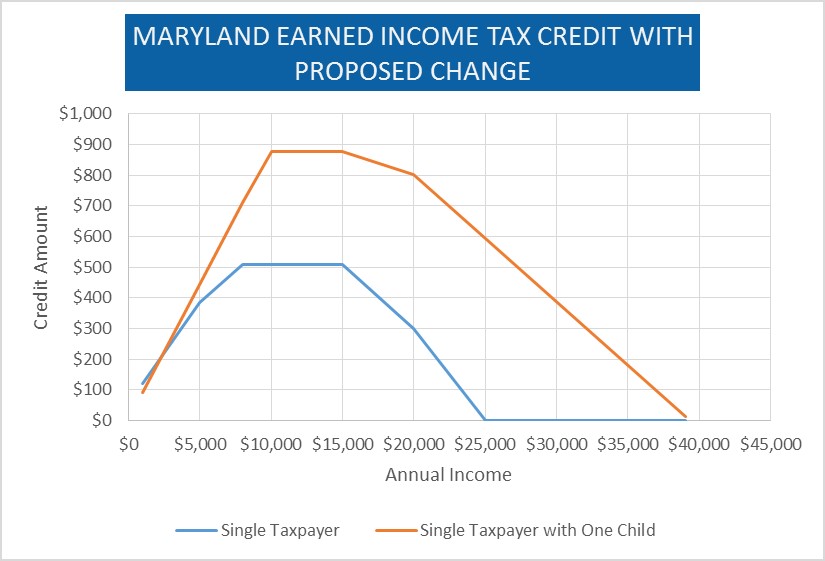

The first graph below illustrates how much of a credit single taxpayers and a taxpayers with one child receive under current law, depending on their incomes. The second graph shows how the proposed bills would change the credit for single taxpayers.[ii]

Sources: 2016 EIC Tables, Internal Revenue Service. 2016 Maryland State and Local Tax Form Instructions, Comptroller of Maryland. Maryland General Assembly 2017 Session Senate Bill 14 Fiscal and Policy Note, Department of Legislative Services.

The lowest-income Marylanders now pay about 9.7 percent of their income in state and local taxes – a much greater share of their income than the wealthiest Marylanders.[iii] Expanding the EITC would help correct this imbalance. The tax credit would also benefit Maryland businesses, as the additional money in recipients’ pockets means they have more to spend on necessities like groceries and car repairs. Every dollar invested in EITC generates $1.23 of economic activity according to one estimate.[iv]

A 2004 study of Maryland’s EITC estimated that it added $16 million to the economy in Baltimore City alone, creating 167 jobs and generating $4.9 million in wages.[v] The federal EITC was highly successful in the 1990s at helping more single mothers start working and continue to work, and many researchers believe that expanding the credit would have a similarly positive effect for young men and women with lower levels of education.[vi]

Maryland’s EITC gives a much needed hand up to working families with children, but right now it is failing single low-wage workers. Existing EITC rules severely limit credits to taxpayers without children and completely exclude taxpayers under the age of 25. Legislators should take the opportunity to strengthen a program proven to lift people out of poverty and stimulate the economy.

[i]Chuck Marr and Chy-Ching Huang, “Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty.” Center on Budget and Policy Priorities. February 20, 2015. http://www.cbpp.org/research/strengthening-the-eitc-for-childless-workers-would-promote-work-and-reduce-poverty

[ii] The actual change in an individual’s tax liability may be different depending on whether the individual has State tax liability or currently claims the nonrefundable credit. These estimates are for taxpayers whose filing statuses are Single, Head of Household or Qualifying Widow(er), not Married Filing Jointly.

[iii] Mark Scott, “Maryland’s Poor Taxed More Than Wealthy.” Maryland Center on Economic Policy. March 23, 2015. http://www.mdeconomy.org/marylands-poor-taxed-more-than-wealthy-communities-of-color-feel-biggest-pinch/

[iv] Mark Zandi, “An Analysis of the Obama Jobs Plan.” Moody’s Analytics, Sept. 9, 2011. https://www.economy.com/dismal/analysis/free/224641

[v] “The Importance of the Earned Income Tax Credit and Its Economic Effects in Baltimore City.” The Jacob France Institute. June 2004. https://www.ubalt.edu/jfi/jfi/reports/EITC-rept.pdf

[vi] Chuck Marr et al. “EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds.” Center on Budget and Policy Priorities. October 1. 2015. http://www.cbpp.org/research/federal-tax/eitc-and-child-tax-credit-promote-work-reduce-poverty-and-support-childrens