Changing Corporate Income Tax Calculation Won’t Create Jobs

Position Statement Opposing House Bill 1252/Senate Bill 842

Given before the House Ways and Means and Senate Budget and Tax Committees

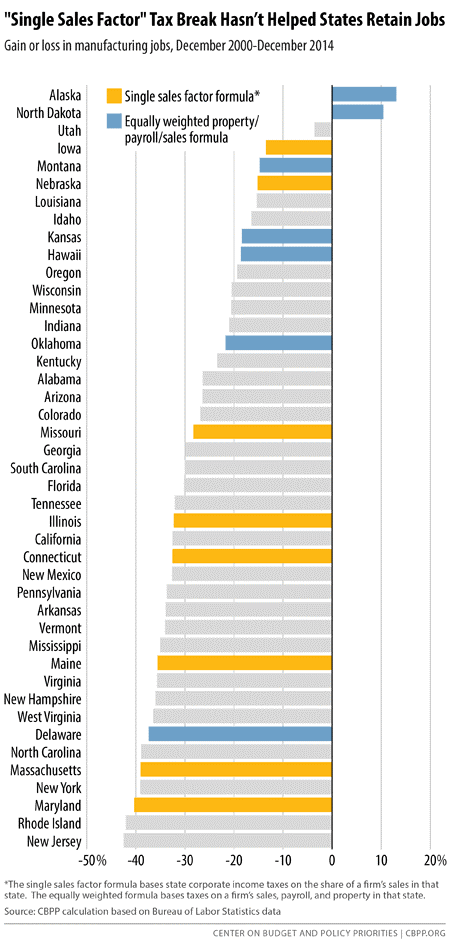

Evidence from experiments in Maryland and other states with the “single sales factor” method of calculating corporate income tax have repeatedly shown that this approach is costly to states and doesn’t create new jobs.[i] F or these reasons, the Maryland Center on Economic Policy opposes House Bill 1252/Senate Bill 842.

or these reasons, the Maryland Center on Economic Policy opposes House Bill 1252/Senate Bill 842.

While often disguised as “simplifying the tax code,” these proposed changes would enable large, profitable multi-state corporations to reduce what counts as taxable income in Maryland by basing their tax only on their sales to consumers in the state. Without this tax break, a corporation’s taxes typically also include the shares of its property and payroll (that is, employees) located in the state.

Maryland’s own experience with allowing manufacturing companies to pay taxes in this way has proven that this tax break will not create jobs; Maryland has continued to lose manufacturing jobs despite allowing manufacturing companies to use the single sales factor formula. At the same time, the state is losing revenue that it could invest in building up the real pillars of 21st century economies: education, healthcare, transportation, and safe communities.

Changing the formula for other types of businesses will only benefit large, profitable multi-state corporations. It will do nothing to help small, local businesses that operate only in Maryland – which are the true drivers of economic growth[ii]. In fact, it would make it even harder for those businesses to compete against large corporations.

The approach proposed in House Bill 1252/Senate Bill 842 also favors certain types of businesses over others. A company could be physically located in Maryland, and benefit from Maryland’s roads, highly educated workforce, and public safety services, but pay virtually no corporate income tax to help support state services because most of their sales take place out of state. Keeping Maryland’s current method of taxation would be a better way of ensuring everyone pays their fair share. However, an even better option for supporting local small businesses would be to close a remaining corporate tax loophole by adopting combined reporting (House Bill 812/Senate Bill 432).

For these reasons, the Maryland Center on Economic Policy respectfully requests that the Ways and Means Committee report House Bill 1252 unfavorably and the Budget and Tax Committee report Senate Bill 842 unfavorably.

[i] Michael Mazerov, “Case for Single Sales Factor Tax Cut Now Much Weaker,” Center on Budget and Policy Priorities, April 2015. http://www.cbpp.org/blog/case-for-single-sales-factor-tax-cut-now-much-weaker

[ii] Michael Mazerov and Michael Leachman, “State Job Creation Strategies Often Off Base,” Center on Budget and Policy Priorities, February 2016. http://www.cbpp.org/research/state-budget-and-tax/state-job-creation-strategies-often-off-base